Elliott wave analysis of EUR/NZD for August 15, 2018

After a dip to 1.7220 all requirements for the correction in red wave i has been fulfilled. Therefore we are looking for a break above resistance at 1.7355 to confirm that red wave iii is developing for a break above the peak at 1.7484 as EUR/NZD moves higher towards 1.7924 and 1.8369.

Short-term support is seen at 1.7243, this support should ideally be able to protect the downside, for the expected rally higher. If, however, a break below 1.7243 is seen, a final dip closer to 1.7196 should be expected to complete red wave ii.

R3: 1.7487

R2: 1.7417

R1: 1.7355

Pivot: 1.7299

S1: 1.7270

S2: 1.7243

S3: 1.7220

Trading recommendation:

We are long EUR from 1.7245 with our stop placed at 1.7215.

Analysis are provided byInstaForex.

Please visit our sponsors

Results 2,601 to 2,610 of 4086

Thread: InstaForex Wave Analysis

-

15-08-2018, 06:40 AM #2601

-

16-08-2018, 06:36 AM #2602

Elliott wave analysis of EUR/NZD for August 16, 2018

A break above resistance at 1.7355 is still needed to confirm that red wave ii has completed and red wave iii to above 1.7484 is developing.

Short-term, we see support at 1.7262 and again at 1.7238. The later will ideally be able to protect the downside for the break above 1.7355 towards 1.7484 and above, with the next important targets seen at 1.7924 and 1.8369.

R3: 1.7484

R2: 1.7417

R1: 1.7355

Pivot: 1.7299

S1: 1.7270

S2: 1.7243

S3: 1.7220

Trading recommendation: We are long EUR from 1.7245 with our stop placed at 1.7215.

Analysis are provided byInstaForex.

-

17-08-2018, 05:40 AM #2603

An alarming bell for pound buyers

Risk assets recovered slightly against the US dollar, but the market continues to be in a bearish trend in general.

The situation around Turkey shows that the Turkish lira and the deby growth of Turkish banks makes all investors refrain also from new investments in risky assets.

Today, one can observe the continuation of a slight strengthening of the Turkish lira against the US dollar, however this harm indicates its stabilization after falling to a record low. Most likely, investors harbor some optimism from the press conference of the Minister of Finance of Turkey, which is due today, and on which Berat Albayrak will present an approximate plan for overcoming the crisis.

The growth of the Turkish currency was approximately 2.5% in line with the closing level of yesterday, and just a week the lira rose against the dollar by 9.9%. Many associate such growth with the promise of Qatar to invest 15 billion dollars in the Turkish economy.

As mentioned above, the press conference of the Turkish finance minister can support the lira, but it can lead to a resumption of its decline if Berat Albayrak does not talk about key issues that worry many investors.

A number of experts are waiting for more resolute measures from the authorities of Turkey. It is expected that in the near future, the Central Bank of the country will raise rates to curb inflation and the government will prepare reforms aimed at a serious decline in the share of borrowed funds in the private sector. It is also expected that Turkey can apply for financial assistance to its partners, which will allow executing short-term debt obligations of banks.

The British pound only strengthened slightly against the US dollar, and then declined again after the release of UK retail sales data, which in July this year resumed their growth. This is a very bad "call" for traders who expect a corrective pair growth in the near future.

As noted in the report, the increase in sales was provided by food and beverages during the World Cup. According to the National Bureau of Statistics, retail sales in the UK increased by 0.7% compared with June, and higher than increased by 3.5% compared to July last year. Economists had expected sales growth of 0.2%.

As for the technical picture of the GBP/USD pair, demand for the pound will remain as long as the trade is above the 1.2660 support, but a return to the intermediate resistance 1.2735 is required to increase the upward correction, the breakthrough will open the direct course to the weekly highs of 1.2825 and 1.2890. While the breakthrough to 1.2660 will hit the pound towards the lows of 1.2570 and 1.2500.

* The presented market analysis is informative and does not constitute a guide to the transaction.

Analysis are provided byInstaForex.

-

20-08-2018, 06:12 AM #2604

Elliott wave analysis of EUR/NZD for August 20, 2018

Nothing happening here. The range-trading between 1.7220 and 1.7310 continues to dominate the picture. We continue to look for a break above resistance at 1.7310 and more importantly a break above resistance at 1.7355 that confirms red wave ii has completed and red wave iii has taken over for the next impulsive rally towards 1.7924 and 1.8369 as the next larger upside targets.

R3: 1.7484

R2: 1.7417

R1: 1.7355

Pivot: 1.7310

S1: 1.7270

S2: 1.7243

S3: 1.7220

Trading recommendation:

We are long EUR from 1.7245 with our stop placed at 1.7215.

Analysis are provided byInstaForex.

-

22-08-2018, 05:33 AM #2605

Elliott wave analysis of EUR/NZD for August 22, 2018

EUR/NZD once again failed to break above important short-term resistance at 1.7355 and instead turned around to make a small new low at 1.7211. This is a disappointment and keeps red wave ii alive, but it does not change our larger bullish count calling for more upside pressure above 1.7484 longer-term. To confirm that red wave ii has completed, we still need a break above resistance at 1.7355 and as long as this short-term important resistance remains able to cap the upside, red wave ii could dip closer to 1.7196, but the potential downside should be limited to here for a break above minor resistance at 1.7327 and more importantly a break above 1.7355 confirming red wave iii is developing for a rally above 1.7484.

R3: 1.7355

R2: 1.7327

R1: 1.7275

Pivot: 1.7255

S1: 1.7221

S2: 1.7196

S3: 1.7162

Trading recommendation:

Ous stop was hit for a small loss of 20 pips. We will re-buy EUR at 1.7205 or upon a break above 1.7327 and place our stop at 1.7200.

Analysis are provided byInstaForex.

-

23-08-2018, 07:14 AM #2606

Elliott wave analysis of EUR/JPY for August 23, 2018

EUR/JPY still has not broken important short-term resistance at 128.48, but then it has not started to move strongly lower as we normally should expect at the completion of an expanded flat.

Therefore we are shifting our preferred count in favor of wave C and II having completed with the test of 124.86 and wave III now in its infancy. Under this count EUR/JPY should make a small downward correction towards 127.23 - 127.33 area in red wave iv and then move higher towards the 128.92 - 129.32 area in red wave v.

This will complete black wave i/ and should set the stage for a corrective decline in wave ii/ towards the 125.76 - 126.44 area before the next impulsive rally higher. That said, the possibility of a final dip closer to 124.62 remains possible, but time is running out fast.

R3: 128.92

R2: 128.48

R1: 128.24

Pivot: 127.93

S1: 127.72

S2: 127.50

S3: 127.33

Trading recommendation:

We are 50% long EUR from 126.26 with our stop placed at 126.84. We will take pro

Analysis are provided byInstaForex.

-

24-08-2018, 05:58 AM #2607

Elliott wave analysis of EUR/NZD for August 24, 2018

EUR/NZD has finally broken above short-term important resistance at 1.7355. This former resistance should now act as support if a re-test is needed.

The break above resistance at 1.7355 should have paved the way for a continuation higher towards 1.7484 on the way towards 1.7924 and 1.8369 as the next important upside targets. EUR/NZD is now in a position where it could start accelerate quiet powerfully higher, but we think a clear break above 1.7484 will be needed to see the expected upside acceleration.

R3: 1.7668

R2: 1.7578

R1: 1.7484

Pivot: 1.7366

S1: 1.7355

S2: 1.7325

S3: 1.7281

Trading recommendation:

We bought EUR at 1.7330 and we have placed our stop at 1.7275.

Analysis are provided byInstaForex.

-

28-08-2018, 05:51 AM #2608

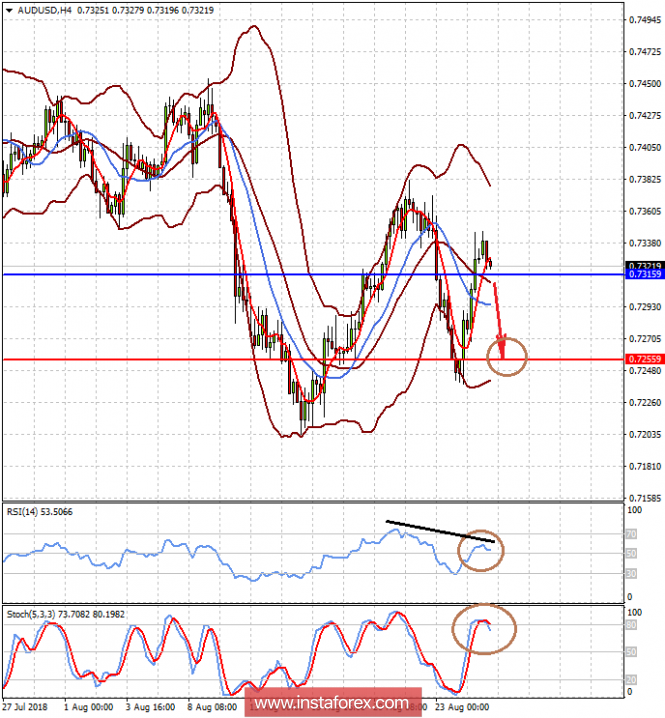

The dollar declined, but it did not last long

The speech of Fed Chair J. Powell at the economic symposium in Jackson Hole, Wyoming, confirmed that the selected course was during the period of J. Yellen to gradually increase interest rates.

The head of the Central Bank was optimistic about the prospects for further growth of the country's economy, pointing out that "he does not see signals of accelerating inflation much higher than the 2.0% target, as well as the risks of overheating of the US economy." Investors took his words optimistically, despite the fact the continuation of the cycle of raising interest rates in general. It seems that market participants believe that the process of a smooth increase in interest rates gives them the opportunity to "have time" to buy risky assets, making a profit until the moment when rates reach absolute neutral values, which can already be perceived as a signal for large-scale profit-taking.

Investors completely switched to Powell's speech, ignoring the failure of the negotiations between the US and China on customs duties. On other hand, this can be explained by the fact that, very few people in general hoped that they would be positive, and on the other is their influence is already taken into account in market sentiments and quotations. Although Friday was positive, we consider it a temporary phenomenon. Markets will pay attention again to trade wars, and probably, this will push up the US dollar rate again. But at the same time we pay attention to the fact that, the overall lateral dynamics of the dollar paired with major currencies will most likely continue in the short term.

The dollar will be bought for a number of reasons. The first and foremost process is the method of capital transfer to the States from emerging markets and from Europe, where the likelihood of a large-scale financial crisis that raged in Turkey has increased significantly, putting European banks at high risk and investing considerable capital in the country's economy. The next problem is Italy, which can get into the debt "bag" on the background of high public debt. The dollar will also receive support in the wake of the trade war between Washington and Beijing as a currency refuge. And, of course, the Fed's position to smoothly continue, as the process of raising interest rates will be a good incentive for its purchases.

Forecast of the day:

After reaching the local maximum on Friday on the wave of J. Powell's speech, the EUR/USD pair may turn down again if it hover below the 1.1620 level. Against this background, it can adjust to 1.1535 after overcoming the 1.1600 mark.

The AUD/USD pair is trading above the 0.7315 mark. It may continue to adjust down to 0.7255 after overcoming this level. The reason is still the continuing tension between the US and China on customs duties.

* The presented market analysis is informative and does not constitute a guide to the transaction.

Analysis are provided byInstaForex.

-

29-08-2018, 05:10 AM #2609

Confidence in the short-term growth of the euro is gradually declining

The euro continues to rise against the U.S. dollar, which was formed in the middle of this month. It looks like investors are planning to end the month on a positive note, getting close to the large monthly resistance levels.

Data on lending in the eurozone and confidence in France supported the euro in the first half of the day, but a number of international economic agencies predict a slowdown in the euro in the short term.

For many technical indicators, risky assets are in the overbought zone, and a good downward correction has not been observed for a long time. Also, the EUR/USD pair got close to fairly large levels of resistance, from which a strong bearish trend was formed in the middle of summer of this year. This is another signal to the fact that there is no need to hurry with the purchase from the current levels.

As I noted above, bank lending in the euro area continued to grow in July this year.

According to the report of the European Central Bank, lending to non-financial companies increased by 4.1% compared to the same period last year. Good indicators were also noted in household lending, which in July 2018 increased by 3.0%, as in the previous month.

As for the M3 money supply indicator, it turned out to be slightly worse than forecasts. According to the data, the annual growth of M3 monetary aggregate slowed to 4.0% from 4.5% in June. Economists had expected the indicator to grow by 4.3 percent.

Good data on consumer morale in France maintained confidence in further economic growth. According to the report of the statistics agency, the consumer confidence index in France in August this year remained at 97 points against 97 in July. Economists had also forecast the index to be 97 points.

An important report on consumer confidence in the US will be published on Tuesday in the afternoon, which can significantly affect the US dollar. It is expected that the indicator of consumer confidence in the US will decrease to 126.6 points in August against 127.4 points in July this year.

As for the technical picture of the EUR/USD pair, the prospects for the movement of the euro remained unchanged. The failure of breaking the resistance of 1.1700 for today could lead to the decline of the European currency against the background of profit taking and return to the area of the lows of 1.1625 and 1.1590.

News are provided by

InstaForex.

-

30-08-2018, 06:41 AM #2610

Gold threw "bears" overboard

The fastest intraday gold gain over the past five months, against the backdrop of Jerome Powell's speech in Jackson Hole, forced the market to rack his brains over the question: from what level will the speculators start fixing profit in short positions en masse? Their net shorts by the end of the week by August 21 increased to 90 thousand contracts. Commerzbank notes that over the past few weeks, long positions have remained virtually unchanged, while short positions grew. The speech of the FRS chairman squeezed a part of the "bears" from the market.

From what levels will the others run? From January's highs, gold lost about 11% of its value and speculators continued to actively sell in April-August against the backdrop of the strengthening of the US dollar. The latter took away from the precious metal the function of the asset-refuge and grew rapidly during the escalation period of trade conflicts between the US and other countries. At the same time, the divergence in economic growth and the monetary policy of central banks played into the hands of the "bulls" at the USD index. The Fed raised the federal funds rate, and the US GDP grew by 4.1% in the second quarter. Gold fans found it difficult to counter something to their opponents, which led to the growth of net shorts to record highs.

Dynamics of speculative positions on gold

It did not receive support from the precious metal from the side of physical demand. Along with the drop in ETF stocks to the lowest level since 2016 and the reduction of Chinese net imports from Hong Kong to 44 tonnes in July, which is the worst monthly indicator since the beginning of the year, bad news came from India. Heavy rains and floods inflicted $ 3 billion damage to local farmers, which is this class of buyers that is most active in the Diwali wedding season.

Since mid-August, the situation began to change. Donald Trump confused the dollar bulls with comments about his dissatisfaction with the activities of Jerome Powell as chairman of the Fed, to which the latter responded with "dovish" rhetoric in Jackson Hole. The head of the Central Bank is confident that inflation will not go far above the 2% target, and therefore it is not necessary to raise the federal funds rate aggressively. After his speech, the dollar fell out of favor, marking the worst weekly dynamics since February. On the contrary, the bulls on XAU/USD came to their senses after the knockdown.

I do not think that the dollar's positions are hopeless. The extent of the trade conflict between the US and China did not declined entirely. The chances of the four monetary restrictions in the FRS this year are still high (74%), the leading indicator from the Federal Reserve Bank of Atlanta signals a 4.6% increase in US GDP for the third quarter. The market turned out to be too emotional for the performances of the White House and the chairman of the Federal Reserve, but gradually calmed down. According to RBC Wealth Management, only a break of $ 1225 ounce will launch an avalanche of mass closure towards speculative short positions.

Technically, the necessary condition for continuing the rally is the ability of the bulls to gain a foothold above the 1209 mark.

Gold daily chart

* The presented market analysis is informative and does not constitute a guide to the transaction.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided byInstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote