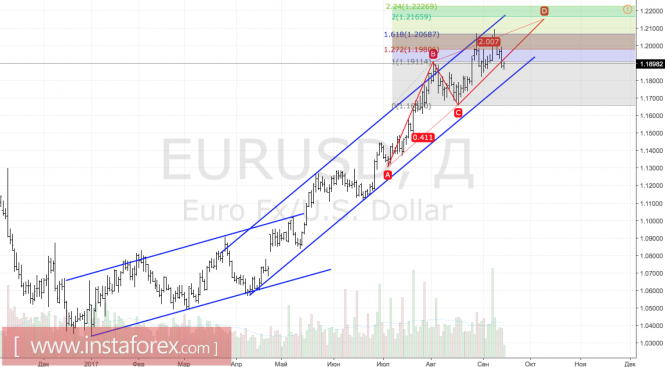

Technical analysis of EUR/USD for Sept 04, 2017

When the European market opens, some Economic Data will be released, such as PPI m/m, Sentix Investor Confidence, and Spanish Unemployment Change. Today the US will not release any Economic Data, so, amid the reports, EUR/USD will move in a low volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1939.

Strong Resistance:1.1932.

Original Resistance: 1.1921.

Inner Sell Area: 1.1910.

Target Inner Area: 1.1882.

Inner Buy Area: 1.1854.

Original Support: 1.1843.

Strong Support: 1.1832.

Breakout SELL Level: 1.1825.

Analysis are provided byInstaForex.

Please visit our sponsors

Results 2,381 to 2,390 of 4086

Thread: InstaForex Wave Analysis

-

05-09-2017, 06:07 AM #2381

-

05-09-2017, 06:15 AM #2382

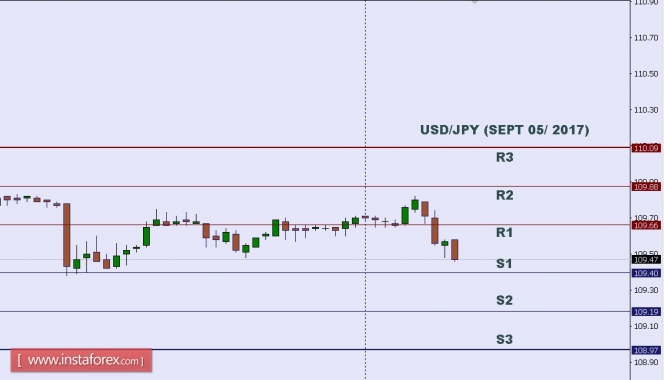

Technical analysis of USD/JPY for Sept 05, 2017

In Asia, Japan will release the 10-y Bond Auction data, and the US will release some Economic Data, such as IBD/TIPP Economic Optimism and Factory Orders m/m. So, there is a probability the USD/JPY will move with low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Resistance. 3: 110.09.

Resistance. 2: 109.88.

Resistance. 1: 109.66.

Support. 1: 109.40.

Support. 2: 109.19.

Support. 3: 108.97.

Analysis are provided byInstaForex.

-

06-09-2017, 05:37 AM #2383

NZD/USD testing major resistance, prepare to sell

The price is testing major resistance at 0.7261 (Multiple Fibonacci retracements, horizontal swing high resistance) and we expect to see a strong reaction from this level to push the price down to at least 0.7208 support (Fibonacci retracement, horizontal pullback support).

Stochastic (34,5,3) is seeing major resistance below 92% and we expect a corresponding reaction off this level.

Sell below 0.7261. Stop loss is at 0.7301. Take profit is at 0.7208.

Analysis are provided byInstaForex.

-

07-09-2017, 05:32 AM #2384

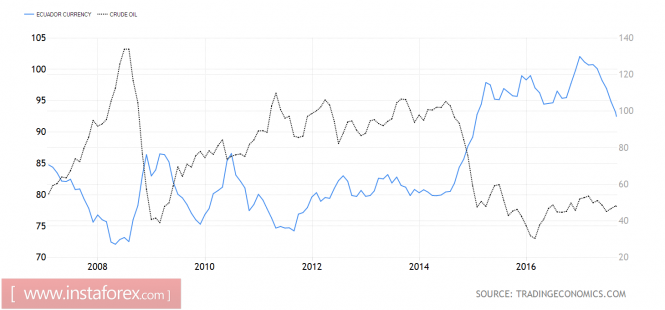

Brent made friends with hurricanes

Hurricane Harvey did not bring happiness, but this disaster helped the "bulls" in the North Sea and saved them by catching the straw, instead of forcing them to flee the battlefield. The experts of Bloomberg predicted that the US black gold reserves will grow by 2.5 million barrels by the end of the week by 1 September, while the Goldman Sachs announced that it will reach 40 million barrels within a month as the hurricane ends. The oil became a more serious driver of growth which returned refinery to life.

ExxonMobil, Phillips 66, Valero Energy and others reported about the resumption of refining operations. As of September 5, factories with a capacity of 3.8 million b/s (about 20% of the total value for the States) were closed, while at the height of the hurricane it was about 4.2 million b/s capacity. According to the US Energy Information Administration, the continuation process can take several days or weeks. Everything will depend on the damage found at the time of the resumption.

Along with the return to life of the oil refinery, oil has another important hidden driver of growth as the domestic energy increased its demand among the states affected by Harvey. The White House asked the Congress for about $ 7.9 billion in aid to Texas and Louisiana for restoration work, which is regarded as a "bullish" factor for black gold.

However, Goldman Sachs claims that the potential growth of oil is limited, as the current situation is likely to take advantage of mining companies from the States. The possible price hike will increase the hedging of price risks and production volumes, which will affect the global balance of the physical asset market and the futures market. The bank draws attention to the fact that companies have significantly reduced costs in recent years, and the level of revenue showed a growth in profits. This position corresponds to the opinion of the Alexander Novak, Minister of Energy of Russia, saying that in 2018 Brent will cost $45-55 per barrel.

Corrections to the current alignment of forces can make another hurricane. Irma is moving in the direction of Florida, but it is impossible that its impact will be more serious for the US oil industry than Harvey's influence.

Brent and WTI gained support from the weak dollar. The dovish statement of Lael Brainard and Neel Kashkari reduced the potential increase of the federal funds rate in December to 37%. The growth of geopolitical risks related to North Korea put pressure on the yields of US Treasury bonds by pushing futures for the North Sea grade to the maximum levels since May.

Dynamics of oil and the dollar index

Source: Trading Economics.

Technically, the "bulls" renewed July highs of Brent along with the activation of the AB = CD pattern increase the risks of continuing the northern campaign towards the target at 127.2% and 161.8%. This corresponds to $54.7 and $56 per barrel. On the contrary, the inability of buyers to keep prices above the levels of $53.7 and $52.9 will indicate weakness.

Brent Daily Chart

Analysis are provided byInstaForex.

-

08-09-2017, 05:47 AM #2385

Draghi moved the answers to late autumn

The European currency strengthened its position against the US dollar after the press conference of the president of the European Central Bank, which took place immediately after the regulator left its interest rates unchanged.

However, it should be noted that the growth of the euro was more restrained than many analysts had predicted. Basically this was due to the fact that specific deadlines or measures regarding the repurchase program of the bonds were not announced.

During the speech ECB President Draghi, he said that rates will be at current levels for a long period, and in the framework of quantitative easing, the ECB will buy assets of 60 billion euros a month until December 2017 or longer, if necessary.

As for the specific time frames, the ECB President said that this fall, it will be decided when to adjust the parameters of the policy next year. This leaves room for further strengthening of the euro in the medium term, therefore it would be wrong to talk of any major downward correction in the EURUSD pair. The market reaction associated with buying the euro in the current situation speaks for itself.

Mario Draghi also drew attention to the fact that the economic recovery seems strong and large-scale, and the available information confirms that the prospects for economic growth remain the same.

Draghi very mildly expressed concern regarding the exchange rate of the European currency, saying that the recent volatility of exchange rates is a source of uncertainty that requires observation. Some analysts predicted today that there will be verbal intervention by the president of the European Central Bank, aimed at weakening the rate of the single European currency.

The ECB President also drew attention to the fact that when deciding on monetary policy, the central bank will have to take into account the exchange rate.

As for inflation, according to Draghi, the core index has grown slightly, but a very significant monetary stimulus is still needed.

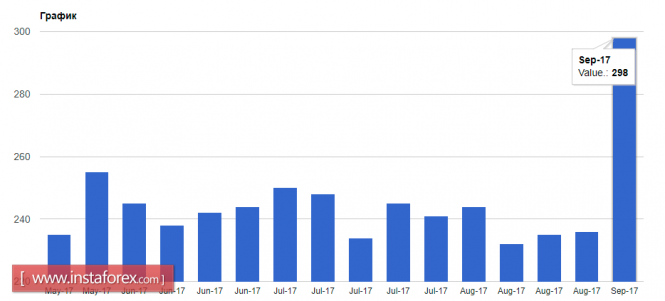

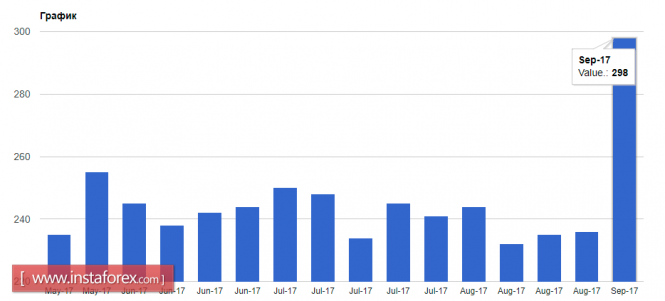

Data on the labor market slightly supported the US dollar, as the number of Americans who applied for unemployment benefits increased last week. The rise is associated with Hurricane Harvey. According to the report of the US Department of Labor, the number of initial applications for unemployment benefits for the week from August 27 to September 2 increased by 62,000 and amounted to 298,000. Economists predicted the number of applications to be at 241,000.

Analysis are provided byInstaForex.

-

11-09-2017, 09:38 AM #2386

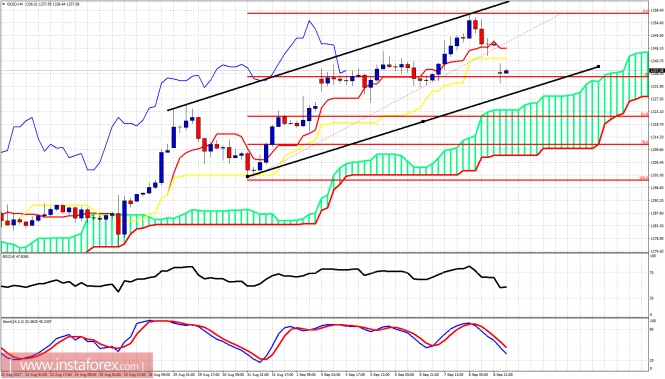

Technical analysis of gold for September 11, 2017

Gold price opened with a gap down today. Trend remains bullish. Price can find support at $1,330-$1,340 area. Gold price is expected to continue its bullish trend higher.

Black lines - bullish channel

Gold price has reached the 38% Fibonacci retracement support. We could see price move a bit lower towards the lower channel boundary or the Ichimoku cloud support at $1,330, This would be a buying opportunity. I remain bullish and expect Gold price to reverse to the upside soon.

On a daily basis, Gold price is making higher highs and higher lows. Support is at $1.330-$1,300 area. Trend is bullish in ichimoku cloud terms as well. The oscillators are turning downwards from overbought levels but we have no divergence. This implies that price should make new highs after the pullback is over.

InstaForex analytical reviews will make you fully aware of market trends!

Being an InstaForex client, you are provided with a large number of free services for efficient trading.

-

12-09-2017, 05:08 AM #2387

The dollar turned into a Whipping Boy

These factors try to justify the current weakening of the dollar. However, the hurricanes did not affect anything important either in the financial world or in oil and gas production. Even the nuclear missiles, that cannot fly as far as the US, have little effect.

Over the past week, the dollar has weakened considerably. Both the euro and the pound have been strengthening day by day. In many ways this was contrary to common sense, or at least it seemed so at first glance. It is often said that the blame for all the hurricanes that hit the south of the United States is the nuclear tests of the DPRK.

The television footage of the destruction caused by the hurricane in Texas, of course, is impressive. Especially when you realize that we are talking about the second-largest economy and the second-largest population in the state. The first thought that this footage led to is panic, which inevitably affected the dollar. Moreover, if you remember, Texas is famous for its oil workers. It's as if the hurricane caused huge damage to France. However, Texas is a huge state, bigger than most countries in the world. The hurricane affected only a small part of it, and oil production in the United States has long ago moved north of Texas itself. Shale oil and gas in the state is not affected too much. Also, do not forget that in terms of the financial world, Texas is simply insignificant. Another thing, it is in New York or Chicago where large investors and financial tycoons live. Well, it was the case back in Boston. In short, it's not worth writing off everything for a hurricane.

North Korea have caused a lot of people to worry about ballistic missile launches. Here, the weakening of the dollar is explained by the fear of investors of the nuclear strikes of Kim Jong-un. However, everything here is very strange. After all, North Korea has never launched a missile capable of flying to the US territory. Experts only suggest that they have them. But here's what the DPRK definitely has: missiles that are capable of hitting the territory of Japan. About South Korea, they said nothing. So, if all these investors are so afraid of a nuclear attack from the DPRK, it is more logical to transfer money to where they will be the least probability of being hit. Namely, in the US and Europe. Despite this, the dollar weakened against all currencies.

There was also the speech by Mario Draghi which was held immediately after the ECB meeting on monetary policy. He said that if necessary, the program of quantitative easing will be extended beyond December of this year. He also added that interest rates will remain low for a long time. After such words, any currency would inevitably collapse. However, a lot rests on the fact that Mario Draghi did not express concern about the euro. It is understandable that he did not speak about it, since the euro is not a priority for the ECB. The European Central Bank has more important tasks.

So it is necessary to state a simple and banal thing: investors are fleeing from the dollar.

The reason is that investors do not care whether things are going badly or well. It is important for them that the situation is understandable and predictable. Here, in Europe, everything is clear. For a long time, the ECB and the Bank of England will pursue an ultra-soft monetary policy. This, of course, is not very good, but at least it's predictable. In the United States, it is not at all smooth. In the first half of the year, it was promised that by the end of the year, the Fed will refinance the rate of 1.5%. This strengthened the dollar. Now, there are a lot of questions to the Fed, including the rate, which, perhaps, will be left at the level of 1.25%. And since the rate will not be raised any more, then there is nothing anymore to lie about without money.

This scenario will please the eyes of market participants this week. Now, a new hurricane will hit Florida, which is the third largest population and the fourth largest economy by the state. However, the value of Florida is much smaller than that of Texas, so it is quite difficult to use it as an excuse to justify the weakening of the dollar. Especially, since in Florida, unlike Texas, there is no serious industry. The state's position on the size of the economy is only because of the size of the population. However, there is no doubt hurricanes will be used as an excuse.

Another argument in favor of the weakening the dollar is the upcoming meeting of the Bank of England on monetary policy. First, there will be data on inflation, which should show acceleration from 2.6% to 2.8%. If these forecasts are justified, then the number of supporters of the increase in the refinancing rate in the Bank of England will increase. Since the hopes for a rapid increase in the rate in the United States have not been justified, it is worth seeing the UK try. So, the dollar still has to fall in price. Moreover, in the US, a significant slowdown in the growth rate of retail sales is expected from 4.2% to 3.1%.

Considering that practically no significant news is coming out in Europe, the EUR/USD pair, if it grows up, is insignificant. Hysteria about the hurricane in Florida will not allow the dollar to strengthen, so there is a high probability of consolidation around 1.2000.

If the number of votes for raising the refinancing rate in the Bank of England is three or more, then the GBP/USD pair will rise to 1.3350. If inflation increases, the members of the Bank of England board will be cautious, and a pound drop to 1.2950 is possible.

Analysis are provided byInstaForex.

-

13-09-2017, 05:14 AM #2388

What are the prospects for the British pound?

The British pound rose sharply against the US dollar and other world currencies after the release of good inflation data, which again "awakened" the talks about raising interest rates by the Bank of England.

Although such prospects, of course, are quite lengthy, judging by the latest data, with inflation in the UK, after a disastrous July month, everything is in order in August.

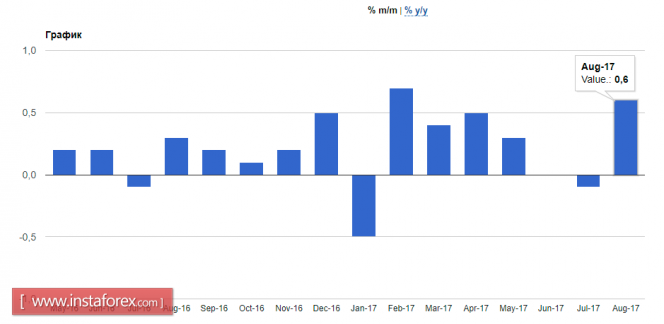

According to the report of the National Bureau of Statistics of Great Britain, both monthly and annual inflation grew. Remarkably, the two indicators were much better than the economists' forecasts. So, the consumer price index of Great Britain in August this year increased by 2.9% compared to the same period of the previous year, while economists expected growth of only 2.7%. The growth was due to a sharp jump in prices for clothing and footwear.

Compared to July 2017, the consumer price index rose by 0.6%, while economists forecast an increase of 0.5%.

The country's factory gate prices in August rose by 3.4% compared to the same period of the previous year, while purchasing prices jumped by 7.6%. The increase in purchasing prices was directly related to the rising prices of crude oil.

Such good performance is unlikely to affect the decision of the Bank of England this Thursday, when it is expected that the regulator will leave the key interest rate unchanged at 0.25%, as the economic growth remains moderate.

The most positive forecasts of economists indicate an increase in the cost of borrowing at the beginning of next year, although the optimal period is mid-2018.

As for the technical picture of the GBPUSD pair, majority will depend on how the new buyers show themselves at the level of 1.3260, because an unsuccessful consolidation above this level can trigger a gradual selling of the pound in the medium term. The high that buyers can expect in this scenario is the update of 1.3330 and 1.3370. If, after the decision of the Bank of England, the trade moves below the level of 1.3260, then it is likely that the pound will be sold quickly to the larger support levels 1.3190 and 1.3090.

According to The Retail Economist and Goldman Sachs, the US retail sales index for the week of September 3-9 fell by 3.0% compared to last week, which is generally related to seasonality before the start of the academic year. Compared to the same period in 2016, the sales index in the US retail chains grew by 2.3%.

Analysis are provided byInstaForex.

-

14-09-2017, 05:16 AM #2389

The Bank of England can raise rates

After the release of strong data on consumer inflation in the UK, as well as the increase in selling and purchasing prices of producers, the question of whether the Bank of England will raise interest rates at the September meeting has surfaced again.

Released on Tuesday, really strong data on consumer inflation unexpectedly showed a significant increase in August, both in monthly terms and in annual terms. This increases the likelihood of an increase in interest rates by the Bank of England at its September meeting. Today there will be more figures on the average level of wages in the UK, as well as on employment. It is expected that wages rose by 2.3% in July against the 2.1% increase in June. Also, growth in applications for unemployment benefits is expected. It can be assumed that if the data prove to be better than forecasts or, at least, not worse than expected, it will support the British currency on the wave of increasing expectations of higher interest rates next week.

In addition to data from the UK, the market will focus today on the publication of figures for industrial inflation in the US. It is estimated that the producer price index will increase sharply both in annual and monthly terms. The annual figures will have to jump to 2.5% from 1.9%, and the monthly increase in August by 0.3% after a 0.1% drop in July.

If these data prove to be worse than forecasts or show higher values, then, the US dollar may receive domestic support against the euro and, possibly, also against the yen.

In general, the currency market can be expected to continue the consolidation period before the meeting of the Bank of England and the Federal Reserve. At the first meeting, a decision may be made to raise interest rates or reduce the volume of asset purchases, while at the second meeting it will be decided to start reducing the balance of the Fed. The first event will support the British currency, and the second will show investors the path of the future monetary policy.

Forecast of the day:

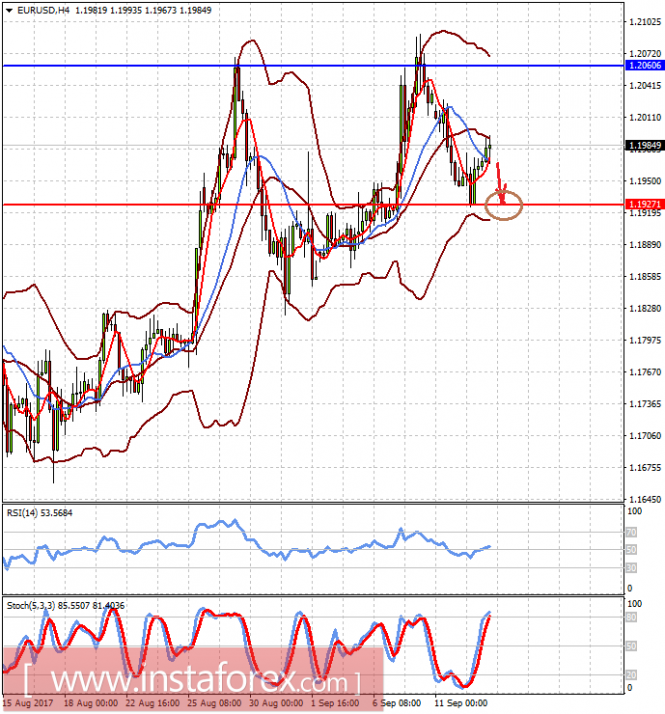

The EURUSD pair may be under pressure on the wave of strong data on production inflation in the US and is able to drop to 1.1925, but its decline will probably be domestic, as the market will expect the release of figures on consumer inflation in the US and the results of the Fed meeting.

The EURGBP pair fell to the level of 0.9000, the overcoming of which can still cause the continuation of its decline to 0.8885. But it is likely that before the meeting of the Bank of England the pair will consolidate, and only the decision of the regulator to raise rates or reduce the volume of asset purchases will lead to its further decline.

Analysis are provided byInstaForex.

-

15-09-2017, 05:29 AM #2390

Fed will not help the dollar

Encouraged by hopes of stimulating the US economy under the influence of Donald Trump's stimulating programs, the "bears" of the EUR/USD pair went into a counter-attack. The consequences of hurricanes "Harvey" and "Irma" were not as terrible as initially expected. Besides, history shows that "Katrina" was stronger against the two, at a time when the Fed raised the federal funds rate in 2005. Natural disasters are temporary and in the end the result of the restoration work can benefit the GDP. Simultaneously, the idea of tax reform, which in late 2016 pushed up the USD index, has returned to the market.

Judging by the comments of the Republicans, the bill on changes in the taxation system will become public for a week by September 25. Up to this point, one can only guess at the basic provisions of the reform and how far it will spread in the American economy. The president only hinted that the rich should not expect special preferences, which contrasts with previous statements about the reduction of corporate tax and real estate tax. However, the fact that Trump changes his mind like a glove, throughout it should be expected.

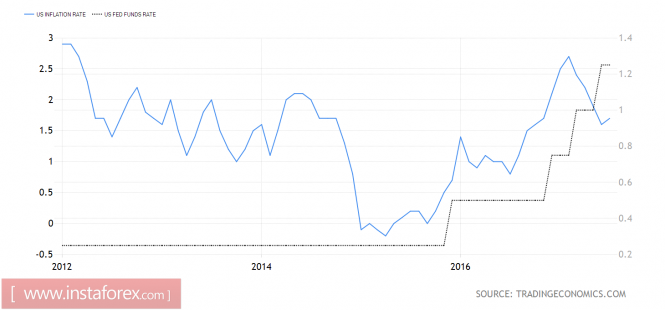

The rise in US GDP growth rate entails a more rapid tightening of the monetary policy by the Fed, compared with what the markets are currently waiting for. While the regulator is concerned about inflation, it must be understood that conditions are constantly changing. If in the 1970s, its average level was 7.1%, in the 1980s - 5.6%, in 1990 - 3%, in the 2000s - 2.6%, but now it is below the 2% mark. The liability is globalization and new technologies that increase competition and force producers to cut prices. In correlation with this, raising the federal funds rate to 3-3.5% or higher, as it was before, is not necessary. The cycle of monetary restriction of the Fed can be completed much earlier, and the realization of this fact will attract new sellers of the US dollar to the market.

Dynamics of inflation and federal funds rates

Source: Trading Economics.

The outlook for the euro, on the contrary, appears optimistic. In fact, due to the lag in the economic cycle in the eurozone compared to the United States, the ECB is at the same pace as the Fed in 2014. The European Central Bank is ready to normalize monetary policy, and the current EUR/USD pair correction only increases the likelihood of it. In October, Mario Draghi will report on the curtailment of the quantitative easing program. This will be a new occasion to buy the euro.

It should be noted that during its last cycle of tightening monetary policy in 2005-2008, the regional currency strengthened against the US dollar by 30%, and if history repeats itself, the current +13% is just the beginning. In this regard, it makes sense for traders to stick to the previous strategy in the main currency pair - buying on payoffs.

Technically, the inability of bulls to move prices above the target by 161.8% on the AB = CD pattern indicates their weakness. The formation of the double vertex increases the correction risks in the direction of at least the lower boundary of the upstream trading channel.

EUR/USD, daily chart

Analysis are provided byInstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 2 users browsing this thread. (0 members and 2 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote