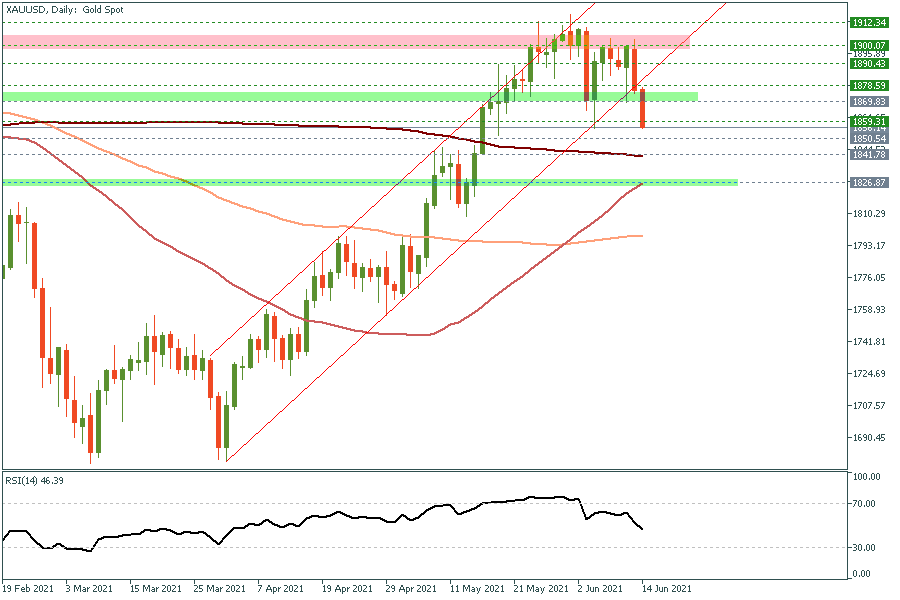

Gold managed to bounce back right after the US Jobs Report on Friday and closed the week near the $1900 resistance. Gold continues to benefit from inflation expectations. Yet, such rebound is unlikely to be sustainable. The technical indicators still suggesting another leg lower in the coming days. The downside retracement may target 1860 and 1850 USD/Oz where we will reassess our medium-term long positions that were issued back in April, while we maintain our stop loss at 1835 for now.

Please visit our sponsors

Results 1 to 6 of 6

Thread: Short-term rebound in gold

-

09-06-2021, 04:57 AM #1Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Short-term rebound in gold

Short-term rebound in gold

-

Sponsored Links

-

10-06-2021, 11:45 PM #2Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

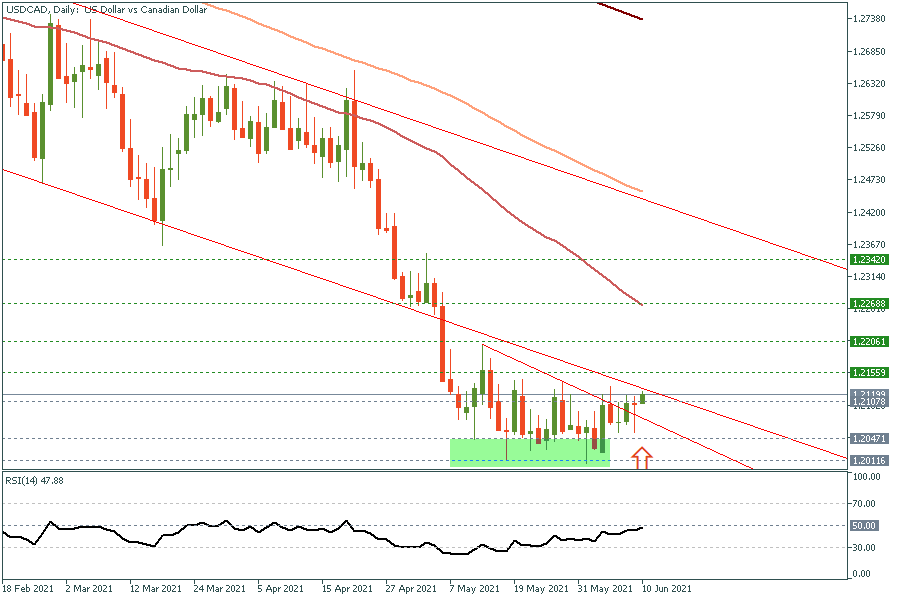

Eyes on Bank of Canada’s decision today

All eyes are headed toward the Bank of Canada today. Estimates point to no change both for the main rate and the ongoing QE which stands at $3B weekly. Moreover, the bank is likely to keep the forward guidance unchanged, while delaying the 2nd round of tapering until July. Our USD/CAD longs from 1.2060 are already in profit and it would be wise to move the stop to entry ahead of the decision to protect the current positions from any possible loss. On the upside view, the technical indicators are improving gradually, while we maintain our target for the current positions at 1.2145 followed by 1.22.

900×600

References: FBS (09.06.2021) Eyes on Bank of Canda today.

-

10-06-2021, 11:52 PM #3Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

USD/CAD is over 1.21 after BoC

The Bank of Canada decided to keep the current policy unchanged as widely expected. However, the bank did not mention anything about tapering again in July. Moreover, the statement mentioned that the recovery still needs an extraordinary stimulus. This was enough to ease the downside pressure on USD/CAD. The pair managed to stabilize and bounced back right from our long entry at 1.2060 all the way to as high as 1.2125 earlier this morning. For the time being, we maintain our bullish outlook and our targets remain at 1.2145 followed by 1.R

References: FBS (10.06.2021) usd/cad IS OVER 1.2 AFTER bOC

-

15-06-2021, 12:46 AM #4Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Gold prices tumbled on Friday and at beginning of the Asian session today, reaching as low as $1854/Oz, breaking through its upside channel on the daily chart, while the technical indicators are now clearly bearish, which confirms our short-term retracement outlook mentioned before since gold was trading above $1910. In the meantime, the key support for this week stands at $1840 which represents the 200-day MA, where gold is likely to show some stabilization, while we maintain our medium-term long positions that were issued back in April at $1710 and $1725 unchanged with a Stop Loss at $1730/Oz for now.

Reference: Gold's break down: what's next? (14.06.2021)

-

16-06-2021, 02:15 AM #5Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Gold prices tumbled during the first trading day of the week declining to as low as 1844 USD/Oz. However, it was able to trim these losses and closed the day around 1866 USD/Oz. Yet, the daily close is another bearish sign , since gold has broken the upside channel on the daily chart. Such a break remains in line with our expectations and the current downside retracement is not over yet. In the meantime, gold may retest its 200-day MA which stands around 1839 USD/Oz which likely to hold for a while before the uptrend resumes . Yet, we prefer to keep gold under our radar for few more days at least until the Federal Reserve decision, which would confirm whether gold will resume its major uptrend or the downside retracement has more legs to go.

100%•75%•50%

100%•75%•50%

Reference: FBS (15.06.2021) Gold reached our retreacement traget.

-

17-06-2021, 07:41 PM #6Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

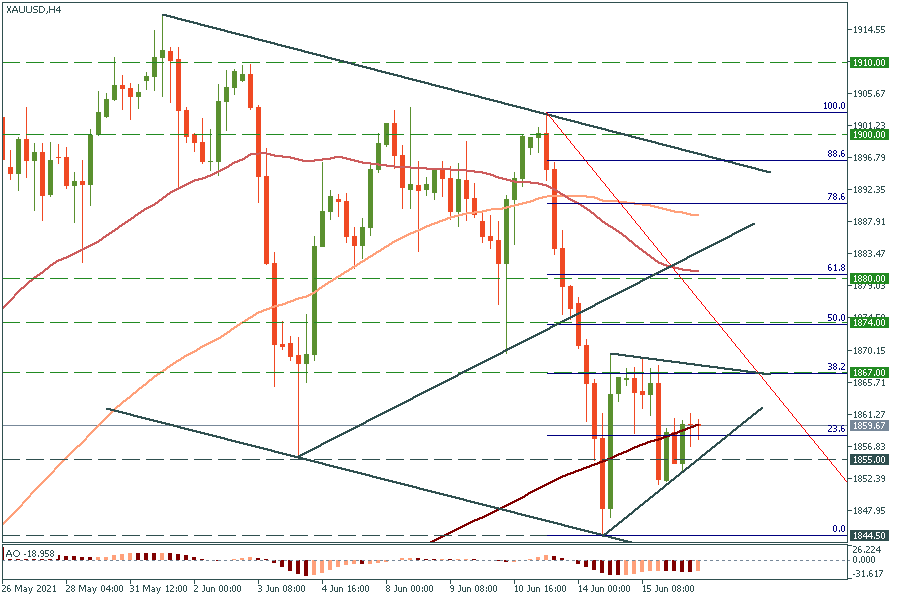

Everyone is interested in trading gold (XAU/USD). The meeting of the Federal Reserve at 21:00 MT time (GMT+3) will certainly drive the price. In this article, however, we’ll look at the technical side of things to see what opportunities lie there.

First, the uptrend since the end of March is still in place. On the weekly chart, there’s a 50-week MA just below $1855 – this level is supporting the price.

Second, on the D1 an Inside bar formed yesterday: it’s a sign that the price is consolidating ahead of the major breakout. The decline below $1855 will open the way down to $1845/$1840 (200-day MA). If XAU/USD stays above $1855, it will rise to $1867. A further breakout will bring the price shoot up to $1874 and $1880.

Reference: FBS (16.06.2021) Gold: short term trade ideas.

Gold: short-term trade ideas

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Tags for this Thread

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote