Weekly technical analysis for 28.07 – 1.08

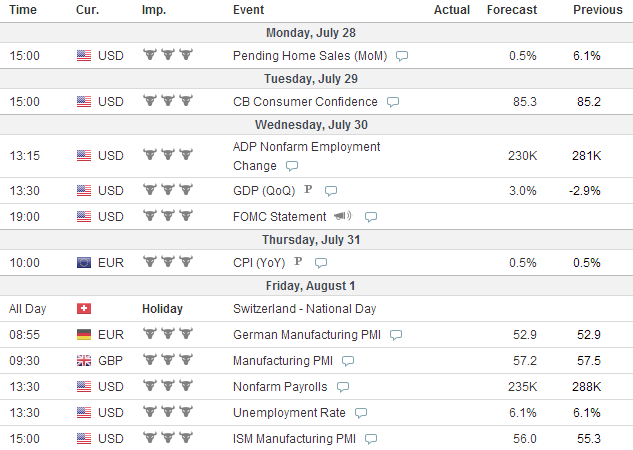

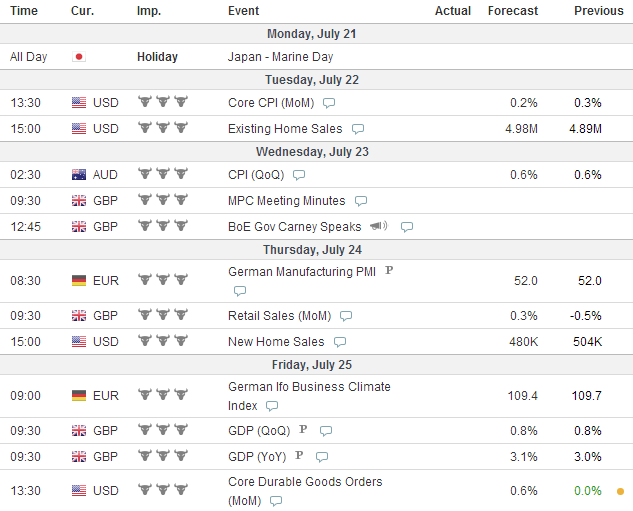

IMPORTANT ECONOMIC EVENTS DURING THE WEEK (GMT)

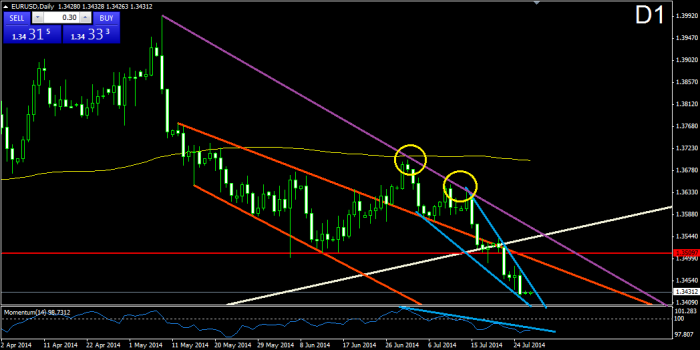

EURUSD:

The recent bearish movement of the price after the interaction with the purple bearish trend line resembles a falling wedge formation. As we all know, the falling wedge formation has the potential to break in bullish direction and to increase the price as much as the size of the formation is. At the same time, the momentum indicator has also been decreasing and it is about to reach its lowest possible point. If this happens, we could expect the indicator (and eventually the price) to make a bullish correction, which would satisfy the falling wedge formation. For this reason, we believe the price would probably return again to the purple bearish trend line for a test. The decrease of the momentum has been following a bearish trend line (blue). A bullish break in the wedge, or in the blue bearish trend of the momentum, could be considered as a signal for a long position.

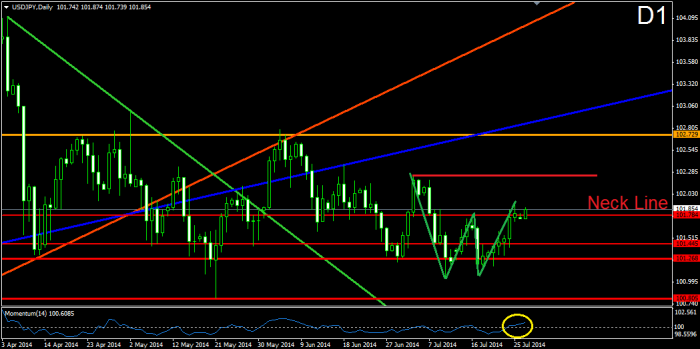

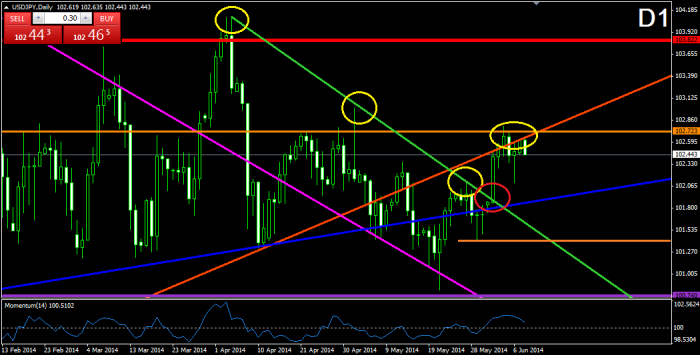

USDJPY:

As you see, the price has confirmed the green double bottom formation with interrupting its neck line at 101.784. At the same time, the momentum indicator has crossed the 100-level line in bullish direction, which supports the continuation of the bullish movement caused by the double bottom formation. For this reason, we believe that the price would increase at least to the resistance, which indicates the beginning of the double bottom formation or even to the many times tested orange 102.729 resistance. After all, the bullish increase is expected to be about 76 bullish pips.

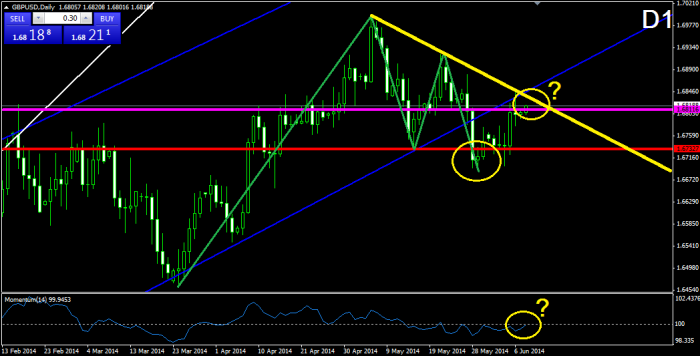

GBPUSD:

After reaching its 70-months high at 1.71792, the price started a bearish decrease, which broke through the lower level of the blue bullish corridor from September 2013, the 1.70527 support and the 1.69922 support. Currently, it looks like the decrease of the price is slowing down its intensity. At the same time, the momentum indicator has reached its lowest possible level, which speaks of an eventual correction. As you see, we have drawn a line, which connects the last two big bottoms of the price and we could use it as a support in case of an eventual meeting of the price with it. But having in mind the recent behavior of the momentum indicator and the Cable in general, this might happen after the price does some kind of correction first.

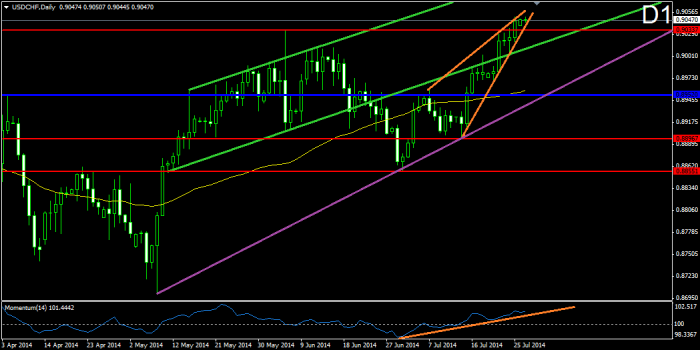

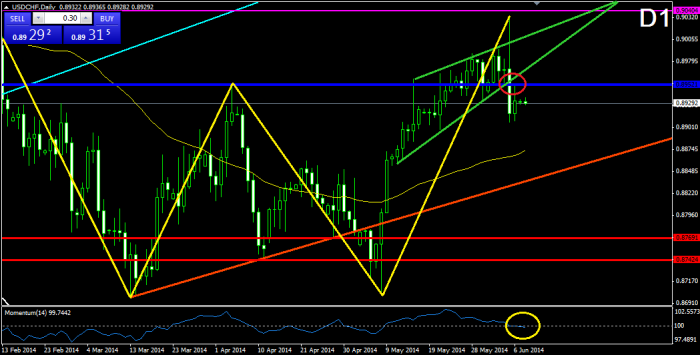

USDCHF:

As we have said for many times, the situation by the Swissy is a mirror image to the EUR/USD currency pair. Again, after the last interaction with the purple bullish trend line, the price started increasing in a rising wedge formation. As we all know, the rising wedge formation has the potential to break in bearish direction and to decrease the price as much as its size. At the same time, the momentum indicator has been moving after a bullish trend line and it has almost reached its highest point. After this happens, we could expect the indicator (and eventually the price) to do a bearish correction, which would satisfy the rising wedge formation. A signal for an upcoming bearish movement could be a bearish break in the wedge, or a bearish break in the orange bullish trend line of the momentum indicator.

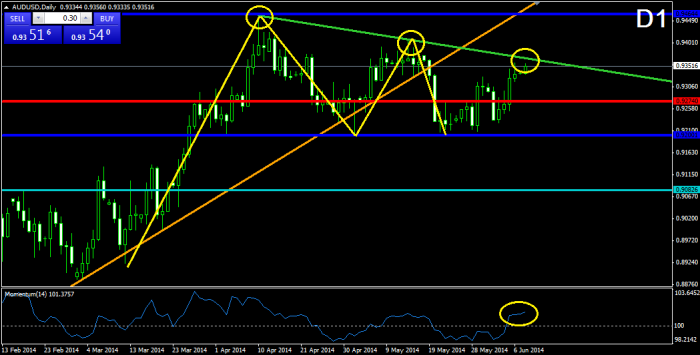

AUDUSD:

During the last week the price returned to the yellow bullish trend line from July 16. Currently, the price is testing the yellow bullish trend line as a support. At the same time, the momentum indicator is testing the 100-level line as a support. For this reason, it looks like the price is likely to bounce from the yellow bullish trend line and the momentum indicator to bounce from the 100-level line. The price is likely to reach the resistances at 0.94376 and 0.94579 afterwards. If the price breaks these resistances, we might witness the creation of a new price high.

Weekly technical analysis for 21 – 25.07

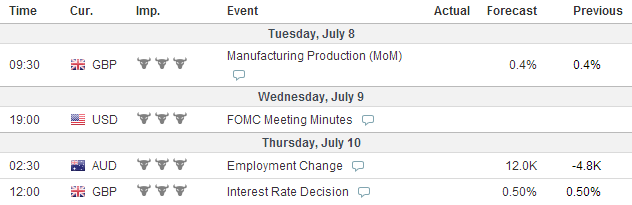

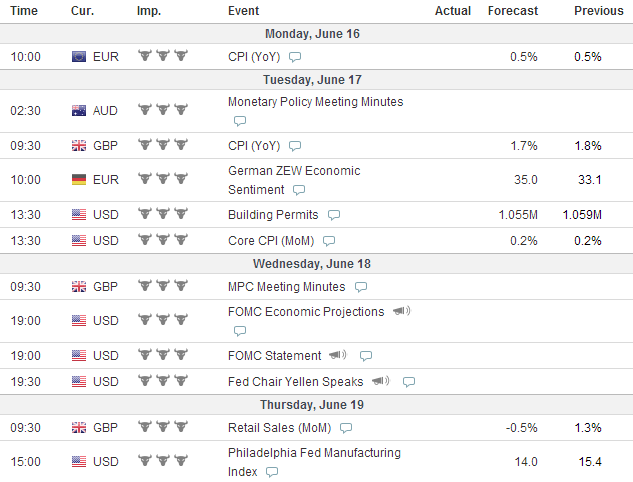

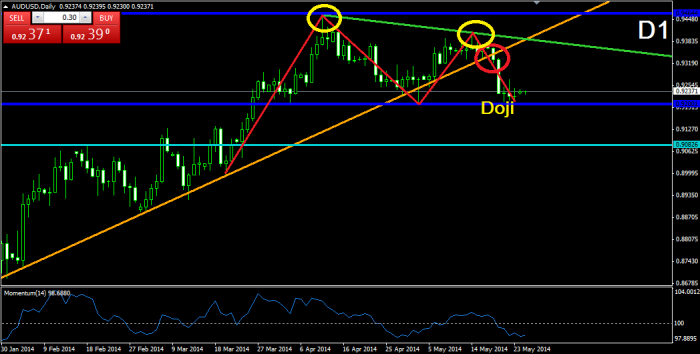

IMPORTANT ECONOMIC EVENTS DURING THE WEEK (GMT)

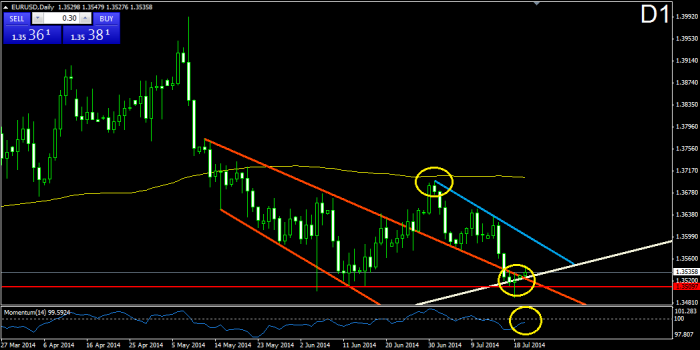

EURUSD:

Currently, the price attempts a bullish bounce from three supports at once. The first one is the red horizontal level at 1.35097. The second one is the already broken upper level of the orange bearish corridor from May 12, and the third one is the white bullish line from July 2012. As we see, the supports, which the price experiences are pretty strong and this is the reason to believe that the bullish scenario is the more possible one. Furthermore, this is the third bottom on the white bullish line and currently it is July 2014. The other two bottoms are from July 2013 and July 2012, which creates the idea that the price starts an increase in every July. The momentum indicator is about to meet the 100-level line in bullish direction.

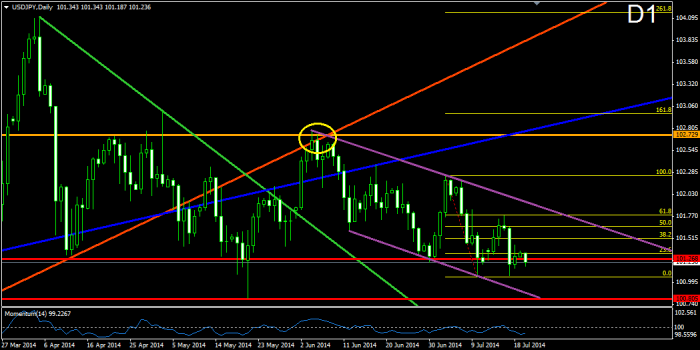

USDJPY:

On its way down from its last interaction with the 102.729 resistance (yellow circle), it looks like the price is following a bearish corridor (purple). Finally, the corridor brought the price to test the support at 101.268 and it even looks like the price attempts to break this level. This would be clear after we see the price testing the lower level of the corridor again. Notice, that the momentum indicator follows exactly every swing of the price and currently it attempts to create a bottom and to start a bullish increase, which means that the 101.268 support might not get broken exactly this time.

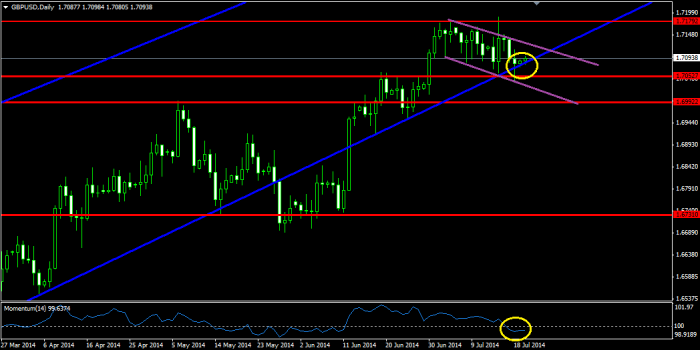

GBPUSD:

Having in mind that after reaching the level of 1.71792 the purple bearish corridor brought the price to test the lower level of the blue bearish corridor from September 2013 and even a bullish bounce appeared, we might expect the price to break the upper level of the purple corridor. If this happens, a new interaction with 1.71792 would be expected and, eventually, the creation of a new high. On the other hand, the momentum indicator did a clear bearish break through the 100-level line, which speaks of the opposite scenario. If a break in the lower level of the blue bullish corridor occurs, we might see the price testing 1.70527 or even 1.69922.

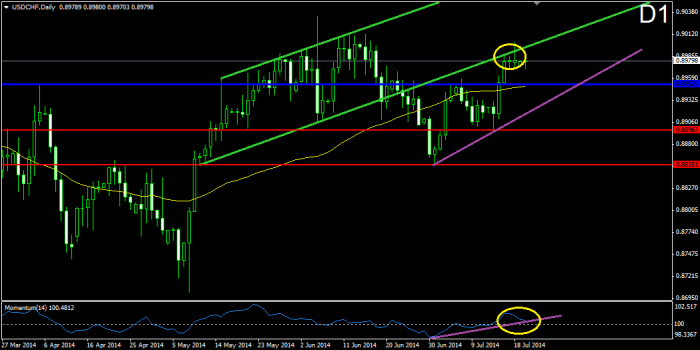

USDCHF:

As you see, the price of the Swissy tests the already broken lower level of the green bullish corridor as a resistance and having in mind the last 4 candles on the chart, we could state that the price is really having a hard time breaking through this level. At the same time, the momentum indicator switched above the 100-level line and currently it is testing its bullish line. This situation gives us two controversial signals – a bearish bounce from the green line, or a bullish bounce for the momentum. If the momentum bounces in bullish direction, a break in the green line on the chart might occur. If the momentum breaks in bearish direction, we would probably see the price bouncing from the green line and reaching the purple bullish line on the chart, which connects the last two bottoms of the price.

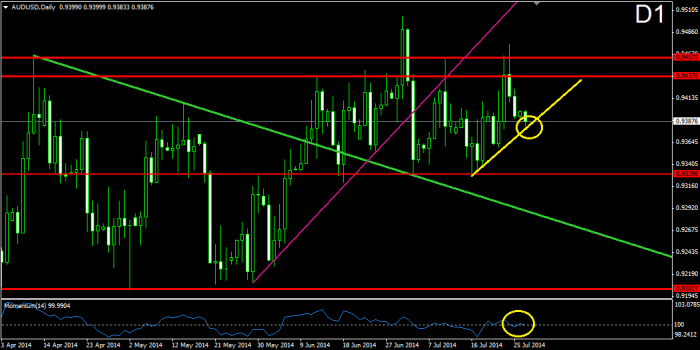

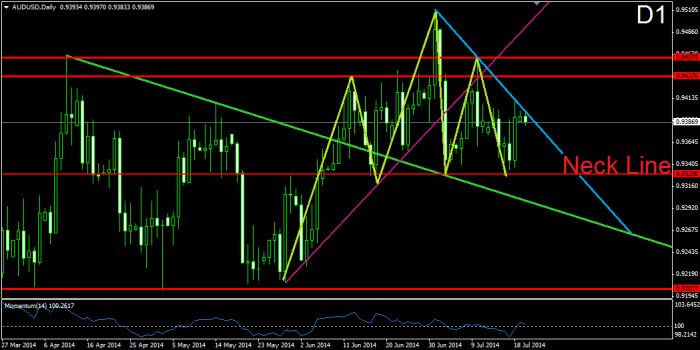

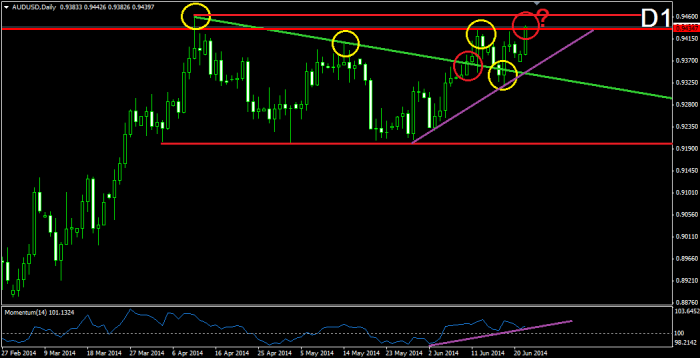

AUDUSD:

The price is currently testing its blue bearish line, which connects the last two tops of the price. For now it looks like the price is going to bounce from the blue line and would meet the neck line of its head and shoulders formation (green-yellow). If a break in the neck line appears, we might see one continuous drop of the price in the next few weeks, which could even reach the support at 0.92927. If a break in the blue bearish line occurs, we might see the price testing the blue bearish line as a support, and increasing to 0.94376 or even to 0.94579.

Weekly technical analysis for 7 – 11.04

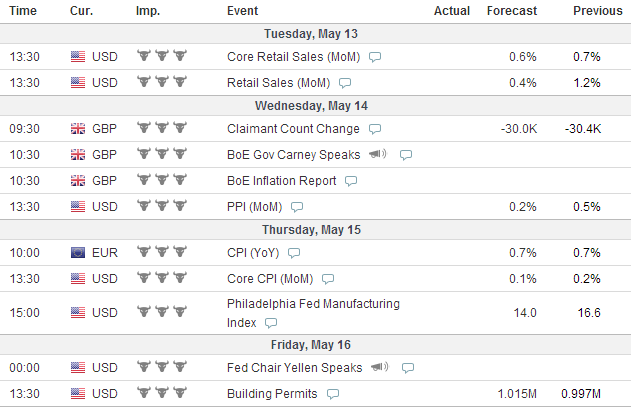

IMPORTANT ECONOMIC EVENTS DURING THE WEEK (GMT)

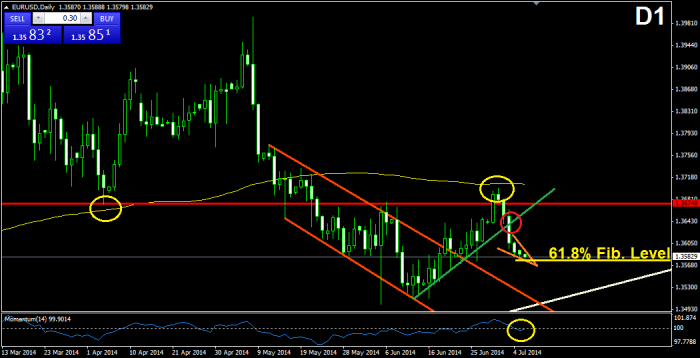

EURUSD:

After interacting with Simple Moving Average 150, the price was resisted and bounced through the green bullish trend line from June 12. The price decreased to the 61.8% Fibonacci Level afterwards, where it looks it is getting supported now. Furthermore, the consolidation around the 61.8% Fibonacci Level resembles a falling wedge formation (orange), which, as we all know, has bullish potential. For this reason, we believe that a bounce from the 61.8% Fibonacci level is about to appear. On the other hand, we get a contrary signal from the momentum indicator, which has just crossed the 100-level line in bearish direction, but at the same time, the cross is tiny and as we see, the indicator is changing direction and might cross the 100-level line back.

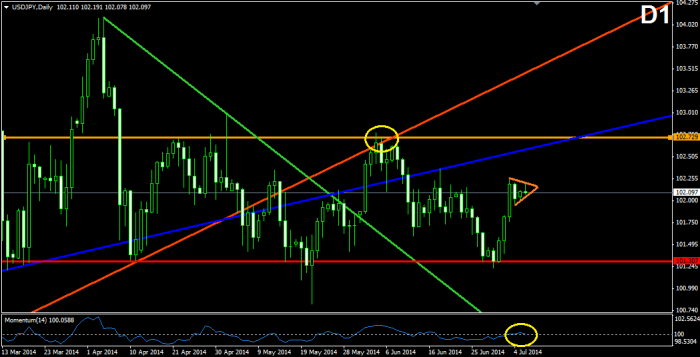

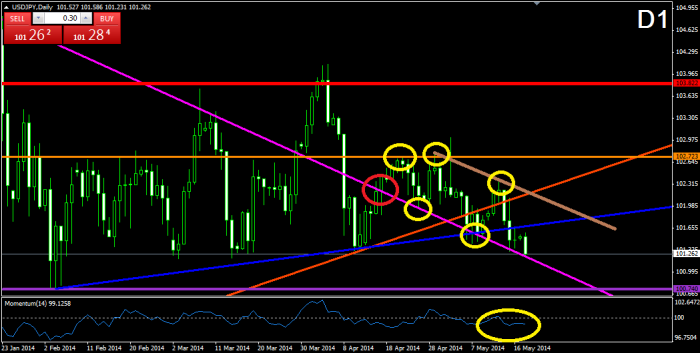

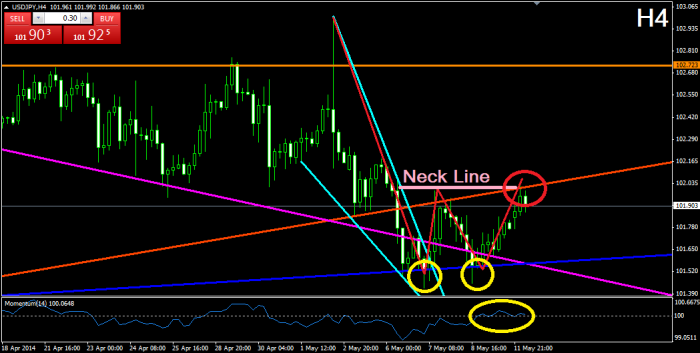

USDJPY:

After decreasing to the 101.307 support, the Yen did a bullish bounce and started moving in bullish direction, which was pretty much what the price was doing during the last week. Currently the price is consolidating, where the consolidation resembles a triangle. At the same time, the momentum indicator has crossed the 100-level line in bullish direction, which implies, that the price would eventually break the triangle in bullish direction. For this reason, we believe that the price is likely to increase to the 102.729 resistance, like it has been doing the last two times.

GBPUSD:

After breaking through its 5-years high, the price has increased with about 120 pips more and it started creating bearish candles, which speaks of an eventual change in the direction of the pair, or for an eventual correction. Furthermore, there is an obvious divergence between the tops and the bottoms of the chart and the momentum indicator, which supports our bearish thesis. For this reason, we believe that the price would eventually decrease to the lower level of the pink bullish corridor or even to the 1.70527 support or the lower level of the blue bullish corridor from the last year.

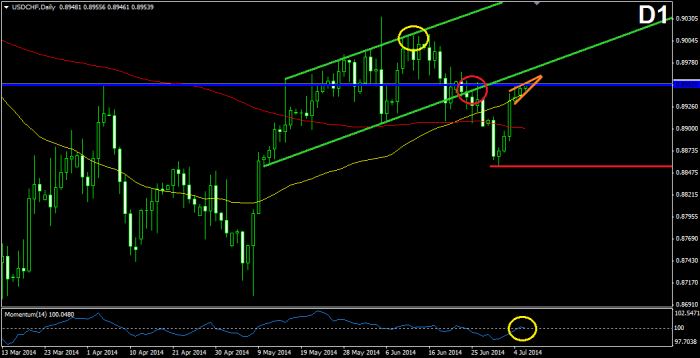

USDCHF:

After breaking in bearish direction through the green bullish corridor, the price decreased to 0.88550n where it found support and bounced in bullish direction. The price increased and it is currently meeting the already broken neck line of the big double bottom formation (W1) at 0.89520 as a resistance. The last three candles of the increase of the price resemble a rising wedge formation, which as we all know, has bearish potential. For this reason, we believe that the price would eventually drop. At the same time, the momentum indicator has done a tiny cross of the 100-level line, but its behavior during the last candle of the price shows that it might return back beyond the 100-level.

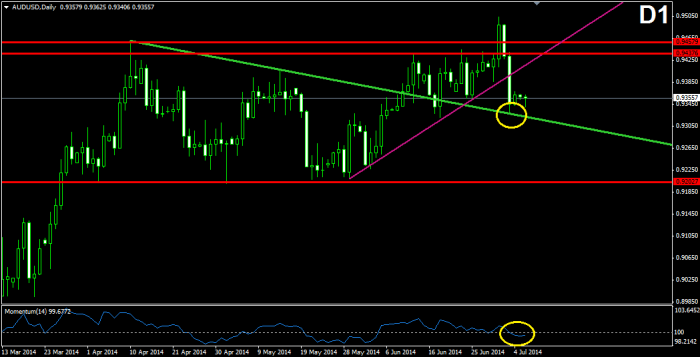

AUDUSD:

After breaking in bearish direction through the purple bullish trend line from May 29, the price decreased to the already broken green bearish line from April 10 and tested it as a support. The Aussie bounced in bullish direction, which speaks of an upcoming new bullish activity. On the other hand, the momentum indicator has crossed the 100-level line in bearish direction, which means that the bounce from the already broken green bearish trend line might appear to be only a correction of a further bearish movement. For this reason, it might be good here to wait for the momentum indicator to go above the 100-level line, or for the price to go beyond the green bearish line, so we would have a confirmation on one of the scenarios.

Weekly technical analysis for 23 – 27.06

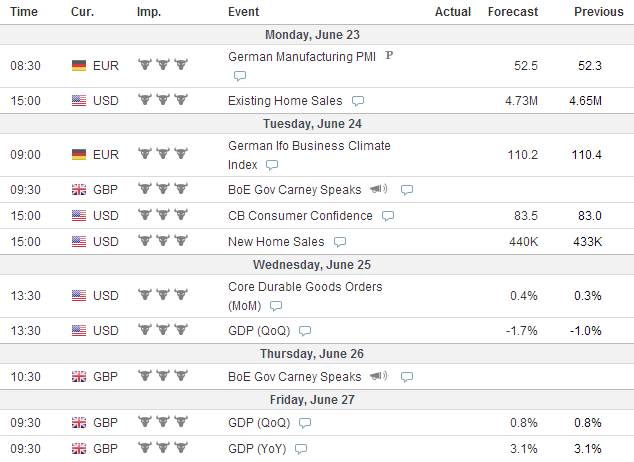

IMPORTANT ECONOMIC DATA DURING THE WEEK (GMT)

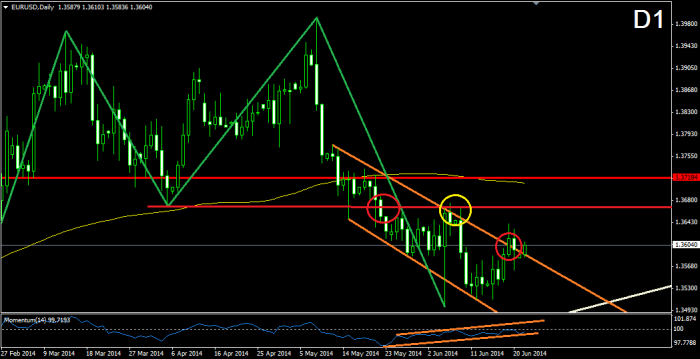

EURUSD:

The price did a bullish break through the upper level of the orange bearish corridor from May 12. As you probably remember, the price was moving after a double top formation (green) and was expected to reach the white bullish line, which connects the bottoms from July 2012 and July 2013 on the MN chart. The bullish break through the bearish corridor implies that the price might reach as a resistance the already broken neck line of the green double top formation. Furthermore, there is a bullish divergence between the bearish corridor and the momentum indicator, which shows a bullish corridor. For this reason, we believe that this might be the end of the bearish movement and the price might reach new levels like 1.37184.

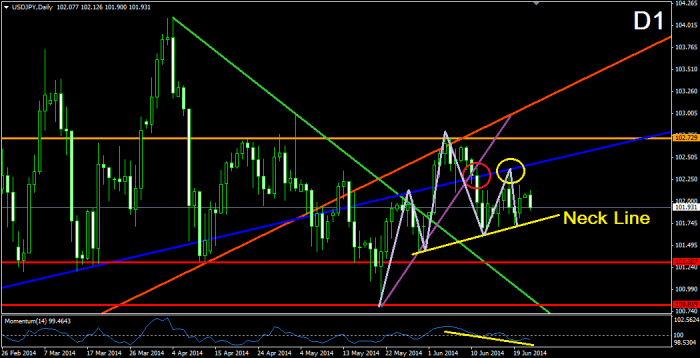

USDJPY:

The bearish break of the price through the small purple bullish trend line has moved the price in such way, so a head and shoulders formation (gray) is about to get confirmed. At the same time, there is a clear bearish divergence between the last two bottoms of the chard and the momentum indicator, which also speaks of an upcoming bearish activity. Furthermore, after the break through the purple bullish trend line, the price returned and bounced from the already broken blue bullish trend line as from a support. For this reason, we believe that the price might start a new bearish movement, which could eventually break through the support at 101.307 and has the potential to reach the next crucial support at 100.819

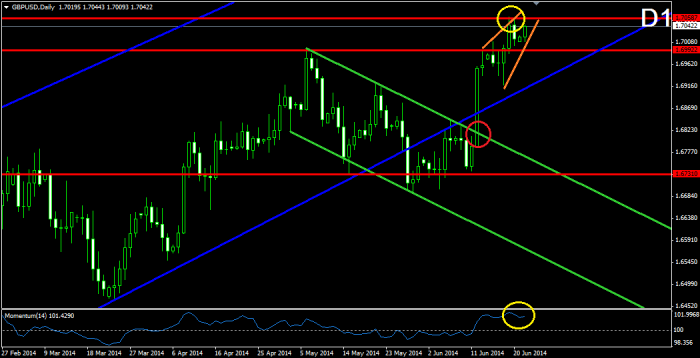

GBPUSD:

After the bullish break through the green bullish corridor, the price also broke through the resistance at 1.69922, which indicates the previous top of the price from the same rank, and then it stopped in the 1.70587 level, which indicates the 5-years high of the price. As you see, the latest bullish movement of the price (orange) resembles a bit a rising wedge formation, which as we all know, has the potential to send the price downwards. At the same time, the momentum indicator is located pretty high, which implies that a drop might be about to occur. Maybe the price would not manage to break the 5-years high at 1.70587 after all.

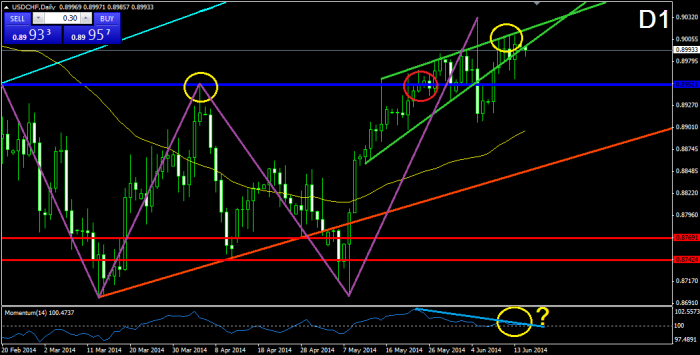

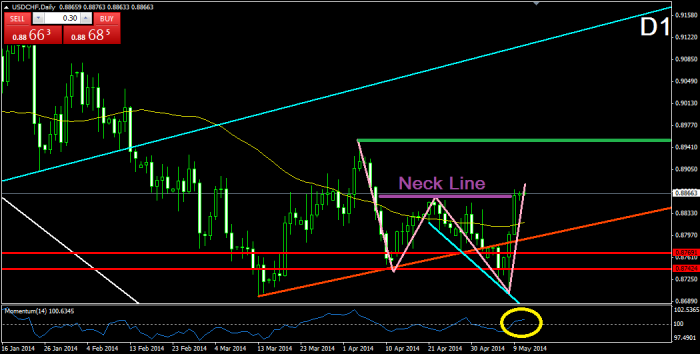

USDCHF:

The first things we notice on the D1 chart of the Swissy are: the potential double top formation (purple) and the bearish divergence between the chart of the price and the momentum indicator in the past 30 days. As we all know, these two conditions have bearish potential and could send the price downwards. Another bearish sign is the break of the price through the lower level of the green bullish corridor, which supports the bearish scenario. These conditions could drop the price at least to the support, which indicates the neck line of the small and already completed double bottom formation (yellow). At the same time, this would confirm the purple double top formation and could push the price even further. On the other hand, the price might continue its bullish increase and could reach at least the resistance, which indicates the second top of the purple double top formation and even the upper level of the green bullish corridor.

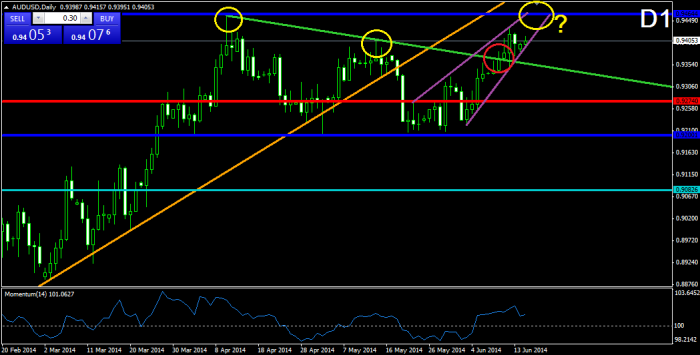

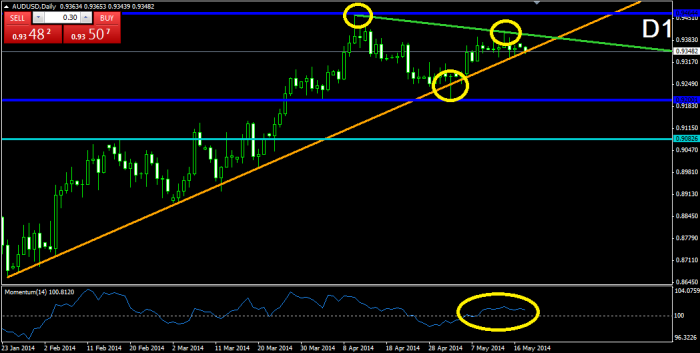

AUDUSD:

After the ice price broke through the green bearish trend from April 10, we saw the price returning to the level and testing it as a support. The followed bullish bounce brought the price to the resistance at 0.94347, which indicates the high point of the price after the break through the green bearish trend line. The break through the 0.943476 resistance gives us now a clear signal for a change in the bearish trend (green). The overall bullish movement follows a bullish trend line (purple), which set its beginning on May 29. So, after the break, the price might find resistance in the next red level, which indicates the 5-months high of the price from April ten, and to return to the purple bullish trend line.

Weekly technical analysis for 16 – 20.06

IMPORTANT ECONOMIC EVENTS DURING THE WEEK (GMT)

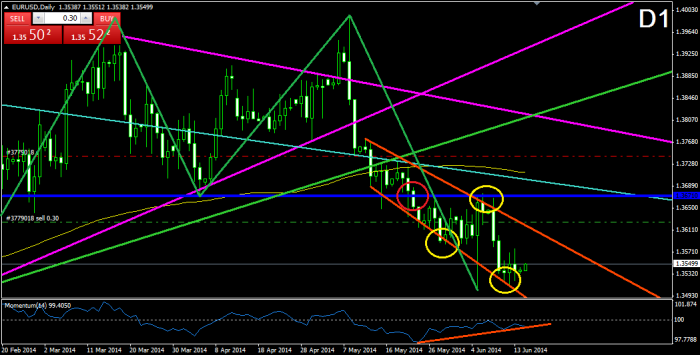

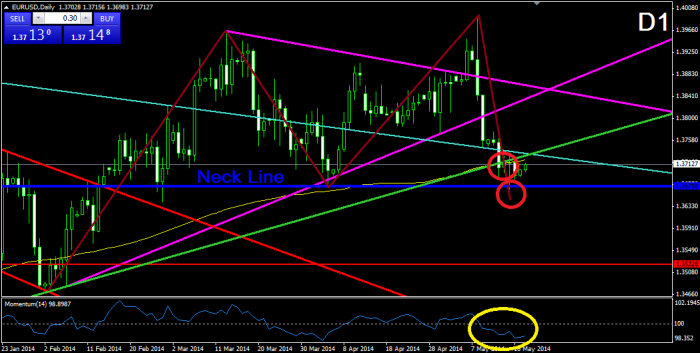

EURUSD:

On the D1 chart we notice that after crossing the 1.36710 blue neck line of the big green double top formation, the price started moving in a bearish corridor (orange). After bouncing from the upper level of the corridor, the price had just bounced from the lower level of the corridor, which implies that the pair might eventually return to the upper level of the corridor again, before making any other bearish movements. At the same time, there is a bullish divergence between the last bottoms of the chart and the momentum indicator, which supports an eventual bullish correction.

USDJPY:

After testing again the resistance at 102.723, the price did a bearish bounce, which sent it through the three times tested blue bullish trend line from May 21. The price even crossed in bearish direction the already broken dark blue bullish trend line from the beginning of February. At the same time, the momentum indicator broke in bearish direction from its yellow bullish trend line and then it tested it as a resistance, which supports the potential bearish movement we are discussing. For this reason, we believe that the price would eventually drop during the week and would probably meet the supports at 101.201 and 100.792.

GBPUSD:

After breaking through the upper level of the green bearish corridor from May 6 and at the same time, through the resistance at 1.68116, the price also broke through the already broken lower level of the blue bullish corridor from November 2013 and increased to the 5-years high of the price from one month ago. Afterwards, the price broke through the 1.69974 resistance, which indicate the 5-years high and now, it is about to test the top from 5 years ago. If the price breaks it, this would create a 6-years high. The resistance, which indicates the top from 5-years ago is located at 1.70547, which is not visible on the D1 chart, but on the W1. Having in mind that the price did such a significant bullish break, we could expect an increase at least to the top from 5-years ago at 1.70547. For this reason, we might see a bearish correction first. If the price increases even more, the already broken 1.69946 resistance might be turned into a support and the price might use this level in order to trigger itself in bullish direction. Another good support might appear to be the lower level of the already broken blue bullish corridor. The price might return there for a test and a bullish bounce.

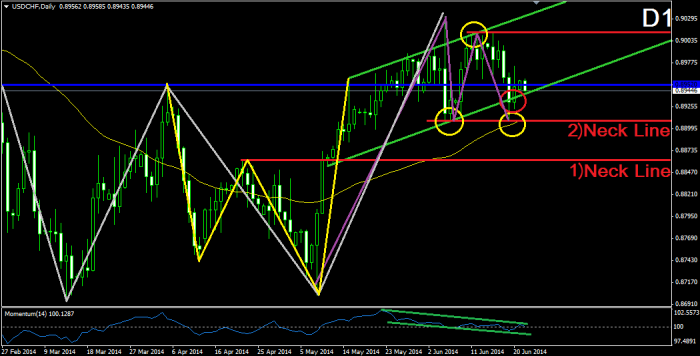

USDCHF:

The price increased again to the upper level of the already broken rising wedge formation, and it bounced in bearish direction afterwards. Now the price is out of the wedge again. If the price drops, it would eventually meet the 0.89521 level, where it could be supported. After all, we should not forget that there is a big double bottom formation, which the price confirmed a month ago (purple). For this reason, it is likely to see the price following the double bottom formation, where the price has completed about 30% of the potential bullish movement yet. Currently, the momentum indicator is above, but almost on the 100-level line and it could be used as a trigger for a short position until the support at 0.89521. At the same time, there is a bearish divergence between the indicator and the chart of the price, which supports the bearish drop.

AUDUSD:

After the price broke through the green bearish line from April 10, which connects the last tops of the price, the Aussie is currently moving in a bullish direction toward the resistance at 0.94644, which indicates the 6-months high of the price. We would like to note, that the upward movement happens in a rising wedge formation, which, as we all know, has the potential to break in bearish direction. Currently, the price is testing the lower level of the wedge, which implies that a bullish bounce is likely to occur. This bounce could actually send the price to test the 0.94644 level. At the same time, the wedge would be to its end and the blue resistance in a combination with the bearish potential of the purple wedge, could send the price downwards.

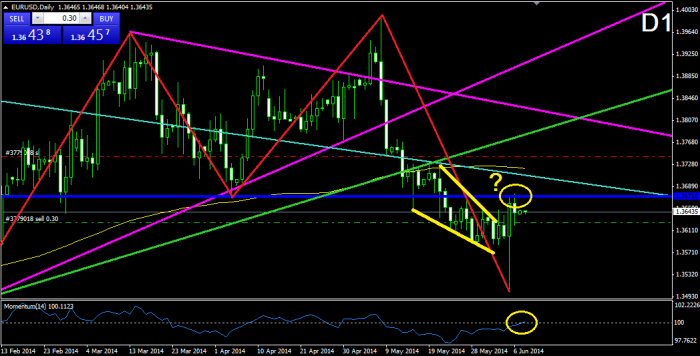

EURUSD:

After the break through the 1.36710 neck line, the double top formation (red) on the D1 chart brought the price to form a falling wedge formation, which broke through the upper level during the last week. The price was send to test the already broken 1.36710 neck line as a resistance, and currently we notice a bounce from this level, which implies for an eventual bearish activity. On the other hand, the momentum indicator has just crossed the 100-level line in bullish direction which is in a contradiction with the bearish bounce from the neck line. Having in mind that the price has not still fully completed the red double top formation, we might see another strong decrease of the price.

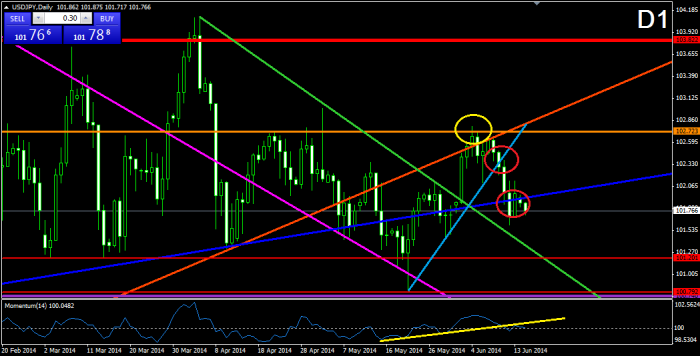

USDJPY:

After the bullish break through the three times tested green bearish trend line from April 4, the price increased and tested the already broken orange bullish trend line from March 2013 as a resistance and the 102.723 resistance at once. As you can see, after interacting with these levels, the price definitely demonstrates a slowdown and a potential for a decrease. For this reason, we should carefully watch the behavior of the price on these two levels. A bullish break might bring the price to interact with the old 103.822 resistance (red). A bearish bounce from the two levels would turn into a potential support any previous bottom of the price.

GBPUSD:

After confirming the double top formation on D1 (green) with crossing the 1.67327 neck line, the price increased to the yellow bearish line again. As we know, the yellow bearish line connects the two tops of the double top formation. With testing it for third time, the price has turned the line into a bearish trend. Currently, the price is still on the yellow bearish trend and also, the price is testing the already broken lower level of the blue bullish corridor as a resistance. At the same time, the momentum indicator is testing the 100-level line from the same side. For this reason, we believe that the current situation is crucial for the Cable. A bullish break in the yellow bearish trend line might actually lead to new highs and a cross in the 100-level line for the momentum indicator could be used as a signal for this scenario. On the other hand, as we know, the price has a double top formation to complete, so a bearish bounce from the green bearish trend is very likely to occur.

USDCHF:

The price broke the lower level of the green rising wedge formation and decreased with about 50 pips, which almost accomplished the potential of the formation. At the same time, the momentum indicator crossed the 100-level line in bearish direction, which confirmed the bearish movement. This means that the potential bearish correction could last even longer, and the price might decrease even more – for example to the Simple Moving Average 50 or the orange bullish line. The situation by the Swissy is pretty similar to the EUR/USD pair. Here we have a confirmed double bottom formation (yellow), which has a strong bullish potential. For this reason, we believe that after reaching a certain support level, the price would probably return to its bullish habits.

AUDUSD:

The potential double top formation by the Aussie is currently turning into a bullish pennant. Currently, the price is testing the green bearish line for third time, which turns the green line into a bearish trend line. At the same time, the momentum indicator records a slowdown in its last movement, which is relevant with the interaction of the price with the green bearish trend. Anyway, we should follow the behavior of the price on the green bearish trend, because a bullish break might destroy the bearish expectations and the price might increase to the 0.94644 resistance, which is above the previous top of the price. On the other hand, if the price is going to move according to the flag, we should expect another decrease to the 0.92001 support (the lower level of the flag) before any bullish break. Furthermore, such decrease might even bring the price through the 0.92001 support, which is also the neck line of the double top formation (yellow) which seems lost for now.

Weekly technical analysis for 2 – 6.06

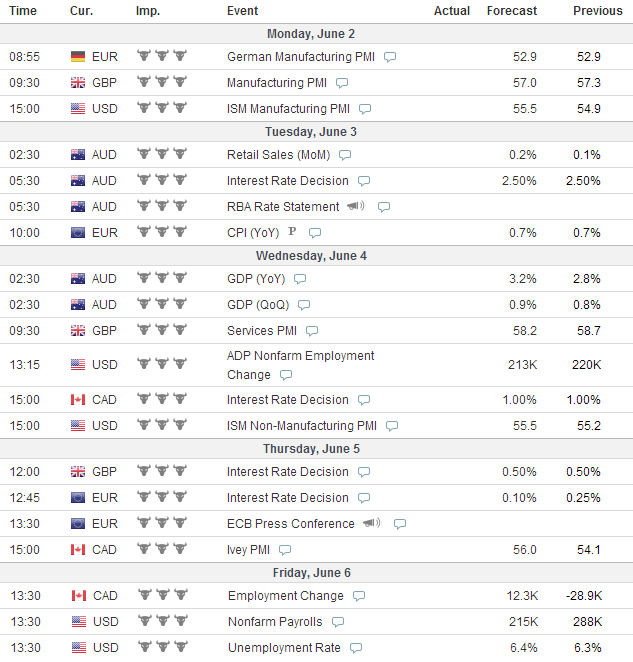

IMPORTANT ECONOMIC EVENTS DURING THE WEEK (GMT)

EURUSD:

After breaking through the lower level of the purple triangle on D1, the price confirmed a double top formation (D1) and the followed bearish movement formed a falling wedge formation, where the price is currently testing the upper level of the formation. At the same time, the momentum indicator is about to cross the 100-level line in bullish direction. For this reason, we believe that the price might do a correction to the already broken neck line of the double top formation (blue) and even to the turquoise bearish trend line from 2008.

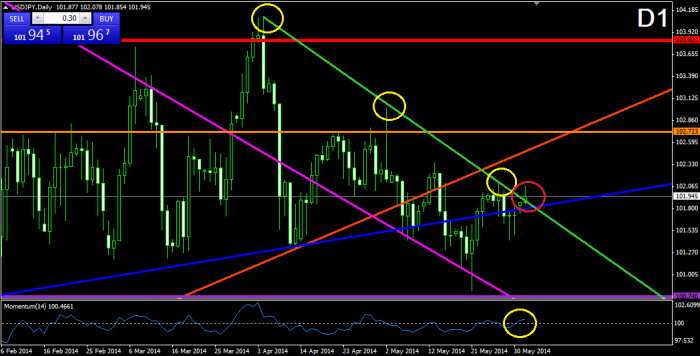

USDJPY:

After the last bullish bounce from the already broken purple bearish trend line from December 2013, the price increased to the green bearish trend line from April 04. The green bearish trend got broken in bullish direction. At the same time, the momentum indicator has crossed the 100-level line in bullish direction, which supports the eventual bullish break and the eventual bullish movement. If this happens, the price is expected to reach at least the orange 102.723 resistance.

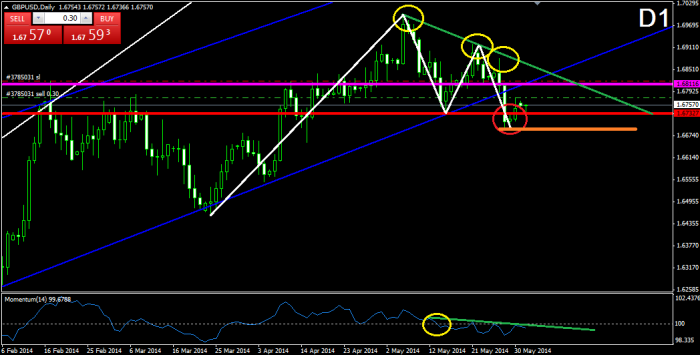

GBPUSD:

The price formed a 3-times tested bearish trend line (green), which was formed on May 6, where after the last bounce, the price confirmed a double top formation with crossing the neck line at 1.67327. At the same time, the momentum indicator confirms the current bearish movement with a trend line, and with the interruption of the 100-level line in bearish direction. Currently, after crossing the neck line, the price is moving upwards, which implies for another interaction with the green bearish trend line. In this case, the orange support, which indicates the last bottom of the price, would be a crucial level for the eventual decrease of the price.

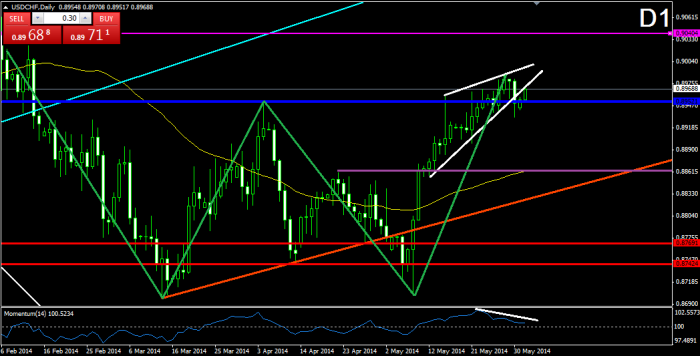

USDCHF:

After the price confirmed the double bottom formation with crossing the blue neck line at 0.89521, a rising wedge formation was formed (white). A break in the lower level of the wedge occurred, which implies for a correction of the bullish movement. Furthermore, there is a slight bearish divergence between the recent movement of the price and the momentum indicator, which supports the eventual correction. For this reason, we believe that the price might eventually drop to the orange neck line of the already completed smaller double bottom formation.

AUDUSD:

After the bearish break through the orange bullish trend line, the price started a consolidation, which reminds on a double top formation, but the price found support in the neck line of the formation. Currently, there is a potential for another formation – a bullish pennant, which is in a contradiction with the double top formation. The bullish pennant consists of the green bearish trend line and the neck line of the double top formation. For this reason, we are careful for breaks in both directions. If the pennant gets broken through the upper level, we could say that the bullish scenario would dominate. If the neck line gets broken, the double top formation rules would be in force.

Weekly technical analysis for 26 – 30.05

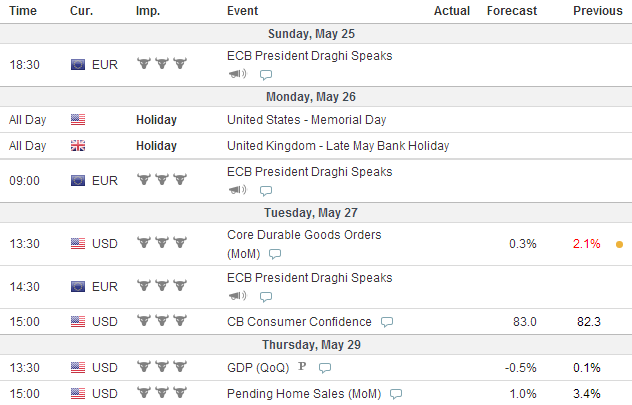

IMPORTANT ECONOMIC EVENTS DURING THE WEEK (GMT)

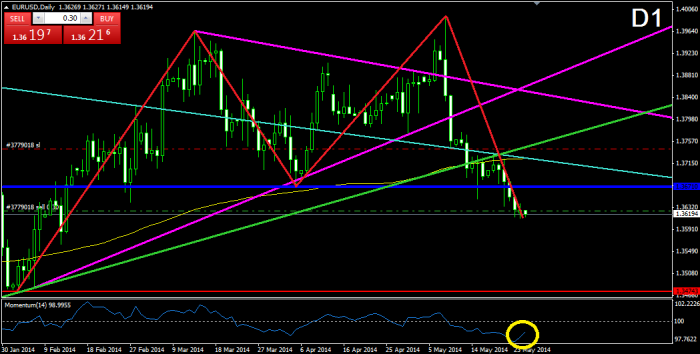

EURUSD:

After breaking through the green bullish trend line from July 2012, the price decreased even more and it also broke through the blue 1.36710 neck line of the red double top formation on D1, which is a confirmation of the figure. For this reason, it is likely to expect the price to drop to the support at 1.34743 in the near future. Currently, the price is signing a slight slowdown of its bearish movement. At the same time, the Momentum Indicator signalizes for a decrease in the bearish activity. For this reason, we might see a bullish correction, which could meet the price with the blue level at 1.36710, or with the already broken turquoise 6-years bearish trend line.

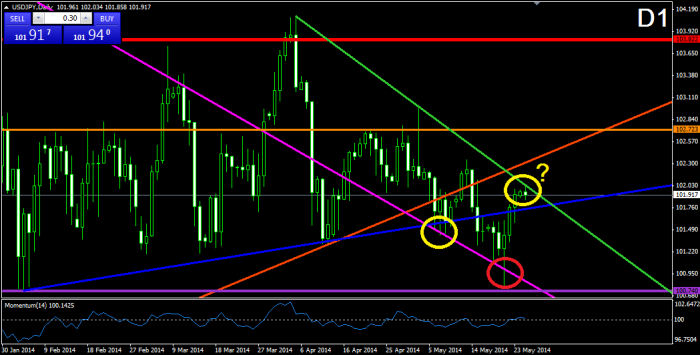

USDJPY:

After breaking through the blue bullish trend line from February, the price decreased twice to the already broken purple bearish trend line from December 2013 and tested it as a support, where the second time, the price even broke the purple bearish line and it reached the purple support at 100.740. The followed bullish bounce during the last week increased the price and created a top, which formed the green bearish trend line from April 04. Currently, the price is testing this trend as a resistance and a bearish bounce is expected. For this reason, we believe that the price would decrease again to the 100.740 support and this time it could even break it. The momentum indicator is around the 100-level line and it could cross it again in bearish direction at any time.

GBPUSD:

After the bounce from the lower level of the blue bullish corridor (W1), the price increased and created a top, which is actually lower than the previous one. This allows us to draw a bearish line between the two tops, which could be considered as a potential resistance. If the price breaks through the white bearish line, we could expect another increase to 1.69700, which could even push the price even higher – to the upper level of the blue bearish corridor for example. At the same time, the momentum indicator is on the 100-level line and it is testing it as a resistance now. A bullish cross of the 100-level line would support the bullish scenario. If the price breaks eventually through the lower level of the blue corridor, we might see the beginning of a new drop, where every previous bottom would be considered as a potential support.

USDCHF:

During its last increase, the Swissy has decreased the intensity of its bullish movement recently and the price has formed a rising wedge formation, which crossed the neck line of the big double bottom formation while forming. The interruption of the blue neck line at 0.89510 speaks of a overall bullish increase, but the rising wedge formation implies that a correction of the bullish activity might occur. As we know, the rising wedge has the potential to push the price in bearish direction to a distance equal to the size of the formation. For this reason, we believe that the price might drop to the already broken purple neck line of the smaller double bottom formation, and to test it as a support before any increase. The momentum indicator has already changed its direction.

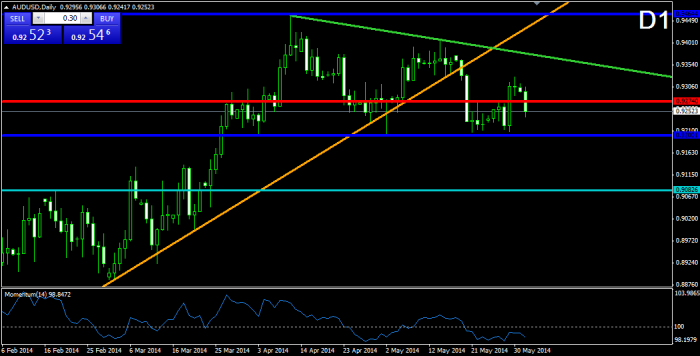

AUDUSD:

After breaking in bearish direction through the orange bullish trend line from January, the price decreased to its previous bottom at 0.92001, which is shown as a blue support on the chart. It is obvious that the price is finding support there, which infers that a new bullish bounce might occur. Furthermore, the price has closed a Doji candle, which supports the eventual change of the direction. Moreover, after it reached its lowest levels, the momentum indicator is currently switching its direction. For this reason we believe that the double top formation will wait for a while and the price would eventually increase to the green bearish line, which connects the last two tops of the price.

Weekly technical analysis for 19 – 23.05

IMPORTANT ECONOMIC EVENTS DURING THE WEEK (GMT)

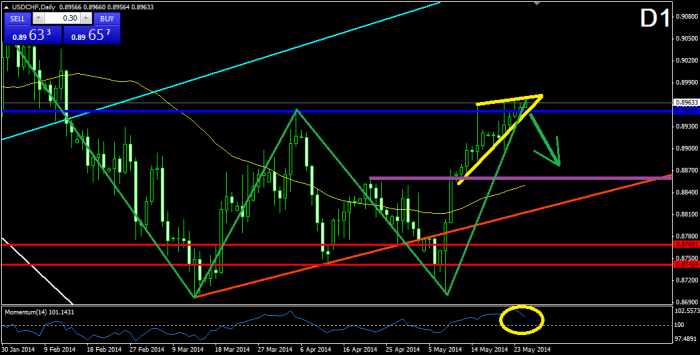

EURUSD:

After getting out of the purple triangle, the price did a rapid decrease, which created a double top formation and the price broke the Simple Moving Average 150, the green 2-years bullish trend line and the 1.36710 neck line of the double top formation on a later stage. This has confirmed the double top formation and now we have a sufficient reason to believe that the price might drop to 1.34660. At the same time, the momentum indicator is getting exhausted in its bearish movement, which could mean that a bullish correction is about to appear before the expected bearish movement.

USDJPY:

After decreasing to the interaction point of the already broken purple bearish trend line from the end of December 2013 (W1) and the blue bullish trend line from the beginning of February, the price did a correction to the orange bullish trend line from March 2013, and a new bearish decrease, which broke the blue bullish trend line and met the price with the already broken purple bearish trend line again, where the price is being supported now. For this reason, we believe that the price is about to do a bullish correction again. A possible resistance for the target of the correction would be the brown bearish trend line, which connects the last two tops of the price and is parallel to the already broken purple bearish trend line.

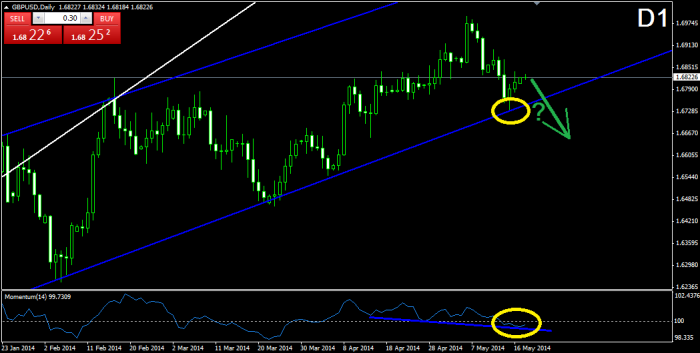

GBPUSD:

During its last increase, the cable did not manage to meet the upper level of the blue bullish corridor it has been following in the last six months. The price even dropped and met the lower level of the corridor, which signalizes for a decrease in the intensity of the general bullish activity. At the same time, the last bottoms of the price are in a bearish divergence with the bottoms of the momentum indicator. Furthermore, the momentum indicator has also crossed the 100-level line in bearish direction, which supports the bearish idea. Anyway, remind that the lower level of the bullish corridor is an old and strong level, which would be hard to be broken.

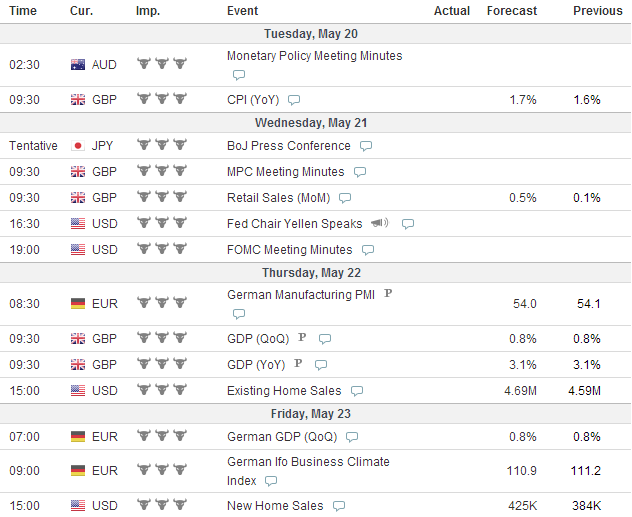

USDCHF:

As we see, the price did a bullish increase to the 0.89510 resistance in a rising wedge formation, where it did a bearish bounce and the rising wedge formation got broken in bearish direction. Another bearish signal is the Doji candlestick which was formed before the current bearish candle. As we all know, the Doji candle means that the bullish and the bearish forces are equalized and a change in the trend might occur. Furthermore, the momentum indicator is in its top positions and it would soon start dropping too. For this reason, we believe that the price would decrease at least to Simple Moving Average 50. The next possible supports are the orange bullish trend line from the middle of March, the red supports at 0.87691 and 0.87424.

AUDUSD:

After bouncing from the orange bullish trend line from January, the price increased and formed a top, which is lower than the previous and which forms a bearish line (green). This green bearish line and the orange bullish trend form a triangle, which is about to get broken at any time. Currently, the price is testing the orange bullish trend line again and there is possibility for a bearish break. If this happens, the supports the price could meet are the blue level at 0.92001, which would also be the neck line of an eventual double top formation, and the already broken resistance at 0.90826. If the triangle gets broken in bullish direction, the first resistance to be met is the blue line at 0.94644, which indicates the previous top of the price. The momentum indicator is above the 100-level line and it is currently moving in bullish direction

Weekly technical analysis for 12 – 16.05

IMPORTANT ECONOMIC EVENTS DURING THE WEEK (GMT)

EURUSD:

After breaking through the upper level of the purple triangle, the price did a big rapid drop to the already broken 6-year bearish trend line (turquoise). Currently, it looks like the price is being supported in this trend line, because something like a bounce is being formed. For this reason, we believe that if the price is going to increase, it would first meet the already broken sides of the triangle as resistances. If the price breaks through the turquoise bearish trend line, we would probably see an interaction with Simple Moving Average 150 and the orange support, which indicates the previous bottom of the price and the neck line of a head and shoulders formation (blue). If this happens, the first break through the upper level of the purple triangle would appear to be fake.

USDJPY:

After breaking in a falling wedge formation through the orange bullish trend line from March 2013, the price found support in the blue bullish trend line from the beginning of February, it broke in bullish direction through the falling wedge formation and it formed a double bottom formation. The price bounced in bullish direction afterwards and the double bottom formation got confirmed. At the same time, the Momentum Indicator crossed the 100-level line in bullish direction. With the cross of the neck line, it looks like the price is testing the already broken orange bullish trend line as a resistance. Having in mind that the double bottom formation is already confirmed and supported by the signals of the momentum indicator, we assume that the price would probably break through the orange line again and would continue its bullish movement.

GBPUSD:

The Cable did a surprising bullish break through the upper level of the rising wedge formation, which created the impression that the price would probably directly meet the upper level of the blue bullish corridor from November 2013. Suddenly, the price decreased as a result of economic information and the turquoise bullish trend line was formed. As you see, there is a bearish divergence between the chart and the momentum indicator, which warned us for the bearish decrease in advance. Now it looks like the price is being supported by this line and we might see a bullish bounce. If the price increases, it would first meet the sides of the already broken rising wedge as resistances. If the price breaks through the turquoise bullish trend line, we would eventually see a decrease to the lower level of the blue bullish corridor.

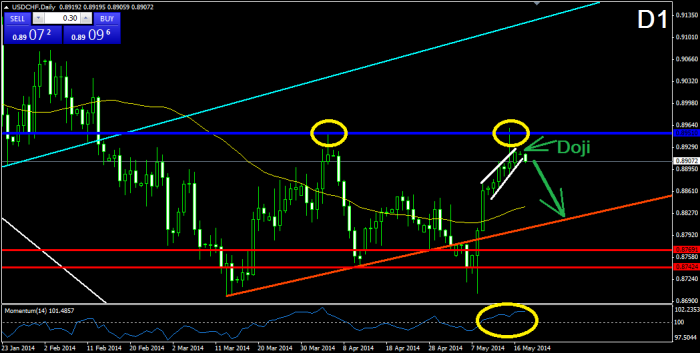

USDCHF:

The price has just confirmed a double bottom formation on the D1 chart. After its last bounce from the turquoise bearish line, the price increased in bullish direction ad crossed the neck line of the formation. At the same time, the momentum indicator has crossed the 100-level line in bullish direction. For this reason, we expect an increase of the price at least to the green resistance, which indicates the previous top of the price, and which is also the neck line of another, bigger double bottom formation. If this neck line gets broken, we would be able to look for more bullish pips from this pair.

AUDUSD:

After correcting to the orange bullish trend line from the beginning of January, the price created a Doji candle (green circle) and broke through the upper level of the wedge, which the price was correcting in. At the same time, the momentum indicator also increased in bullish direction through the 100-level line. Currently, the price is still increasing in bullish direction and it is expected to increase at least to the green resistance, which indicates the previous top of the price around 0.94530. If this happens, we should be careful for a break or a bounce, which would determine the future movement of the price of the Aussie.