De-dollarization or de-eurozation? Analysts consider both scenarios possible

Analysts have been discussing the possible ditch of the US dollar in foreign settlements for a long time. However, now, they do not exclude a similar scenario for the euro. Analysts are mulling over what could lead to such outcomes. They fear that in the near future the European currency will face the same challenges as the Us dollar. Currently, many countries are trying to replace the US dollar in mutual settlements.

Analysts pinpoint that the euro has more disadvantages than advantages. Settlements in the euro and its support are getting more expensive. According to the Eurobarometer, the euro is popular with 60% of the population. However, now many EU citizens are skeptical about the future of the euro. Some economists reckon that some EU states may leave the eurozone and ditch the euro.

Earlier, economists suggested a possible replacement of the US currency by many countries. However, the euro is now facing such a risk as well. De-eurozation looks quite feasible. However, the situation in the global financial market is unlikely to change in the near future, economists believe.

Currently, the authorities of many countries are trying to diversify their foreign exchange reserves to reduce dependence on the greenback. However, a sharp decline in the dollar share of international reserves looks unlikely as roughly 40% of the world's transactions are done in dollars.

The use of national currencies in international settlements spurs their demand and reduces dependence on the Fed's monetary policy. At the same time, the current geopolitical turmoil is fueling a rally of the US dollar as many countries prefer to keep the US currency in their reserves.

At the start of the week, the euro was trading almost at the same levels. On October 31, the EUR/USD pair was fluctuating near 0.9952, slightly below the previous pivot level of 0.9963.

Investors are now awaiting the release of the euro area's important macroeconomic report, namely GDP for the third quarter of 2022. According to preliminary estimates, from July to September, the economy declined slightly to 2.1%. In the second quarter of 2022, this figure totaled 4.1%.

The greenback has been rising for some time thanks to the Fed's hawkish stance. On November 2, the Bank of England and the Fed will hold their meetings. The Fed is widely expected to raise the key rate by 75 basis points to the range of 3.75-4%.

The Fed's key rate decision may significantly impact market sentiment. Some analysts believe that the regulator could switch to less aggressive tightening despite a 75 basis point rate hike. However, other analysts are certain that the regulator will hike the rate by 75 basis points at the next meeting scheduled for December 14.

At the February meeting in 2023, the watchdog is expected to increase the key rate by 25 basis points to 4.50-4.75%. Analysts suppose that three will be more 25 basis point rate increases next year. Such a scenario is bearish for the US dollar. The euro is also unable to regain long-term rise. Thus, it is recommended to buy the EUR/USD pair with a long-term target level above 1.0500.

Many economists are afraid that sentiment will become more bearish on the US currency. Last week, large traders initiated a sell-off of the greenback. As a result, the number of short positions during the week increased by 21%. If there are no positive fundamental favors, the greenback may drop lower.

Nevertheless, the US dollar remains the most popular currency, with close to 90% of all currency trades having the dollar as one leg of the transaction. It has been rallying for some time amid the Fed's aggressive tightening. In the last few months, the US dollar has reached multi-year highs against the euro, the pound sterling, the yen, and the yuan. It also took advantage of a recession in the eurozone as investors got rid of the euro in favor of the US dollar.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

News are provided by

InstaForex.

Read More

Please visit our sponsors

Results 3,071 to 3,080 of 3458

Thread: Forex News from InstaForex

-

01-11-2022, 03:01 AM #3071

-

01-11-2022, 06:47 AM #3072

US stocks closed lower, Dow Jones down 0.39%

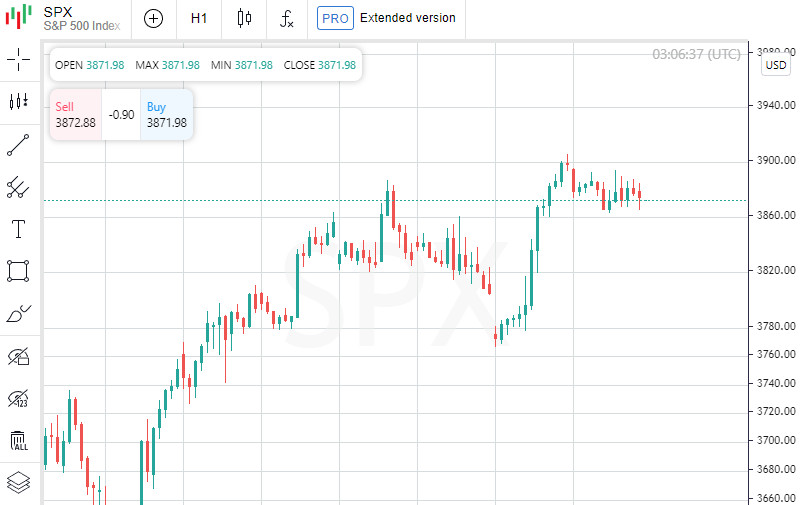

At the close in the New York Stock Exchange, the Dow Jones fell 0.39%, the S&P 500 fell 0.75% and the NASDAQ Composite fell 1.03%.

The leading gainers among the components of the Dow Jones index today were The Travelers Companies Inc, which gained 2.59 points (1.42%) to close at 184.55. Quotes of Goldman Sachs Group Inc rose by 3.03 points (0.89%), ending trading at 344.85. UnitedHealth Group Incorporated rose 4.11 points or 0.75% to close at 555.35.

The losers were shares of Intel Corporation, which lost 0.64 points or 2.20% to end the session at 28.43. Microsoft Corporation was up 1.59% or 3.74 points to close at 232.13, while Dow Inc was down 1.58% or 0.75 points to close at 46.73 .

Leading gainers among the S&P 500 index components in today's trading were Wynn Resorts Limited, which rose 9.61% to hit 63.90, Coterra Energy Inc, which gained 3.49% to close at 31.15, and also shares of DaVita HealthCare Partners Inc, which rose 3.47% to end the session at 72.99.

The biggest losers were Global Payments Inc, which shed 8.83% to close at 114.25. Shares of Newell Brands Inc shed 8.24% to end the session at 13.81. Quotes of Meta Platforms Inc decreased in price by 6.09% to 93.16.

The leading gainers among the components of the NASDAQ Composite in today's trading were Sonnet Biotherapeutics Holdings Inc, which rose 66.38% to 1.93, Acorda Therapeutics Inc, which gained 63.36% to close at 1.07. as well as shares of Shineco Inc, which rose 37.96% to close the session at 1.09.

The biggest loser was Y mAbs Therapeutics, which shed 59.80% to close at 3.61. Shares of Tusimple Holdings Inc lost 45.64% to end the session at 3.43. Quotes Bull Horn Holdings Corp. decreased in price by 45.61% to 6.50.

On the New York Stock Exchange, the number of securities that fell in price (1604) exceeded the number of those that closed in positive territory (1472), while quotes of 118 shares remained virtually unchanged. On the NASDAQ stock exchange, papers of 2004 companies fell, 1753 rose, and 165 remained at the level of the previous closing.

The CBOE Volatility Index, which is based on S&P 500 options trading, rose 0.50% to 25.88.

Gold futures for December delivery lost 0.53%, or 8.65, to hit $1.00 a troy ounce. In other commodities, WTI crude for December delivery fell 1.95%, or 1.71, to $86.19 a barrel. Futures for Brent crude for January delivery fell 1.32%, or 1.24, to $92.53 a barrel.

Meanwhile, in the Forex market, EUR/USD was down 0.80% to hit 0.99, while USD/JPY was up 0.87% to hit 148.74.

Futures on the USD index rose 0.77% to 111.45.

News are provided by

InstaForex.

Read More

-

02-11-2022, 07:26 AM #3073

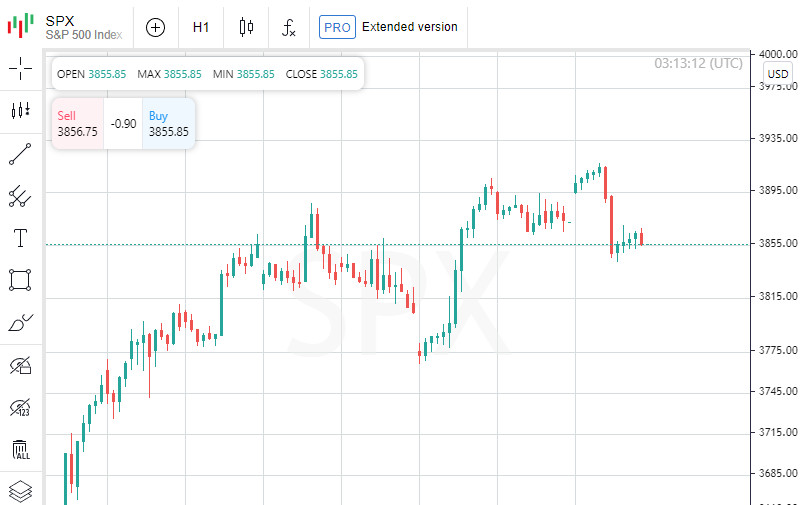

The U.S. stock market closed lower, the Dow Jones fell 0.24%

At closing time on the New York Stock Exchange, the Dow Jones was down 0.24%, the S&P 500 was down 0.41% and the NASDAQ Composite was down 0.89%.

The leaders among Dow Jones index components in today's trading were shares of JPMorgan Chase & Co. which gained 2.28p (1.81%) to close at 128.16. Nike Inc rose 1.09 pct (1.18%) to close at 93.77. Goldman Sachs Group Inc rose 3.94p (1.14%) to close at 348.45.

The least gainers were shares of Apple Inc, which fell 2.69p (1.75%) to close the session at 150.65. Salesforce Inc shares rose 2.79p (1.72%) to close at 159.80, while Microsoft Corporation dropped 3.96p (1.71%) to close at 228.17.

The top gainers among S&P 500 index components in today's trading were ABIOMED Inc which gained 49.88% to 377.82, IDEXX Laboratories Inc which gained 9.80% to close at 394.93, and Hologic Inc which gained 9.34% to end the session at 74.13.

Catalent Inc shares were the fallers, down 24.62% to close at 49.55. Shares of Zebra Technologies Corporation lost 15.86% and ended the session at 238.30. Ecolab Inc dropped 8.98% to 142.96.

The gainers among the components of the NASDAQ Composite index in today's trading were shares of ABIOMED Inc. which gained 49.88% to 377.82, Sonnet Biotherapeutics Holdings Inc. which gained 46.63% to close at 2.83 and shares of NLS Pharmaceutics AG which gained 44.00% to close the session at 0.74.

Varonis Systems shares were the fallers, dropping 35.49% to close at 17.27. Shares of China Liberal Education Holdings lost 27.39% to end the session at 1.14. Acorda Therapeutics Inc. was down 25.22% to 0.80.

On the NYSE, 1,960 securities gained more than 1,172 which closed negative and 95 were flat. On NASDAQ, 2,101 stocks gained in value, 1,680 declined, and 194 remained flat.

The CBOE Volatility Index, which is based on the S&P 500 options trade, fell 0.27% to 25.81.

Gold futures for December delivery added 0.55%, or 8.95, to $1.00 per troy ounce. In other commodities, December WTI crude oil futures rose 2.02%, or 1.75, to $88.28 a barrel. January Brent crude futures traded up 1.83%, or 1.70, to $94.51 per barrel.

Meanwhile, on the Forex market, EUR/USD remained unchanged 0.08% to 0.99, while USD/JPY dropped 0.33% to 148.23.

The USD index futures rose 0.02% to 111.44.

News are provided by

InstaForex.

Read More

-

04-11-2022, 12:46 AM #3074

Asian stock indices decline after robust rally

Today, Asian indices declined by up to 3%. In general, they showed slight declines. The Korean KOSPI decreased by 0.29%, and the Chinese Shanghai Composite and Shenzhen Composite indices dropped by 0.63% and 0.59% respectively. The Australian S&P/ASX 200 and Hong Kong Hang Seng Index were among the top losers, plummeting by 1.77% and 2.9% respectively. Japan's stock exchanges are closed today because of the holiday but yesterday Japan's Nikkei 225 dropped by 0.06%.

Asian indicators traditionally follow the US indices, which showed a decline of up to 3.3%. This was due to the release of the US Federal Reserve's decision to raise the rate by 0.75%, to 3.75-4%.

Although the increase coincided with experts' forecasts, investors fear an economic downturn, as the rate reached a record high for 14 years. In addition, the Fed chairman's statement warned them that the central regulator had no plans to reduce the pace of rate hikes so far. Thus, the risk of a recession is getting higher but the Fed is going to continue its policy in order to bring inflation under control. Softer monetary policy, according to the head of the Fed, will be discussed either at the next meeting in December or as early as next year.

According to the fresh data, China's PMI declined last month to 48.3 points from September's level of 48.5 points. If this indicator falls below 50 points, it indicates a decrease in business activity. Experts note that such a value was due to the country's strict policy against the spread of the coronavirus.

Due to the fact that Lenovo Group managed to increase its net profit by 6% in the second quarter of the fiscal year, while its revenue decreased by 4%, its share price declined by 0.8%.

CanSino Biologics, Inc.'s stock price plummeted by 26.5% after the company announced that it was not expected to increase profits from sales of China's first inhalation vaccine against coronavirus due to the high level of competition and an overall decline in demand.

Following this statement, other representatives of the pharmaceutical industry also showed declines. Securities of CSPC Pharmaceutical Group, Ltd. fell by 10.1%, and Sino Biopharmaceutical, Ltd. dropped by 5.9%.

Also among the components of the Hong Kong Hang Seng index, Netease, Inc. slipped by 6.7%, Sands China, Ltd. lost 6.1% as well as Alibaba Group Holding, Ltd. fell by 6%.

Among the components of the Korean KOSPI, Samsung Electronics dropped by 0.8%, as well as Hyundai Motor lost 2.1%.

The Australian S&P/ASX 200 index also showed declines. BHP lost 3.1% and Rio Tinto declined by 2.3%.

News are provided by

InstaForex.

Read More

-

04-11-2022, 10:21 AM #3075

Where is the USD/JPY ceiling?

The dollar is back on horseback and aims to continue the rally on all fronts, including against the yen. But how far can USD/JPY go if there are intervention barriers on its way?

The dollar is sprinting

The US central bank once again raised interest rates by 75 bps, but signaled that it may be approaching a tipping point in its aggressive anti-inflationary campaign.

Such a dovish remark literally undermined the dollar's position in all directions. However, a little later, the mood in the market changed: dollar bulls received a calming pill from Federal Reserve Chairman Jerome Powell.

The official dispelled traders' concerns about a possible slowdown in the pace of tightening. He categorically stated that it was too early to discuss a slowdown and hinted at higher final interest rates in America.

In light of Powell's latest comments, the market has revised its forecast for the US interest rate upwards. Investors now expect the figure to peak at 5.15% by June next year.

Strengthening hawkish sentiment has served as a great driver for the yield of 10-year US government bonds. Yesterday, the figure jumped to 4.16%, which contributed to a sharp rise in the dollar.

On Friday night, the DXY index rose 0.8% and tested the highest level in almost two weeks at 113.15.

This put the greenback on track for a weekly gain. Since Monday, the dollar has already strengthened by 2% against its main competitors. This trend has not been seen since September.

Last night, the USD showed a parabolic gain against the pound (+2%), and also performed well against the euro, Australian and New Zealand dollars, rising against all currencies by 0.7%.

As for the yen, the greenback grew the least against it - by 0.2%. Its rise was limited by the heightened risk of intervention by the Japanese government.

Forecast for USD/JPY

On Friday morning, Japanese Finance Minister Shunichi Suzuki once again repeated his warning to currency speculators. He stated that the authorities would not put up with a sharp weakening of the yen and would take all necessary measures in the event of a new attack on the JPY.

The increased threat of intervention from the Ministry of Finance of Japan did not come as a surprise to traders. Many anticipated this development, given the current fundamental picture, which points to a further increase in monetary divergence between the Bank of Japan and the Fed.

Recall that at the last seven-day period, the BOJ again confirmed its commitment to ultra-soft policy and left interest rates in negative territory.

This was the first negative signal for the yen. The second already came this week, when Powell made it clear that the final level of interest rates in the US could be higher than previously expected.

Double pressure leaves no chance for the JPY, so the Japanese government has no choice but to be fully armed.

Of course, bulls are well aware that the effect of future interventions is likely to be as short-lived as the previous ones. Despite this, they still do not dare to play with fire.

According to some analysts, this situation may drag on. Fear of intervention will keep the USD/JPY pair in deep consolidation for at least a few more days until some compelling trigger appears on the horizon.

It is probably not worth hoping that the major will receive a strong impetus from the US economic data. Most likely, fresh statistics on inflation will inspire dollar bulls to new exploits.

If the market does not see signs of a slowdown in consumer price growth in November, this will be another argument for the Fed in favor of further aggressive tightening.

"Sustained inflation may indeed force the Fed to raise the final level of rates significantly higher than the initial estimate – up to 5% and even more," MUFG Bank strategists argue. In this case, we expect USD/JPY to rise from its current level of 148 to 155, which, apparently, will be its ceiling.

Experts are also considering a more optimistic scenario, in which the quote may rise to the highest level since April 1990 at 160.35. This will only happen if there is talk of an even higher US final rate range of 5.5% to 6%.

News are provided by

InstaForex.

Read More

-

07-11-2022, 09:03 AM #3076

US stock market closes higher, Dow Jones gains 1.26%

At the close of the New York Stock Exchange, the Dow Jones rose 1.26%, the S&P 500 rose 1.36%, and the NASDAQ Composite rose 1.28%.

The leading performer among the components of the Dow Jones index today was Nike Inc, which gained 5.43 points (6.01%) to close at 95.83. Quotes Dow Inc rose by 2.52 points (5.41%), ending trading at 49.01. Caterpillar Inc rose 4.37% or 9.58 points to close at 228.84.

The least gainers were Salesforce Inc, which shed 6.54 points or 4.47% to end the session at 139.79. UnitedHealth Group Incorporated rose 5.46 points (1.00%) to close at 538.15, while Apple Inc shed 0.27 points (0.19%) to end at 138. 38.

Leading gainers among the S&P 500 index components in today's trading were Freeport-McMoran Copper & Gold Inc, which rose 11.53% to 35.20, Estee Lauder Companies Inc, which gained 8.69% to close at 210.62, as well as Newmont Goldcorp Corp, which rose 8.55% to end the session at 41.02.

The least gainers were Warner Bros Discovery Inc, which shed 12.87% to close at 10.43. Shares of Live Nation Entertainment Inc shed 7.25% to end the session at 70.88. ServiceNow Inc lost 6.12% to 361.95.

Among the components of the NASDAQ Composite Index today, the leaders of growth were Huadi International Group Co Ltd, which rose 70.26% to 180.00, Sentage Holdings Inc, which gained 34.54% to close at 4.09 , as well as shares of Digimarc Corporation, which rose 29.35% to close the session at 18.95.

The least gainers were Pulmonx Corp, which shed 60.94% to close at 4.82. Shares of Funko Inc lost 59.38% and ended the session at 7.92. Quotes of Sensus Healthcare Inc decreased in price by 51.23% to 6.34.

On the New York Stock Exchange, the number of securities that rose in price (2275) exceeded the number of those that closed in the red (839), while quotes of 85 shares remained virtually unchanged. On the NASDAQ stock exchange, 2070 companies rose in price, 1658 fell, and 202 remained at the level of the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, fell 2.96% to 24.55, hitting a new monthly low.

Gold futures for December delivery added 3.30%, or 53.90, to $1.00 a troy ounce. In other commodities, WTI crude for December delivery rose 5.08%, or 4.48, to $92.65 a barrel. Futures for Brent crude for January delivery rose 4.24%, or 4.01, to $98.68 a barrel.

Meanwhile, in the Forex market, EUR/USD rose 2.16% to hit 1.00, while USD/JPY shed 1.12% to hit 146.60.

Futures on the USD index fell 1.91% to 110.65.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

News are provided by

InstaForex.

Read More

-

08-11-2022, 10:00 AM #3077

The dollar is building muscle, but fears a loss in the long run

In the short and medium-term planning horizons, the US currency will remain afloat, although from time to time it shows a decline. However, traders and analysts are worried about the long-term prospects of USD, as the greenback is losing its position in the global financial market.

The dollar fell at the beginning of this week, remaining weak on Tuesday, November 8, amid the strengthening of the European and Chinese currencies. Later, the greenback "built up its muscles" and partially won back its positions, rising in price against the euro and the yen. Recall that last Friday, November 4, the dollar index (USDX) lost over 2%. This is one of the largest intraday declines in the last 20 years, experts emphasize. In a similar situation, dollar bulls capitulated, failing to give momentum to the US currency.

However, the greenback does not give up, trying to bypass the euro and other competitors of the financial market. On the morning of Tuesday, November 8, the key EUR/USD currency pair began with the consolidation of parity and headed above the 50-day moving average. According to analysts, the upward trend in the EUR/USD pair remains in force, while the pair has reached 1.0001.

The EUR/USD pair started the current week with steady growth, but further recovery is questionable. According to experts, in the short term, the EUR/USD pair can test a three-month high of 1.0200. The pair has currently restored the bullish dynamics and is cruising near parity.

Analysts pay attention to how the euro's dynamics are unstable compared to the dollar. This is facilitated by the growth of negative sentiment about the possible onset of recession in the eurozone. A decrease or slowdown in a number of fundamental indicators that affect the EUR in the long term adds fuel to the fire.

According to analysts, the euro's movements depend on the dollar's dynamics, geopolitical news and divergence between the strategies of the Federal Reserve and the European Central Bank. The US central bank's recent decision to raise rates and the likelihood of a prolonged tightening of the monetary policy on its part is the main obstacle to a steady recovery of the EUR/USD pair. According to economists, the inflation rate in the US fell slightly in October, but any unscheduled rate hike will have negative consequences for the euro. The prerequisites for such a forecast were the statements of Fed Chairman Jerome Powell, who indicated that the current macro data justify a significant rise in interest rates for the next year.

This week, market participants expect annual inflation in the US to slow down to 8%. Recall that in September, this figure was 8.2%. To date, inflation has retreated from the peak value of 9.1%, but remained above the Fed's target level of 2%. Against this background, experts are confident that the Fed will raise the interest rate again in December, but only by 0.5 percentage points.

According to previous forecasts, by the end of 2022, interest rates in the United States could reach 4.5%, and by the beginning of 2023 – 4.75%. However, Powell's recent speech forced the financial markets to reconsider these decisions. According to preliminary calculations, the possible peak of the federal funds rate in the United States will be 5%. This will allow the greenback to strengthen, but weaken the euro, experts are certain.

The US currency currently remains under pressure, as market participants continue to evaluate the Fed's recent statements, which indicate difficulties in the process of normalization of monetary policy. According to Scotiabank's currency strategists, USD will remain stable in the short term, but in the long term it is expected to undergo a "significant correction". According to experts, the current dollar rally has been "unnecessarily prolonged", and this may provoke its collapse. However, the USD will not fall until the Fed's tightening cycle ends, analysts believe. *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

News are provided by

InstaForex.

Read More

-

09-11-2022, 07:44 AM #3078

US stock market closes higher, Dow Jones gains 1.02%

At the close on the New York Stock Exchange, the Dow Jones rose 1.02% to hit a monthly high, the S&P 500 index grew 0.56%, the NASDAQ Composite index climbed 0.49%.

Amgen Inc was the top performer among the components of the Dow Jones in today's trading, up 15.37 points or 5.55% to close at 292.39. Quotes Boeing Co jumped by 4.71 points (2.86%), closing at 169.62. American Express Company rose 2.19% or 3.22 points to close at 150.20.

The worst performers were Walgreens Boots Alliance Inc, which shed 0.30 points or 0.78% to end the session at 38.29. The Walt Disney Company was up 0.53 points (0.53%) to close at 99.90, while Chevron Corp was down 0.27 points (0.15%) to close at 185. 34.

The top performers in the S&P 500 index today were SolarEdge Technologies Inc, which surged 19.13% to 251.73, Expeditors International of Washington Inc, which gained 9.06% to close at 104.40, as well as Welltower Inc, which increased by 8.22% to end the session at 66.51.

The least gainers were Take-Two Interactive Software Inc, which shed 13.68% to close at 93.57. Shares of Medtronic PLC lost 6.25% to end the session at 80.19. Quotes of International Flavors & Fragrances Inc decreased in price by 4.96% to 91.41.

Leading gainers among the components of the NASDAQ Composite in today's trading were Taskus Inc, which rose 37.22% to hit 22.01, GrowGeneration Corp, which gained 35.05% to close at 4.47, and Skywater Technology Inc, which rose 31.60% to end the session at 11.37.

The least gainers were Bioventus Inc, which shed 57.51% to close at 3.00. Shares of R1 RCM Inc lost 49.76% and ended the session at 7.41. Quotes of Athersys Inc decreased in price by 43.36% to 1.28.

On the New York Stock Exchange, the number of securities that rose in price (1834) exceeded the number of those that closed in the red (1256), while quotes of 125 shares remained virtually unchanged. On the NASDAQ stock exchange, 1,894 stocks fell, 1,771 rose, and 259 remained at the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, rose 4.89% to 25.54.

Gold futures for December delivery added 2.15%, or 36.20, to $1.00 a troy ounce. In other commodities, WTI crude for December delivery fell 2.83%, or 2.60, to $89.19 a barrel. Brent futures for January delivery fell 2.39%, or 2.34, to $95.58 a barrel.

Meanwhile, in the Forex market, EUR/USD climbed 0.56% to hit 1.01, while USD/JPY fell 0.73% to hit 145.55.

Futures on the USD index fell 0.46% to 109.49.

News are provided by

InstaForex.

Read More

-

10-11-2022, 06:39 AM #3079

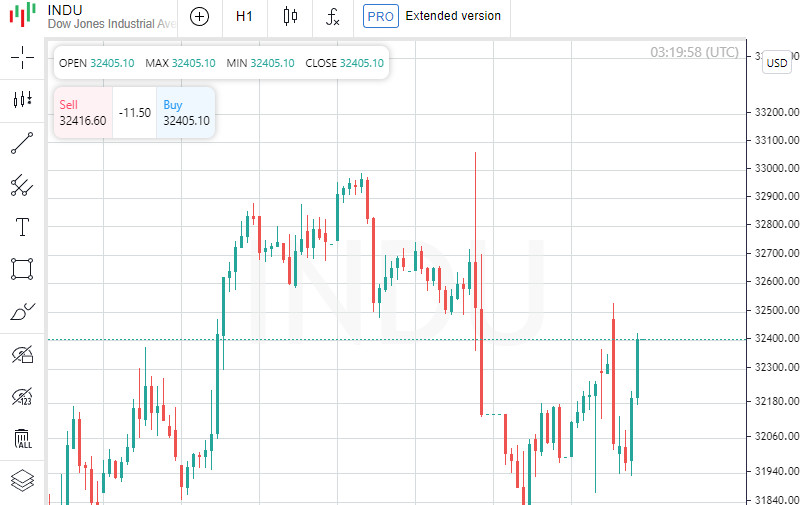

US stocks closed lower, Dow Jones down 1.95%

At the close on the New York Stock Exchange, the Dow Jones fell 1.95%, the S&P 500 fell 2.08%, and the NASDAQ Composite index fell 2.48%.

Merck & Company Inc was the top gainer among the components of the Dow Jones in today's trading, up 0.09 points (0.09%) to close at 101.59. Quotes of McDonald's Corporation fell by 0.61 points (0.22%) to end trading at 277.79. Procter & Gamble Company lost 0.33 points or 0.24% to close at 136.48.

The least gainers were Walt Disney Company, which fell 13.15 points or 13.16% to end the session at 86.75. Chevron Corp was up 4.00% or 7.41 points to close at 177.93 while Dow Inc was down 3.97% or 1.97 points to close at 47.68. .

Leading gainers among the S&P 500 index components in today's trading were Akamai Technologies Inc, which rose 6.19% to hit 89.08, Gen Digital Inc, which gained 6.01% to close at 22.92, and also shares of Bio-Rad Laboratories Inc, which rose 5.67% to end the session at 403.49.

The least gainer was Walt Disney Company, which shed 13.16% to close at 86.75. Shares of Occidental Petroleum Corporation shed 9.22% to end the session at 67.93. Quotes Norwegian Cruise Line Holdings Ltd fell in price by 8.74% to 15.77.

Leading gainers among the components of the NASDAQ Composite in today's trading were Merrimack Pharmaceuticals Inc, which rose 212.75% to 12.51, Outset Medical Inc, which gained 29.90% to close at 14.90, and also shares of Neurobo Pharmaceuticals Inc, which rose 29.60% to close the session at 1.62.

The least gainers were Clovis Oncology Inc, which shed 71.62% to close at 0.28. Shares of Telos Corp lost 68.84% and ended the session at 3.44. Quotes of Athersys Inc decreased in price by 56.45% to 0.56.

On the New York Stock Exchange, the number of securities that fell in price (2539) exceeded the number of those that closed in positive territory (564), while quotes of 97 shares remained virtually unchanged. On the NASDAQ stock exchange, 2,848 stocks fell, 900 rose, and 221 remained at the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, rose 2.15% to 9/26.

Gold futures for December delivery lost 0.44% or 7.60 to hit $1.00 a troy ounce. In other commodities, WTI crude for December delivery fell 3.77%, or 3.35, to $85.56 a barrel. Futures for Brent crude for January delivery fell 3.15%, or 3.00, to $92.36 a barrel.

Meanwhile, in the Forex market, EUR/USD was down 0.62% to hit 1.00, while USD/JPY was up 0.52% to hit 146.41.

Futures on the USD index rose 0.75% to 110.37.

News are provided by

InstaForex.

Read More

-

11-11-2022, 10:42 AM #3080

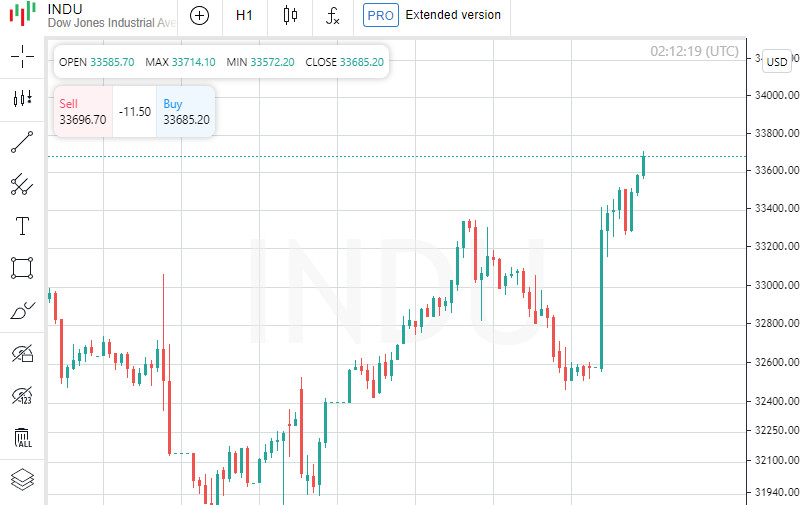

US stock market closes higher, Dow Jones gains 3.70%

At the close of the New York Stock Exchange, the Dow Jones rose 3.70% to a one-month high, the S&P 500 rose 5.54% and the NASDAQ Composite rose 7.35%.

Salesforce Inc was the top gainer among the components of the Dow Jones in today's trading, up 14.24 points or 10.02% to close at 156.30. Quotes of Apple Inc rose by 12.00 points (8.90%), ending trading at 146.87. Home Depot Inc rose 24.95 points or 8.70% to close at 311.70.

Shares of McDonald's Corporation led the decline, losing 1.91 points (0.69%) to end the session at 275.88. Merck & Company Inc was down 0.30 points (0.30%) to close at 101.89 while Amgen Inc was up 0.47% or 1.36 points to close at 291. .01.

Leading gainers among the S&P 500 index components in today's trading were Invesco Plc, which rose 17.85% to hit 18.75, Caesars Entertainment Corporation, which gained 17.83% to close at 50.62, and shares of T. Rowe Price Group Inc, which rose 16.36% to close the session at 124.65.

The least gainers were McKesson Corporation, which shed 4.12% to close at 370.32. Shares of Cardinal Health Inc shed 2.79% to end the session at 77.93. Quotes of Altria Group decreased in price by 2.19% to 44.22.

Leading gainers among the components of the NASDAQ Composite in today's trading were Fast Radius Inc, which rose 156.19% to hit 0.26, SHF Holdings Inc, which gained 85.78% to close at 3.79, and also shares of EpicQuest Education Group International Ltd, which rose 73.79% to close the session at 1.79.

The least gainers were Apyx Medical Inc, which shed 60.45% to close at 1.74. Shares of Veru Inc lost 53.56% and ended the session at 6.97. Quotes of AGBA Acquisition Ltd decreased in price by 50.89% to 5.50.

On the New York Stock Exchange, the number of securities that rose in price (2830) exceeded the number of those that closed in the red (347), while quotes of 80 shares remained virtually unchanged. On the NASDAQ stock exchange, 3,100 companies rose in price, 694 fell, and 216 remained at the level of the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, fell 9.81% to 23.53, hitting a new monthly low.

Gold futures for December delivery added 2.68%, or 45.95, to $1.00 a troy ounce. In other commodities, WTI crude for December delivery rose 0.55%, or 0.47, to $86.30 a barrel. Futures for Brent crude for January delivery rose 0.90%, or 0.83, to $93.48 a barrel.

Meanwhile, in the Forex market, EUR/USD rose 2.03% to 1.02, while USD/JPY shed 3.97% to hit 140.62.

Futures on the USD index fell 2.55% to 107.65.

News are provided by

InstaForex.

Read More

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 18 users browsing this thread. (0 members and 18 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote