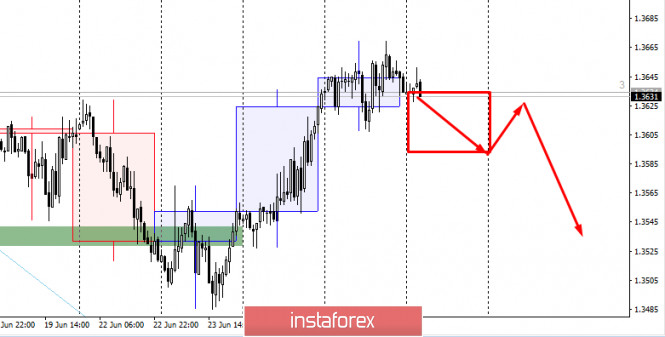

Control zones for USD/CAD on June 26, 2020

The main direction of the USD / CAD pair is upward, so buy positions are currently the most profitable in the medium term. The nearest resistance is the monthly control zone in June, the lower border of which is located at the highs of last week. This increases the likelihood of a stunt in the coming days.

The next target area is the WCZ 1/2 1.3783-1.3767, so part of the positions may be left in the hopes of its test. However, a fall and continued formation of the accumulation zone will occur, if an "absorption" pattern forms today in the daily chart. The closing of weekly trades will be the new starting point for both upward and downward patterns.

Daily CZ - daily control zone. The area formed by important data from the futures market, which changes several times a year.

Weekly CZ - weekly control zone. The area formed by the important marks of the futures market, which changes several times a year.

Monthly CZ - monthly control zone. The area that reflects the average volatility over the past year.

Analysis are provided byInstaForex.

Please visit our sponsors

Results 3,041 to 3,050 of 4086

Thread: InstaForex Wave Analysis

-

26-06-2020, 07:10 AM #3041

-

29-06-2020, 08:27 AM #3042

Technical Analysis of BTC/USD for June 29, 2020:

Crypto Industry News:

Over the past few years, cryptocurrencies have attracted a lot of interest from institutional investors. Encryption has become quite popular due to more rules on the digital asset market. However, since most economies work with digital resources, there has also been pressure to strengthen regulations so that cryptocurrencies do not become a safe haven for money laundering and other illegal activities. Recent AML regulations and FAFT guidelines aimed to strengthen cryptography regulations.

However, as digital assets are gaining popularity in the world of finance, traditional financial institutions such as banks have now come under the eye of dealing with cryptocurrency users and stock exchanges regarding virtual assets. A recent Ciphertrace report looked at how virtual asset laws can affect banks. The report notes that 57% of these Virtual Asset Providers (VASPs) had weak or porous KYC processes. This is a greater threat because a weak KYC can lead to bad entities being able to launder virtual assets through stock exchanges operating as fiat off-ramps according to the report.

It is not clear, however, whether large banks are willing or willing to cope with exposure to crypto assets and at the same time ensure that there is no illegal activity in space. Although the number of cryptocurrencies has increased significantly over the years, mainstream banks still have reservations about users and cryptographic transactions. In the recent past, Bank of America raised concerns and kept customers from using debit cards to buy cryptocurrency. However, at the beginning of the Fifth Anti-Money Laundering Directive or AMLD5 it was pointed out that banks cannot refuse to provide services to sectors and must analyze cryptocurrencies on a case-by-case basis.

According to data provided by Ciphertrace, almost 74% of Bitcoins transferred in "from exchange to exchange" transactions have been transferred cross-border and pose a significant risk of money laundering. Given this scenario, FATF noted that illegal users of virtual assets (VAs) may, for example, benefit from the global reach and transaction speed that VA provides, as well as from inadequate regulation or supervision of financial activities and VA suppliers in various jurisdictions, resulting in inconsistent legal and regulatory rules of the game in the VA ecosystem.

Technical Market Outlook:

The BTC/USD pair has made a new local low at the level of $8,795, which means the key short-term technical support located at the level of $8,858 had been violated. The bounce has been continued for some time now, but so far it was rather shallow and the price is starting to reverse again. If the intraday support located at the level of $8,971 is clearly violated, the odds for another low are high as the momentum is still weak and negative. The next target for bears is seen at the level of $8,565.

Weekly Pivot Points:

WR3 - $10,465

WR2 - $10,072

WR1 - $9,509

Weekly Pivot - $9,126

WS1 - $8,593

WS2 - $8,191

WS3 - 7,623

Trading Recommendations:

The larger time frame trend remains down and as long as the level of $10,791 is not violated, all rallies will be treated as a counter-trend corrective moves. This is why the short positions are now more preferred until the level of $10,791 is clearly violated. The key mid-term technical support is located at the level of $7,897.

Analysis are provided by InstaForex

-

30-06-2020, 07:07 AM #3043

Technical Analysis of GBP/USD for June 30, 2020:

Technical Market Outlook:

The GBP/USD pair has made another local low at the level of 1.2251 after all the bounces were too shallow to trigger a strong rally. The price is back inside the descending channel and despite the oversold market conditions, the momentum remains weak and negative as the RSI indicator hovers below its fifty level. The nearest technical resistance is seen at the level of 1.2361 and 1.2406. The larger time frame trend remains bullish.

Weekly Pivot Points:

WR3 - 1.2667

WR2 - 1.2600

WR1 - 1.2441

Weekly Pivot - 1.2377

WS1 - 1.2213

WS2 - 1.2143

WS3 - 1.1969

Trading Recommendations:

On the GBP/USD pair the main trend is down, which can be confirmed by the down candles on the weekly time frame chart. The key long-term technical support has been recently violated (1.1983) and the new one is seen at the level of 1.1404. The key long-term technical resistance is seen at the level of 1.3518. Only if one of these levels is clearly violated, the main trend might reverse (1.3518) or accelerate (1.1404). The market might have done a Double Top pattern at the level of 1.2645, so the price might move even lower in the longer-term.

Analysis are provided byInstaForex.

-

01-07-2020, 08:02 AM #3044

Technical Analysis of BTC/USD for July 1, 2020:

Crypto Industry News:

Anxiety in the cryptocurrency community is growing every day. No change in Bitcoin prices, trade between $ 9,000 to $ 9,500, for almost two months is currently not perceived as a feature of the strongest cryptocurrency in the world, but rather its relationship with larger financial markets.

Bitcoin, for most of this year, when the pandemic began shifting markets, acted against itself. According to the "uncorrelated" status, the cryptocurrency reached enormous highs when both the stock market and the commodity market collapsed, losing millions. This is despite the fact that Bitcoin lost over 50% of its value in one day in March and increased its supply by 50% in May.

However, now that price and supply have normalized, the unstable asset is stable from the outset, and some cryptocurrency community members suggest that the reason is that it has not yet separated from the stock market.

Bitcoins and the larger cryptocurrency market, despite being called 'decentralized', have often exerted an impact on macroeconomic activities, usually affecting traditional markets. Last year, Bitcoin saw movement in the gold market on various isolated occasions, mainly because of the safe harbor narrative in times of economic or political turmoil.

Now the prices on the stock market offset the negative effects of the slowdown of global economies by a pandemic and the inflow of liquidity from central banks. At this time, Bitcoin is actually moving according to the highest stock index, S & P500. Market data indicate that the 1-month correlation of Bitcoins with S & P500 is the highest in over a year, and is currently estimated at over 42.6%.

Because Bitcoin is "coupled" with S & P500, this presents a different set of short-term fate for cryptocurrency in the future. Given the likelihood of a second package of government assistance in the United States, another injection of freshly minted dollars may again positively affect Bitcoin, as it did in May. Another scenario is the second wave of COVID-19 cases that could cause another liquidation madness.

Technical Market Outlook:

The BTC/USD pair has made a new local high at the level of $9,129, but there is a Doji candlestick pattern made at the top of this move, so if the intraday support located at the level of $8,971 is clearly violated, the odds for another low are high. The momentum is still weak and negative, but is getting closer to the level of fifty, which is a neutral level for the momentum indicator. The next target for bears is seen at the level of $8,565, but in a case of an upside breakout, the next target for bulls is seen at the level of $9,249 (technical resistance level).

Weekly Pivot Points:

WR3 - $10,465

WR2 - $10,072

WR1 - $9,509

Weekly Pivot - $9,126

WS1 - $8,593

WS2 - $8,191

WS3 - 7,623

Trading Recommendations:

The larger time frame trend remains down and as long as the level of $10,791 is not violated, all rallies will be treated as a counter-trend corrective moves. This is why the short positions are now more preferred until the level of $10,791 is clearly violated. The key mid-term technical support is located at the level of $7,897.

Analysis are provided byInstaForex.

-

02-07-2020, 07:50 AM #3045

Technical Analysis of EUR/USD for July 2, 2020:

Technical Market Outlook:

The EUR/USD pair has made series of Pin Bar candlesticks just above the key short-term support located at the level of 1.1185 and bounced significantly. The bulls are heading north, so any violation of the level of 1.1287 makes the rally towards the technical resistance located at the level of 1.1347 highly possible, so please keep an eye on the current developments at this market. Please notice the positive market conditions and strong momentum support the short-term bullish outlook.

Weekly Pivot Points:

WR3 - 1.1484

WR2 - 1.1410

WR1 - 1.1289

Weekly Pivot - 1.1235

WS1 - 1.1124

WS2 - 1.1056

WS3 - 1.0936

Trading Recommendations:

On the EUR/USD pair, the main long-term trend is down, but the local up trend continues. The key long-term technical support is seen at the level of 1.0336 and the key long-term technical resistance is seen at the level of 1.1540. Only if one of this levels is clearly violated, the main trend might reverse (1.1540) or accelerate (1.0336).

Analysis are provided byInstaForex.

-

03-07-2020, 07:19 AM #3046

echnical Analysis of EUR/USD for July 3, 2020:

Technical Market Outlook:

After the EUR/USD pair has made series of Pin Bar candlesticks just above the key short-term support located at the level of 1.1185 some serious bounce has been expected, but it turned out the bulls have a fuel only to rally to the level of 1.1302. Then the Bearish Engulfing candlestick was made and the really reversed. The bulls might still be heading north, so any violation of the level of 1.1302 makes the rally towards the technical resistance located at the level of 1.1347 highly possible, so please keep an eye on the current developments at this market. Please notice the positive market conditions and strong momentum support the short-term bullish outlook. Weekly Pivot Points: WR3 - 1.1484 WR2 - 1.1410 WR1 - 1.1289

Weekly Pivot - 1.1235

WS1 - 1.1124

WS2 - 1.1056

WS3 - 1.0936

Trading Recommendations:

On the EUR/USD pair, the main long-term trend is down, but the local up trend continues. The key long-term technical support is seen at the level of 1.0336 and the key long-term technical resistance is seen at the level of 1.1540. Only if one of this levels is clearly violated, the main trend might reverse (1.1540) or accelerate (1.0336).

Analysis are provided byInstaForex.

-

06-07-2020, 07:10 AM #3047

Technical Analysis of GBP/USD for July 6, 2020:

Technical Market Outlook:

The GBP/USD pair has been hovering around the level of 1.2438 for most part of the weekend, but during the early Monday trading hours the bullish activity has increased. It looks like the bulls might want to test the 50% Fibonacci retracement once again, so in the case of a successful breakout, the next target for them is 61% retracement located at the level of 1.2597. Please notice, there is an important intraday technical resistance located just above 50% Fibonacci retracement at the level of 1.2542. On the other hand, the nearest technical support is still seen at the level of 1.2406 and 1.2362.

Weekly Pivot Points:

WR3 - 1.2879

WR2 - 1.2698

WR1 - 1.2610

Weekly Pivot - 1.2423

WS1 - 1.2323

WS2 - 1.2148

WS3 - 1.2056

Trading Recommendations:

On the GBP/USD pair the main trend is down, which can be confirmed by the down candles on the weekly time frame chart. The key long-term technical support has been recently violated (1.1983) and the new one is seen at the level of 1.1404. The key long-term technical resistance is seen at the level of 1.3518. Only if one of these levels is clearly violated, the main trend might reverse (1.3518) or accelerate (1.1404). The market might have done a Double Top pattern at the level of 1.2645, so the price might move even lower in the longer-term.

Analysis are provided byInstaForex.

-

07-07-2020, 06:43 AM #3048

Forecast for EUR/USD on July 7, 2020

EUR/USD

The euro broke the resistance of the target level of 1.1265 on Monday, showing a growth of 61 points. The price peaked on June 23. After overcoming the intermediate level of 1.1353, we expect the growth to continue to 1.1420, the second goal is 1.1465. Reaching any of these levels with the Marlin oscillator will form a technical divergence, which will become a reversal signal. Perhaps a medium-term downward trend.

The price is firmly held above both indicator lines on the four-hour chart – the balance line (red) and the MACD line (blue). The Marlin oscillator is in the growth zone. We are waiting for the euro to grow to the designated goal of 1.1420.

Analysis are provided byInstaForex.

-

08-07-2020, 06:18 AM #3049

Japan Has Y1,176.8 Billion Current Account Surplus

Japan posted a current account surplus of 1,176.8 billion yen in May, the Ministry of Finance said on Wednesday.

That exceeded expectations for a surplus of 1,088.2 billion yen and was up from 262.7 billion yen in April.

The trade balance showed a deficit of 556.8 billion yen, down 18.1 percent on year. Exports tumbled 28.9 percent on year to 4.197 trillion yen, while imports sank an annual 27.7 percent to 4.754 trillion yen.

The capital account showed a deficit of 3.7 billion yen, while the financial account saw a deficit of 187.3 billion yen.

News are provided by

InstaForex.

-

08-07-2020, 07:32 AM #3050

Technical Analysis of EUR/USD for July 8, 2020:

Technical Market Outlook:

After the EUR/USD pair has hit the level of 1.1347 which is the part of the supply zone located between the levels of 1.1347 - 1.1361 the price reversed quickly. The Bearish Engulfing candlestick pattern at the top of the rally has forced bulls to pull-back towards the technical support located at the level of 1.1300, but even this level was violated and the market trades now around 1.1268. The key intraday support is still seen at the level of 1.2228 and break out below this level will likely end up in test of the 1.1185 support. The momentum remains positive on H4 time frame, but there is no clear indication regarding the market conditions.

Weekly Pivot Points:

WR3 - 1.2879

WR2 - 1.2698

WR1 - 1.2610

Weekly Pivot - 1.2423

WS1 - 1.2323

WS2 - 1.2148

WS3 - 1.2056

Trading Recommendations:

On the EUR/USD pair, the main long-term trend is down, but the local up trend continues. The key long-term technical support is seen at the level of 1.0336 and the key long-term technical resistance is seen at the level of 1.1540. Only if one of this levels is clearly violated, the main trend might reverse (1.1540) or accelerate (1.0336).

Analysis are provided byInstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote