Watch this video: https://youtu.be/IhSUuFP1zbU

Login to 3Commas SmartTrade

Now, login to your 3Commas account. We need to choose the exchange that we want to trade on.

In this case, itís my Binance, which is the Binance account that I just created and now I need to choose a trading pair.

You could select a pair that youíve been eyeing on Binance either by scrolling down or you could just go ahead and type it in.

What Trailing Buy Does?

It does, once the price hits where you want to buy, maybe that price will keep going down. What this does is, add a set percent.

Letís say 1 percent. Every 1 percent, it goes down below the initial price that you selected, the buy price will go lower 1 percent, 1 percent, 1 percent, itís trailing, itís following, so that when the price goes back up, you will have purchased it at a cheaper price than you originally would have.

Market order vs Limit order

A market order is going to sell it to the highest bidder at that moment. If that highest bidder is not buying a lot, then it might fall down a little bit from where you purchased it from. However, if itís a high volume chart, youíll probably get sold at that price.

Whereas with a limit order, you decide what price you want to sell and youíre waiting for that price. So youíre waiting for all the bids to come up and itís going to surpass that price and then it will sell itíll sell everything at that set limit price.

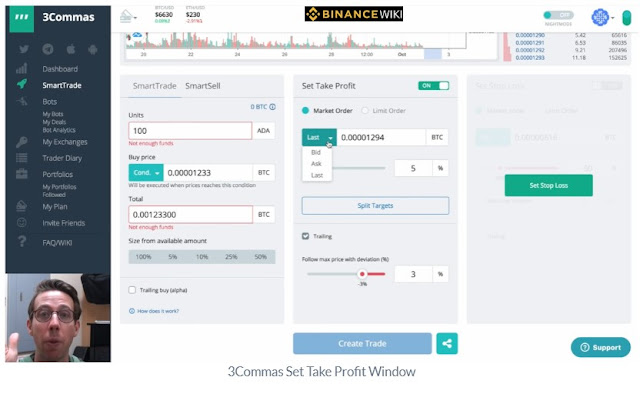

What is Set take profit window

Thereís Bid, Ask and Last. Bid means youíre going to be selling to the highest bidder. Ask means youíre going to be selling to the lowest person selling. Last means youíre going to be selling when itís that price exactly.

Coming back over to SmartTade, we have bid, ask and last. We also have a new one limit. This is just like this limit order over here and takes profit. Except now, this is where we want to buy at this absolute price.

Let me show you why? with stop loss, you can decide at what price you want to exit the trade. You can decide if itís going to be selling to the highest bidder to the lowest asker or at the last price. I usually leave it on bid.

Thereís also this nice little button Ė stop-loss timeouts.

Stop Loss timeout means if thereís a sudden drop in the price or what I like to call a fat-fingered drop.

This is not going to trigger your stop loss. Itís just a momentary drop that happens just for one minute. It will not trigger your stop.

This is a huge insurance policy on avoiding getting stopped out by these fat finger drops and happened on so many crypto charts.

A lot of you know what Iím talking about. Maybe youíve been stopped up before and itís been painful.

This is a great way to make sure that your trades donít exit in those times. We also have an option for trailing. This trailing is similar to the take profit except trailing stop loss, works below the price and follows it up.

A GUIDE TO 3COMMAS SMARTTRADE CREATION

https://binancewiki.io/3commas-smarttrade/

Please visit our sponsors

Results 1 to 1 of 1

-

15-12-2019, 04:32 PM #1Senior Investor

- Join Date

- Oct 2019

- Posts

- 799

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

A guide to 3commas smarttrade creation

A guide to 3commas smarttrade creation

-

Sponsored Links

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote