The ECB leaves the rate unchanged, and Draghi leaves the answers

The euro fell in the morning against the US dollar, but did not go beyond the lows. Pressure on the pair had data from the company GfK, according to which the mood of consumers in Germany in May will deteriorate. This will happen because of fears about the geopolitical risks and the growth of protectionism, which the US is promoting with respect to trade.

As indicated in the leading report, the index of consumer confidence in Germany in May was 10.8 points against 10.9 points in April. The data fully coincided with the forecasts of economists.

After the publication of the ECB's decision on the interest rate, the euro again returned to the lows of the day.

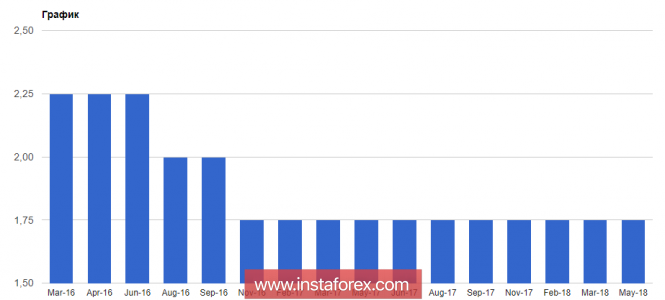

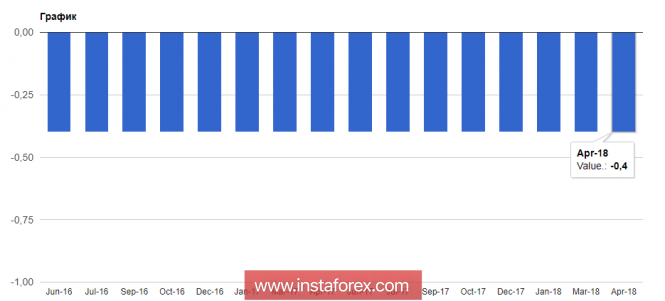

Thus, the European Central Bank left the refinancing rate unchanged, at 0.0%, while the deposit rate was also maintained at a negative level of -0.4%.

The ECB said that rates will remain at current levels for an extended period, especially highlighting the point that changes in monetary policy will not be introduced long after the completion of asset purchases. Let me remind you that a number of experts suggest that as soon as the European regulator completely turns off the asset buy-back program, there will immediately appear the prerequisites for raising interest rates.

As for the program of quantitative easing, then, according to the ECB, it will be implemented in the amount of 30 billion euros a month before the end of September this year, and if necessary, then longer.

The ECB President's speech at the press conference led to a surge in market volatility.

Many market participants expected specifics in the statements of the ECB President regarding the asset buy-back program. Despite this, Mario Draghi again blurrily commented on the current situation. According to him, the incoming information speaks in favor of a somewhat moderate position.

With regard to the rate of price growth, Draghi expressed concern about the restrained growth of core inflation, confident that inflation will continue to rise to the target level in the medium term, and that it will still require significant stimulus to maintain it.

Draghi also drew attention to the fact that economic growth will remain confident, large-scale, even though the growth rate has become more moderate compared to the beginning of 2018. In this connection, according to the president of the ECB, there remains a need for sufficient monetary and credit incentives.

Analysis are provided byInstaForex.

Please visit our sponsors

Results 2,531 to 2,540 of 4086

Thread: InstaForex Wave Analysis

-

27-04-2018, 05:40 AM #2531

-

02-05-2018, 05:55 AM #2532

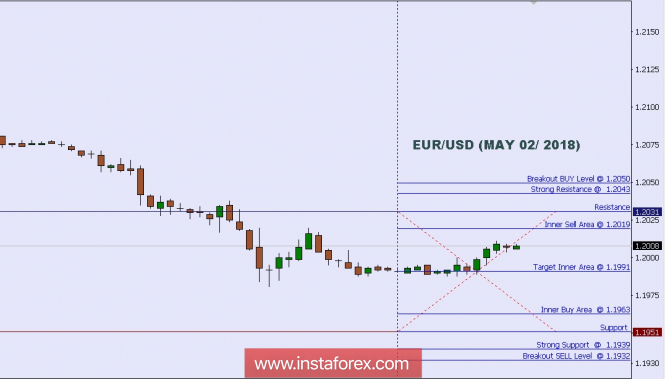

Technical analysis: Intraday Level For EUR/USD, May 02, 2018

When the European market opens, some Economic Data will be released such as Unemployment Rate, Italian Prelim GDP q/q, Prelim Flash GDP q/q, Italian Monthly Unemployment Rate, Final Manufacturing PMI, Final Manufacturing PMI, French Final Manufacturing PMI, Italian Manufacturing PMI, and Spanish Manufacturing PMI. The US will release the Economic Data too, such as Federal Funds Rate, Crude Oil Inventories, and ADP Non-Farm Employment Change, so, amid the reports, EUR/USD will move in a medium to high volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.2050.

Strong Resistance:1.2043.

Original Resistance: 1.2031.

Inner Sell Area: 1.2019.

Target Inner Area: 1.1991.

Inner Buy Area: 1.1963.

Original Support: 1.1951.

Strong Support: 1.1939.

Breakout SELL Level: 1.1932.

Analysis are provided byInstaForex.

-

03-05-2018, 05:39 AM #2533

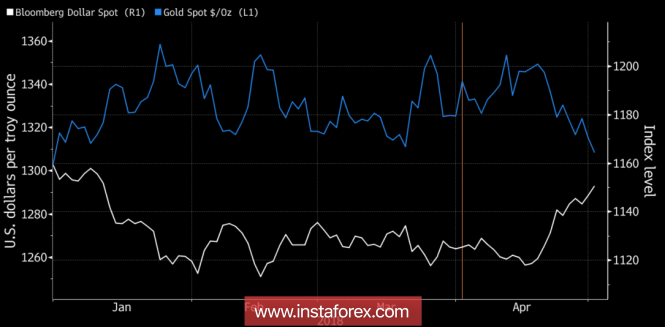

Gold tests advisor

The dollar rose from its knees and the yield of 10-year US Treasuries broke through a psychologically important mark of 3%, which made gold a whipping boy. The precious metal fell to the level of 4-month lows, and the market is discussing the prophetic forecast of Larry Kudlow. When assuming the post of chief economic advisor to the president, he recommended buying the US dollar and selling gold. By that time, and the case was in mid-March, the USD index lost about 8.6%, while the XAU/USD, by contrast, added 8.8%, so Kudlow's advice at best was puzzling. In fact, everything turned out differently. The Economic Adviser proved his professionalism. A great start, Larry!

Dynamics of gold and the US dollar

Someone perceived the success of the replacement Gary Cohen as an accident (once a year and a stick shoots), someone - a confirmation of the theory that markets are ruled by people from Washington, whether the Fed or the US administration. Much more important is another - the precious metal and the dollar continue to walk in pairs, although in different directions. The gold is traditionally perceived as a hedge against inflation, but always take into account the dynamics of real rates of the US debt market. The rapid growth in the yield of treasury bonds caused no less a blow to the positions of the "bulls" in the XAU/USD than the "greenback" who rose from the ashes. The precious metal is unable to compete with bonds because of its inability to pay dividends, so it fell into disgrace. Stocks of the world's largest specialized stock exchange fund SPDR Gold Trust fell to 866.77 tons, while XAU/USD prices fell to the lowest level since the end of December.

Gold as easily slid into the red zone from the beginning of the year, as it started to kick off. What can save it? Short-term - the absence of signals from the Fed on four hikes in the federal funds rate in 2018 and disappointing statistics on the US labor market for April. Mid-term - the restoration of the global economy after a disastrous first quarter. Do not be surprised that the safe-haven will respond positively to an improvement in the global appetite for risk. In fact, the scheme "overclocking the US economy - increasing the growth rate of global GDP - the normalization of monetary policy by central banks-competitors of the Fed" can cause a re-earn, which will lead to a weakening of the dollar and a return to interest in gold.

Investors should closely monitor the ability of the yield of 10-year US bonds to break the level of 3%, and gain a foothold above it. It does not work out - large accounts will begin to record profits on long positions in US currency.

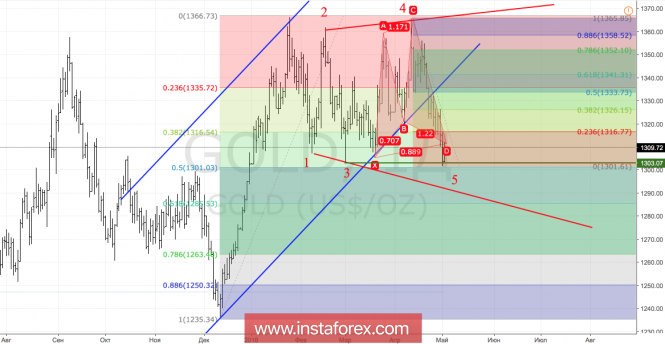

The technically formed pattern of the "Broadening Wedge" pattern and the transformation of the "Shark" pattern into a 5-0 increase the risks of a pullback in the direction of 23.6%, 38.2% and 50% of the CD wave. Correction, as a rule, is used for selling, however, if bulls on gold manage to return quotes to the resistance at $1352 and $1359 per ounce, the risks of recovery of the upward trend will increase.т.

Gold, daily chart

Analysis are provided byInstaForex.

-

04-05-2018, 10:36 AM #2534

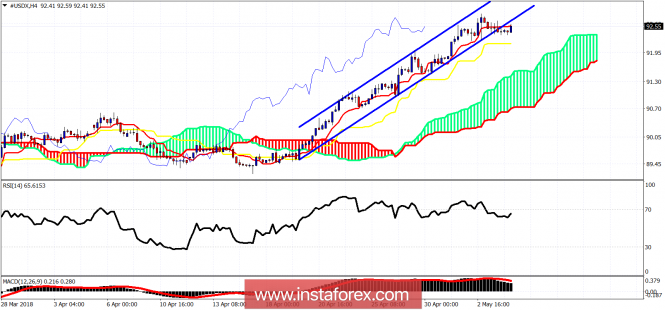

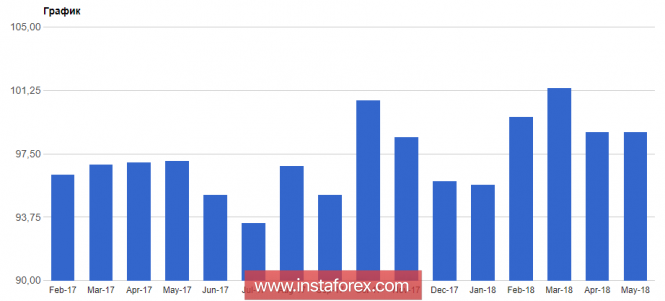

Technical analysis on USDX for May 4, 2018

The Dollar index has broken out of the bullish channel. Price has been giving bearish divergence signs in the RSI for the last few days while it was making higher highs and higher lows. With Non Farm Payrolls expected today, traders should be very cautious and wait to act until after the announcement.

Blue lines - bullish channel

The Dollar index above the Ichimoku cloud. Trend remains bullish. However we have two warning signs. The break below the channel and the bearish divergence in the RSI. Short-term support is at 92.15 and next at 91.40. I expect a major trend reversal to occur today or early next week to the downside. I would not be buying the index around current levels but look for selling.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

08-05-2018, 06:03 AM #2535

Pound keeps gunpowder dry

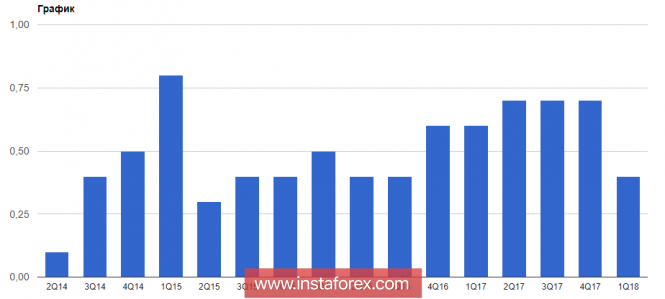

Looking at the dynamics of the British pound in the last two weeks, "bulls" are really sorry. Excessive euphoria after the announcement of the transition period between the UK and the EU and the "hawkish" speeches by representatives of the Bank of England allowed the GBP/USD pair to climb to a peak since the referendum on membership in the European Union. Many forecasters saw sterling at $1.45 and higher by the end of the year, but the reality turned out to be harsh. Disappointing statistics and a surprise from Mark Carney is a cold shower spilled on the heads of the pound fans. From the levels of the April highs, it lost about 6% of its value.

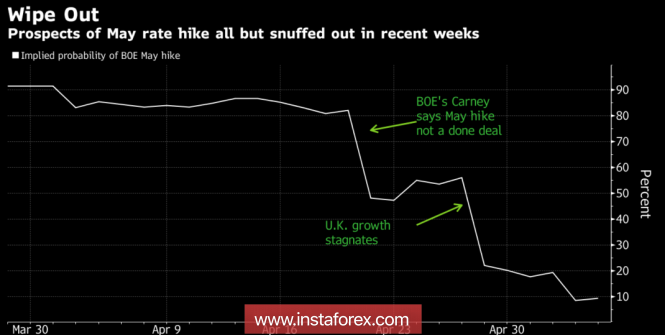

British tabloids love to criticize foreign players. Therefore, the speech of the Canadian nationality of Carney that BoE has other meetings to talk about raising the REPO rate was interpreted as cowardice. The subsequent negative from GDP for the first quarter and from business activity in April reduced the chances of a tightening of monetary policy from 90% to 10% in May. Is it possible to resist such a background sterling?

The dynamics of the likelihood of an increase in the REPO rate in May

The US dollar rose from the ashes to the fire. The US currency is attacking the entire front of the market due to the growth of the yield of treasury bonds and the large-scale winding up of record speculative net-euros. The slowdown of the eurozone's GDP affects the economy of the UK.

Is it worth to blame Mark Carney for cowardice? The departure of inflation from the 3% mark and the weak macroeconomic statistics on industrial production, retail sales, GDP and other indicators compel the Bank of England to keep its powder dry. The final touch was the release of data on business activity in the service sector, which accounts for about 80% of UK GDP. The purchasing managers' index rose from a 20-month low of 51.7 to 52.8 in March, but did not reach the forecasts of Bloomberg experts.

And yet BofA Merrill Lynch recommends its clients - "bears" - to be cautious. The Bank of England does not refrain from normalizing monetary policy, which, together with a reduction in political risks, should support the sterling. The National Institute of Economic and Social Research predicts that the REPO rate will be raised in August, and during the remainder of the year GDP growth will be about 1.7%.

Most likely, on May 10, Mark Carney and his colleagues will decide to retain the previous parameters of monetary policy, nevertheless the BoE head's emphasis on a strong labor market, including stable growth of average wages, can serve a good service to the pound's fans. When most sell sterling, the positive from the Central Bank is able to fool those who came in late to join the downward path of the GBP/USD.

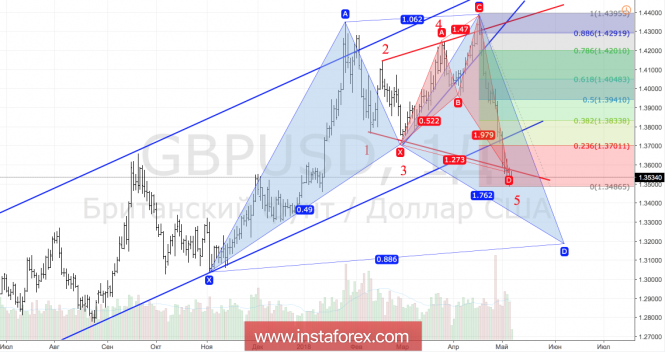

Technically, reaching a target of 127.2% for the subsidiary "shark" pattern increases the risks of a pullback of the pair being analyzed in the direction of 1.37 and 1.383. The renewal of the May low will create the prerequisites for continuing the peak in the direction of the 88.6% target over the parent "shark" pattern.

GBP/USD, daily chart

Analysis are provided byInstaForex.

-

09-05-2018, 03:47 AM #2536

Pound and the euro continue to fall

Despite good industrial production figures in Germany for March of this year, the European currency continued its decline against the US dollar and a number of other world currencies on Tuesday morning. The speech of the chairman of the Fed was taken by traders with a certain optimism. Although, Powell did not touch on the conditions of monetary policy but instead spoke more about its impact on other developed economies of the world.

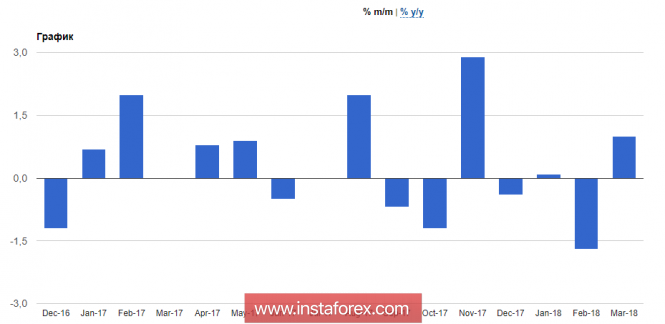

According to the report of the Federal Bureau of Statistics of Germany, industrial production in March 2018 grew by 1.0% compared with February, while economists expected an increase of 0.8%. As stated in the report, the main reason for the growth was the increase in production of capital goods. Compared with March 2017, industrial production in Germany increased by 3.2%.

Good data from Germany, after the disastrous beginning of the year, instilled some optimism in investors, but, as we see on the EURUSD chart, this is not enough.

The morning speech by the Chairman of the Federal Reserve, Jerome Powell, had a positive effect on the quotes of the US dollar. Powell said that despite the Fed's repeated increase in rates since December 2015, financial conditions in the US have become less stringent, while monetary stimulus has had only a relatively limited impact on the flow of capital in emerging economies in recent years. He also noted that the Fed, as much as possible, clearly intends to talk about the prospects of politics in order to avoid unrest in the markets.

As for the technical picture of the EURUSD pair, the downtrend persists and so far there are no prerequisites for a reversal. The breakdown at the support level of 1.1890 opens up new prospects for updating the lows in the areas of 1.1830 and 1.1790. The main goal now will be the level of the minimum of December 12, 2017 which is the level of 1.1717.

The British pound grew reluctantly but returned to the lower boundary of the side channel, which also indicates the continued downward trend in the trading instrument. Pressure on the pound in the first half of the day could be formed by statements of British Foreign Secretary Boris Johnson. During the interview, Johnson expressed his dissatisfaction with the plan of the customs agreement, which was proposed by Prime Minister Theresa May and which should enter into force after Brexit.

According to the minister, the variant of the customs agreement contradicts everything that the UK aspired to by agreeing to Brexit and leaving the EU, since the preservation of import duties in favor of the EU will retain control over trade policy and laws.

Analysis are provided byInstaForex.

-

10-05-2018, 08:22 AM #2537

GBP/JPY Reversed Nicely Off Resistance, Remain Bearish

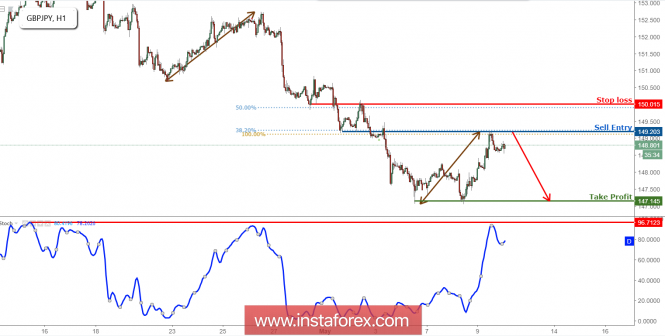

GBP/JPY reversed off its resistance at 149.20 (100% Fibonacci extension, 38.2% Fibonacci retracement, horizontal overlap resistance) where we expect prices to drop to its support at 147.14 (horizontal swing low support)

Stochastic (89, 5, 3) is reversed off its resistance at 96% where it has a lot of corresponding downside potential.

Sell 149.20. Stop loss at 150.01. Take profit at 147.14.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

11-05-2018, 04:02 AM #2538

Euro buyers have a chance

Weak data on producer prices in the US and the performance of representatives of the Fed did not put much pressure on the US dollar, which will continue its steady growth against risky assets.

According to the report, the producer price index in the US for the month of April this year grew by only 0.1% after rising by 0.3% in March. Economists expected inflation to grow by 0.2%.

Compared to the same period in 2017, producer prices rose only 2.6%, also showing a slowdown. Economists had expected growth of 2.8%.

The speech of the President of the Federal Reserve Bank of Atlanta, Raphael Bostic, was rather optimistic.

Bostic said that a gradual increase in rates would lead to an increase in inflation above the target level and the economy is close or has already reached full employment.

He also noted that the Fed will continue to closely monitor the signs of rising price pressure, as inflation is close to achieving the target level.

According to the representative of the Fed, the main risk for the US economy is associated with uncertain prospects for trade.

The buyers of the euro managed to hold within the minimum of the month in yesterday's session, which indicates an upcoming upward correction. However, for this it is necessary to break above the resistance level of 1.1890, where the areas of 1.1930 and 1.1970 open.

The New Zealand dollar collapsed against the US dollar after the Reserve Bank of New Zealand left the official interest rate unchanged at 1.75%, saying that monetary policy will remain stimulating for a long time.

According to the RBNZ, the growth of the world economy will support the demand for New Zealand exports, and government and consumer spending will support GDP growth. Economists predict annual inflation of 2% in the fourth quarter of 2020, while the current level was previously expected in the third quarter. The official interest rate is also expected at 2% in the first quarter of 2020.

Data on the Chinese economy have passed without a trace for commodity currencies. According to the report, China's consumer price index rose by 1.8% in April compared to the same period last year. It is important to note that in March, the growth was 2.1%.

As noted in the report, the main pressure on the index was created by falling prices for pork. Compared with April 2017, it decreased by 16.1%. Prices for non-food products rose by 2.1%. Economists predicted that in April, consumer prices will rise by 1.9%.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided byInstaForex.

-

15-05-2018, 05:47 AM #2539

Correction potential in the euro can be restrained

The upward correction in the European currency continued on Friday amid a lack of good fundamental statistics on the US economy, as well as rather restrained statements by the representatives of the Federal Reserve, in particular James Bullard, who stated that it was necessary to "slow down" with the increase in rates.

According to the University of Michigan, consumer sentiment in the US in May remained unchanged. Despite the fact that the index is preliminary, the lack of growth in consumer confidence could negatively affect the economy in the second quarter of this year.

Thus, the leading index of consumer sentiment at the University of Michigan in May this year was 98.8 points, unchanged from April. Economists had expected the index to be 98.0 points. Let me remind you that in March the mood index rose to 101.4 points, and then began its decline.

As noted above, the speech of the representative of the Fed Bullard was of a rather interesting nature. Despite the fact that the US economy is in very good condition and there are no problems with inflation growth above 2% the regulator will not, Bullard is concerned that two more rate hikes this year could lead to a coup in the yield curve of government bonds.

In his view, it is wrong to assume that a reversal of the yield curve will not lead to serious changes in the market. In this connection, the official of the Federal Reserve indicated that he will express his disagreement with the further increase of interest rates this year.

His colleague in the role, Loretta Mester, was more optimistic. In her opinion, the Fed may have to make their policies deterrent, as the neutral interest rate increases. However, improving economic prospects will be a strong argument in favor of further tightening of monetary policy, as this will prevent overheating of the economy.

Mester is sure that the prospects for the economy are positive, and the level of full employment has been reached in the labor market.

As for the technical picture of the EURUSD pair, buyers of risky assets have already formed a fairly large upward wave, which led the trading instrument to the resistance level area of 1.1980. Only its breakthrough will serve as a new impetus to the opening of long positions in the expectation of updating the highs of 1.2020 and 1.2070.

If the bulls are not so persistent, and in the resistance area 1.1980 there will be a drop in demand for risky assets, another attempt to return to the market of large sellers with the removal of stop orders of buyers below the support of 1.1930 is not ruled out.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided byInstaForex.

-

16-05-2018, 06:04 AM #2540

Weak indicators of GDP growth in the Eurozone put pressure on the euro

The Eurozone's weak economic growth, along with the slowdown in its flagship German economy, has affected the sentiment of traders who are rushing to lock in long positions in the European currency after the recent corrective growth.

According to the Federal Bureau of statistics, German economic growth slowed in the 1st quarter of 2018. As noted in the report, one of the reasons for the slowdown was a series of strikes that swept through Germany. Thus, GDP growth in annual terms was at 1.2% against 2.5% in the 4th quarter of 2017. Economists also predicted a slowdown in the German economy in the 1st quarter.

According to the Bureau of statistics, France's GDP growth for 2017 was revised to 2.2%, from 2%, as previously reported. Good GDP growth was recorded in the 1st quarter in Spain, which partly offset the fall in the overall indicator for the Eurozone.

According to the report of the statistical Agency Eurostat, the growth rate of economic activity slowed. Thus, the Eurozone economy in the 1st quarter of 2018 grew by only 0.4% compared to the previous quarter after an increase of 0.7% in the 4th quarter of last year. These data fully coincided with the preliminary forecast, as well as with the expectations of economists.

As for the technical picture of the EUR/USD pair, the bearish scenario continues to work out. The breakthrough of support at 1.1890, from which the euro continued to grow on Friday, could lead to a number of new short positions and a further decline of the euro towards the low of 1.1850 and 1.1820

The British pound did not receive much support after the publication of the report on the labor market, which indicated that from January to March this year, unemployment in the UK remained at its minimum level.

According to the National Bureau of Statistics, unemployment remained at 4.2 percent, while the number of unemployed in the UK decreased by 46,000 during the reporting period.

Despite this, the pound continues to decline, moving towards the lower border of the side channel, which was formed after the decision of the Bank of England on interest rates last week in the level of 1.3460.

Data from the National Bureau of Statistics also came out in the first half of the day, which indicated that industrial production in China in April of this year increased by 7.0% compared to the same period last year after an increase of 6.0% in March. Economists had expected production to grow by 6.4 percent.

aRetail sales in China rose only 9.4% in April, following a 10.1% increase in March compared to the same period last year. The unemployment rate fell to 4.9% in April.

Analysis are provided byInstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote