Forex Analysis & Reviews: Forecast for EUR/USD on May 5, 2023

EUR/USD

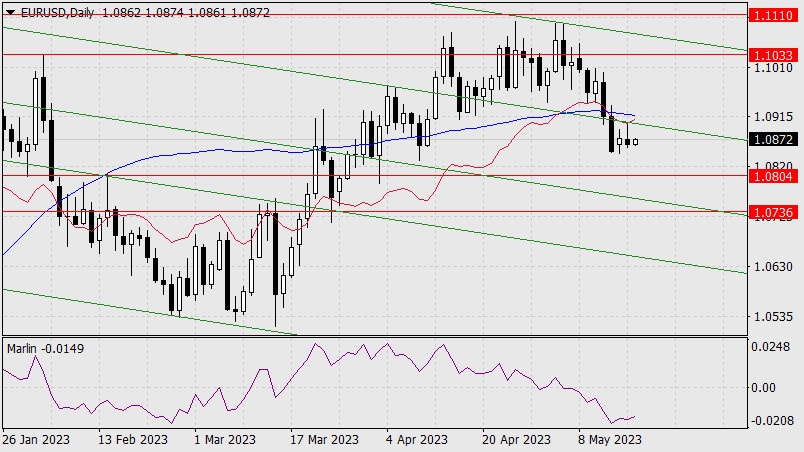

Yesterday, the European Central Bank raised the rate by the expected 0.25%, and ECB President Christine Lagarde "promised" another increase around September. In general, the ECB's mood cooled investors' expectations, and the euro fell by 46 points.

Yesterday, the Marlin oscillator managed to record a low below the zero line (-0.0003), which, for a market with moderate volatility, shows the effective desire for the asset. The price needs to consolidate below 1.1033, which is easy to do with today's employment report since there's a possibility that it may exceed expectations. The euro's target is the convergence area of the MACD line with the embedded line of the descending price channel at 1.0920.

On the four-hour chart, the price has not yet been able to consolidate below the MACD indicator line – the volatility after the ECB meeting is making itself felt. Also, the Marlin oscillator did not stay in negative territory.

I believe that today's US employment report will turn out to be better than forecasts, as the preceding indicators this week indicate an improvement in the labor market. This is a sharp increase in employment in the private sector (296,000 versus a forecast of 148,000), a sharp decrease in the number of layoffs according to Challenger data, and a normalization of unemployment benefit claims (albeit above average).

And such an important point – three major American banks: PacWest Bancorp, Western Alliance Bancorp, Metropolitan are at risk of bankruptcy in the coming days, with KeyCorp, Valley National Bancorp, and a number of small banks approaching. The stock market is no longer able to grow at a rate of 5.25% (especially the banking sector), S&P 500 is falling heavily for the third straight day (yesterday -0.72%), so the counter-dollar currencies are unlikely to rise even with neutral macro data.

Analysis are provided by InstaForex.

Read More https://ifxpr.com/3NHr46H

Please visit our sponsors

Results 3,841 to 3,850 of 4086

Thread: InstaForex Wave Analysis

-

05-05-2023, 05:26 AM #3841

-

08-05-2023, 07:24 AM #3842

Forecast for GBP/USD on May 8, 2023

GBP/USD

On Friday, the British pound chose an alternative scenario with a short-term perspective – on quite good data on US employment, it overcame the resistance of 1.2598 and approached the target level of 1.2666. Now the whole question is in the level of divergence slope by the Marlin oscillator. The price may continue to rise to the second target of 1.2785, and the divergence will not be obstructed.

This target level is the average value of the extremes of June 2020 and November 2019. Such a scenario can be realized if the price consolidates above 1.2666. If the price consolidates below 1.2598, the pound will make additional efforts to reach 1.2447.

On the four-hour chart, the price, indicators, and oscillator are growing. The bullish sentiment is optimistic, and we can only wait for the price to consolidate above 1.2666. The probability of implementing the described scenarios is equal.

Analysis are provided by InstaForex.

Read More

-

09-05-2023, 06:28 AM #3843

Forecast for EUR/USD on May 9, 2023

EUR/USD

As of today, the euro clearly correlates with the yields of US government bonds, which are growing and pulling the single currency down. But for more reliable conditions for the euro's medium-term decline, it lacks other correlating instruments - commodities or the stock market, which are still growing. Other counter-dollar currencies are also not in a hurry to reverse.

On the daily chart, the price is moving towards the important support of 1.0910, and consolidating below it may indicate a break in the uptrend from March 16th. The 1.0804 target will become available. The signal line of the Marlin oscillator is in negative territory - in the downtrend area. At the moment, the euro has not fallen deep enough to prevent it from reversing and working through the range of 1.1078-1.1110.

On the four-hour chart, the price has once again consolidated below the indicator lines, with Marlin in the area of the downtrend. If signals from related markets support the dollar, this time these technical signals will be effective.

Analysis are provided by InstaForex.

Read More

-

10-05-2023, 05:11 AM #3844

Forecast for GBP/USD on May 10, 2023

GBP/USD

Yesterday, the pound closed almost at Monday's closing level. The Marlin oscillator's signal line lies in a sideways trend, thereby reducing the likelihood of creating divergence from Monday's peak, which tested the target level of 1.2666.

But the reversal potential is not exhausted, so consolidating below 1.2598 and overcoming yesterday's low of 1.2577 opens the target at 1.2447. On the four-hour chart, the Marlin oscillator returned to the positive area, but probably for a short time.

Below the level of 1.2598, there is another support – the MACD line. Overcoming it (1.2568) will remove the last obstacle for the development of a medium-term decline in the British currency.

Analysis are provided by InstaForex.

Read More

-

11-05-2023, 05:26 AM #3845

Forecast for USD/JPY on May 11, 2023

USD/JPY

After the price reached the target level of 135.40 on Wednesday, it returned below the price channel line (134.50). The target on the MACD indicator line is 133.03.

The Marlin oscillator approached the zero line and presents two different interpretations: either the oscillator's signal line will reverse from this zero boundary and pull the quote above 134.50 for a repeated attack on the 135.40 level, or the Marlin will move to negative territory and help the price reach the MACD line (133.03).

On the four-hour chart, the price has consolidated below 134.50 and below the indicator lines; the Marlin oscillator has returned to negative territory. All these circumstances maintain the downtrend and the main scenario of achieving the target of 133.03.

Analysis are provided by InstaForex.

Read More

-

12-05-2023, 08:26 AM #3846

Technical Analysis of GBP/USD for May 12, 2023

Technical Market Outlook:

The GBP/USD pair has made another new swing high at the level of 1.2678, so the key technical resistance located t 1.2666 was broken. After the new swing high was made, the Bearish Engulfing candlestick pattern was made at the top of the move, so the market pulled-back and keeps moving lower towards the technical support seen at the level of 1.2434. Please keep an eye on this level as any breakout lower might trigger the bigger correction on Pound. The weak and negative momentum in the H4 time frame chart supports the short-term bearish outlook for Pound.

Weekly Pivot Points:

WR3 - 1.27061

WR2 - 1.26746

WR1 - 1.26607

Weekly Pivot - 1.26431

WS1 - 1.26292

WS2 - 1.26116

WS3 - 1.25801

Trading Outlook:

Pound continues the corrective cycle to the upside and on the Weekly time frame chart the price is about to hit the 61% Fibonacci retracement located at the level of 1.2778. When this level is hit, the high volatility is expected, so please stay focused as the bears will defend this level strongly.

Analysis are provided by InstaForex.

Read More

-

15-05-2023, 06:35 AM #3847

Technical Analysis of Intraday Price Movement of GBP/JPY Cross Currency Pairs, Monday May 15, 2023

On the 4-hour intraday chart of the GBP/JPY cross currency pairs, a Failing Wedge pattern can be seen and the support level at 168.04 is strong enough to prevent the GBP/JPY downward correction, especially with the confirmation by the MACD indicator which is in a speculative BUY position, so there is a high probability for GBP/JPY In the near future, JPY will appreciate, rally up to the level of 171.14 as the first target and the level of 172.30 as the second target as long as it is on its way to these targets, there will be no significant downward correction, especially if it breaks below the 166.46 level because if this level is broken down, all Bull scenarios that have been previously described will become invalid and cancel by themselves.

Analysis are provided by InstaForex.

Read More

-

16-05-2023, 06:24 AM #3848

Forecast for EUR/USD on May 16, 2023

EUR/USD

On Monday, the euro went through a calm correction after sharply falling in the last two days. On the daily chart, there is no sign of the end of the correction, so it could continue to the resistance line of the price channel at the 1.0900 mark. It is possible to overcome this line, and then the price will be stopped by the MACD indicator line, located 15 points higher.

Then the price could reverse into a new wave of decline with the nearest target of 1.0804. On the 4-hour chart, the accelerated growth of the Marlin oscillator catches the eye.

This could be a sign of oscillator discharge before further subsequent decline, or the euro is waiting for a more complex correction from the new local low with the formation of convergence, as shown on the chart with dashed lines. Perhaps, until the end of the month, the euro will spend in a sideways wide-range.

Analysis are provided by InstaForex.

Read More

-

17-05-2023, 06:17 AM #3849

Forecast for EUR/USD on May 17, 2023

EUR/USD So, in accordance with our forecast, after sharply falling below technical supports on May 12, yesterday the price returned to one of them and went through a retest (embedded line of the price channel). It's also noticeable that on the daily chart, touching the channel line occurred at the point of contact with the balance indicator line.

Now we are waiting for the price to drop to the previously indicated target of 1.0804. Falling below this level will allow the price to compete with the support of the underlying price channel line and reach the support level of 1.0736 (the peak of December 15, 2022). However, if it fails to cross support at 1.0804, the price will stay in a short-term sideways trend.

On the four-hour chart, there was a reversal of the signal line of the Marlin oscillator from the zero line (arrow) yesterday. In general, the price is falling in a linear regression channel. We are waiting for the price at the target level of 1.0804.

Analysis are provided by InstaForex.

Read More

-

18-05-2023, 06:27 AM #3850

Forecast for AUD/USD on May 18, 2023

AUD/USD The Australian dollar traded within the target levels of 0.6628 and 0.6670 yesterday. The reversal of the Marlin oscillator's signal line from the zero line was confirmed (arrow) on the daily chart.

Now, the probability of the price overcoming the 0.6628 support has significantly increased, and the price will soon reach the target level of 0.6567 (the low of March 8). In case of an alternative scenario, with the price surpassing 0.6670, it will continue to rise to the MACD line around the 0.6704 mark.

On the four-hour chart, the Marlin oscillator's signal line has turned down from the oscillator's zero line. The price is developing under the balance and MACD indicator lines. In the short term, we expect the price to overcome the 0.6628 support level according to the main scenario.

Analysis are provided by InstaForex.

Read More

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 2 users browsing this thread. (0 members and 2 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote