Technical analysis: Intraday Level For EUR/USD, Mar 05, 2019

When the European market opens, some economic data will be released such as Retail Sales m/m, Final Services PMI, German Final Services PMI, German Final Services PMI, French Final Services PMI, Italian Services PMI, and Spanish Services PMI. The US will also publish the economic data such as Federal Budget Balance, IBD/TIPP Economic Optimism, New Home Sales, ISM Non-Manufacturing PMI, Final Services PMI, so amid the reports, EUR/USD will move with a low to a medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1392.

Strong Resistance: 1.1385.

Original Resistance: 1.1374.

Inner Sell Area: 1.1363.

Target Inner Area: 1.1336.

Inner Buy Area: 1.1309.

Original Support: 1.1298.

Strong Support: 1.1287.

Breakout SELL Level: 1.1280.

Analysis are provided byInstaForex.

Please visit our sponsors

Results 2,731 to 2,740 of 4086

Thread: InstaForex Wave Analysis

-

05-03-2019, 06:29 AM #2731

-

06-03-2019, 07:06 AM #2732

AUD/USD. In the grip of contradictions: the aussie cannot choose the vector of its movement

The March meeting of the Reserve Bank of Australia was quiet and almost imperceptible. The regulator retained the parameters of monetary policy in its previous form and did not frighten the market with arguments about the interest rate reduction in the foreseeable future. The Australian dollar, in turn, reacted accordingly: paired with the US currency, the "aussie" remained within the 70th figure, and Tuesday's price fluctuations were associated more with Chinese data than with the results of the RBA meeting.

In order to assess the prospects of AUD/USD, first of all it is necessary to remember the reasons for the pair's decline last month. The downward impulse was due to the rhetoric of the head of the RBA Philip Lowe, who, to the surprise of many traders, allowed the probability of lowering the interest rate this year. It is worth noting that in fact his phrase was more shrouded – firstly, he reported the transition to a "neutral position" in monetary policy, and secondly, he noted that the rate can be both increased and reduced. But the market interpreted this commentary in its own way, especially since earlier in the text of the accompanying statement there was only a phrase that "in the future" the parameters of monetary policy will be tightened. In other words, the regulator has transparently hinted that in the near future it will take a wait-and-see position, and then act on the situation, and the option of reducing the rate is likely to be the opposite scenario. In response to such prospects, the AUD/USD pair fell by almost 200 points, but the price did not fall below the 70th figure, stuck in a narrow-range flat.

Given Philip Lowe's rather dovish rhetoric, many experts warned that the regulator could significantly soften its tone at the March meeting. However, these forecasts did not come true: the Reserve Bank voiced a cautious, but not pessimistic position, even noting positive developments in the Australian economy - in particular, regarding the labor market.

Let me remind you that according to the latest published data, the unemployment rate in Australia remained at five percent, but the increase in the number of employed jumped to 39.1 thousand - the last time such a dynamics was observed was back in August 2018. Moreover, employment growth in January was not due to part-time employment — on the contrary, the employment rate for full-time jobs, which imply higher wages, surpassed a one-and-a-half high, while part-time employment showed a negative trend. This factor has a positive effect on the dynamics of wage growth and, indirectly, on the dynamics of inflation growth.

However, despite the neutral and optimistic results of the March meeting of the RBA, the aussie did not regain its position or even leave the region of the 70th figure. The reason for this is China. Today, another disappointing data from China was published, which again reminded the market of the slowdown of the world's largest economy. Thus, the index of business activity in the services sector from Markit (Markit Services PMI) sharply declined in February, reaching 51.1 points. Over the previous three months, this indicator came out within the framework of 53 points, therefore, such a sharp and, most importantly, unexpected (forecast was at the level of 53.5 points) downward jump had an impact on the dynamics of today's trading. The Australian dollar is most sensitive to the decline in Chinese indicators, since China is its main trading partner.

Taking into account such contradictory fundamental factors, the AUD/USD pair will continue to be traded in the flat - if only the data on Australian GDP growth for the fourth quarter of last year (the release is scheduled for March 6) prove to be stronger/weaker than forecasts. According to general expectations, the Australian economy should grow by 0.5% qoq and decrease to 2.7% year-on-year. If the release comes out at the level of forecasts, then the pair's situation will remain as before, otherwise the aussie will test either the support level (0.7020 - the lower boundary of the Kumo cloud on the daily chart), or the resistance level (0.7180, where Kijun-sen coincides with the upper line of the Bollinger Bands indicator on the same timeframe).

Analysis are provided byInstaForex.

-

07-03-2019, 06:47 AM #2733

AUD/USD: The aussie dives down, but there is strong support ahead

Yesterday, the Australian dollar showed certain optimism, "inspired" by the results of the March meeting of the RBA. The regulator took a cautiously optimistic stance, focusing on the positive aspects of the Australian macroeconomic reports. Contrary to the fears of many experts, the central bank did not discuss the issue of reducing the interest rate, leaving some hope for the preservation of the status quo. But today, market mood regarding the prospects of the Australian currency has changed dramatically: published data on GDP growth in Australia suggests that the option of easing monetary policy can not be dismissed. Moreover, according to a number of currency strategists, such a scenario should be considered as one of the main ones.

Data on the growth of the Australian economy was disappointing. What is alarming is not just the fact that the country's GDP slowed down in the fourth quarter of last year - it is a persistent trend towards a decrease in the key indicator. Thus, if in the first quarter of 2018, Australia's GDP was at the level of 1.1% (quarterly), in the second quarter it decreased to 0.9%, in the third – to 0.3%, and finally in the fourth – to 0.2%. The same dynamics is observed in annual terms of the indicator: I quarter – 3.2%, II – 3.1%, III – 2.7% and IV – 2.3%. Today's release was not only worse than forecasts, but it also marked a certain anti-record. For example, on a quarterly basis, the indicator showed the weakest growth dynamics since the third quarter of 2016.

It is worth recalling that at its January meeting, the Reserve Bank of Australia downwardly revised its forecast for economic growth this year - from 3.5% to 3%. However, the figures published today suggest that the RBA may return to this issue in the future, reducing its growth forecast to at least 2.8%. Extremely weak indicators for the fourth quarter cast doubt on the sustainability of the country's economic growth and, consequently, increases the likelihood of a response from the Australian regulator. As I mentioned above, some currency strategists warn their clients about the implementation of such a scenario.

So, in late February, experts from Westpac (one of the largest banks in Australia, included in the "big four" banks of the country) surprised traders with the fact that they had made a double RBA rate cut before the end of this year. At the same time, economists of this bank, at the beginning of the year, claimed that the regulator would leave the rate unchanged until the end of 2020. Such a sharp turn put some pressure on the Australian dollar, which was then offset by good data on the Australian labor market and neutral results of the March meeting.

Nevertheless, Westpac did not abandon its "dovish" forecast: moreover, today this opinion was supported by two more conglomerates - JPMorgan and Macquarie Bank. Analysts of these banks said that the Australian regulator will not be able to ignore the further slowdown in the economy, while there are no prerequisites for changing the situation at the moment, especially against the background of the slowdown in the PRC economy. Therefore, the RBA will have no other choice but to lower the interest rate - at least once before the end of this year. The opinion of several large banks is shared by many experts, who voiced their point of view following the release of disappointing data.

According to more restrained forecasts, the RBA will still hold a wait-and-see position, but if there are no clear and strong signals about economic recovery in the coming months, then the central bank will still lower the rate - especially if economists worsen GDP growth forecasts for this year to 2.6% .

After such an unexpected reversal in the market's general sentiment, the Australian dollar was under considerable pressure. Paired with the US dollar, the aussie is heading to the main support level of 0.70. This mark is a "price stronghold", which is difficult to break through, but even more difficult - to consolidate in the area of 69-68 figures. If you look at the weekly and monthly charts, you can see that the pair was under the 70th mark only in 2016 for the last time in a long time. After that, the bears made impulsive attempts to break through, but the price quickly returned to its usual niche.

Therefore, despite the negative fundamental background for the aussie, short positions in the AUD/USD pair currently appear risky, with the price now in the area of 0.7030, that is very close to the key level of support. In this case, it is advisable to observe the behavior of the pair at the bottom of the 70th figure. If the bearish momentum fades, then a corrective pullback will probably follow (approximately to 0.7080, that is, to the upper boundary of the Kumo cloud on D1), which, however, does not cancel the overall downward trend for the pair.

Analysis are provided byInstaForex.

-

08-03-2019, 08:46 AM #2734

Forecast for GBP/USD on March 8, 2019

Data on the growth of the Australian economy was disappointing. What is alarming is not just the fact that the country's GDP slowed down in the fourth quarter of last year - it is a persistent trend towards a decrease in the key indicator. Thus, if in the first quarter of 2018, Australia's GDP was at the level of 1.1% (quarterly), in the second quarter it decreased to 0.9%, in the third – to 0.3%, and finally in the fourth – to 0.2%. The same dynamics is observed in annual terms of the indicator: I quarter – 3.2%, II – 3.1%, III – 2.7% and IV – 2.3%. Today's release was not only worse than forecasts, but it also marked a certain anti-record. For example, on a quarterly basis, the indicator showed the weakest growth dynamics since the third quarter of 2016.

On a smaller scale, H4, price convergence with the Marlin oscillator is being formed, which can be realized in a correction from the pound's fall from February 28, visually from the balance line to the daily. We do not expect a high correction, since the signal level of 1.3108 can assume the role of a split, that is, the level at which the price will be wound in a consolidation process.

Analysis are provided byInstaForex.

-

11-03-2019, 06:38 AM #2735

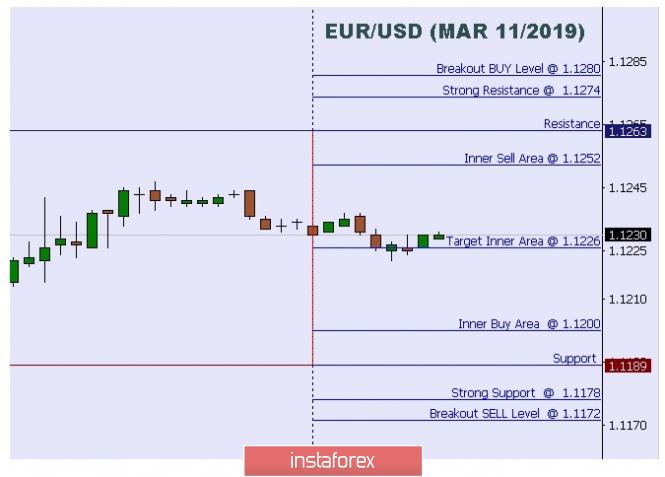

Technical analysis: Intraday Level For EUR/USD, Mar 11, 2019

When the European market opens, some economic data will be released such as German Trade Balance and German Industrial Production m/m. The US will also publish the economic data such as Business Inventories m/m, Retail Sales m/m, and Core Retail Sales m/m, so amid the reports, the EUR/USD pair will move with a low to a medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1280.

Strong Resistance:1.1274.

Original Resistance: 1.1263.

Inner Sell Area: 1.1252.

Target Inner Area: 1.1226.

Inner Buy Area: 1.1200.

Original Support: 1.1189.

Strong Support: 1.1178.

Breakout SELL Level: 1.1172.

Analysis are provided byInstaForex.

-

12-03-2019, 06:46 AM #2736

Technical analysis: Intraday Level For EUR/USD, Mar 12, 2019

analytics5c7fec608c857_source!.jpg

When the European market opens, some economic data will be released such as French Final Private Payrolls q/q. The US will also publish the economic data such as 10-y Bond Auction, Core CPI m/m, CPI m/m, and NFIB Small Business Index, so amid the reports, the EUR/USD pair will move with a low to a medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1313.

Strong Resistance:1.1307.

Original Resistance: 1.1296.

Inner Sell Area: 1.1285.

Target Inner Area: 1.1259.

Inner Buy Area: 1.1233.

Original Support: 1.1222.

Strong Support: 1.1211.

Breakout SELL Level: 1.1205.

Analysis are provided byInstaForex.

-

13-03-2019, 07:05 AM #2737

Technical analysis: Intraday Level For EUR/USD, Mar 13, 2019

analytics5c7fec608c857_source!.jpg

When the European market opens, some economic data will be released such as German 30-y Bond Auction, Industrial Production m/m, and Italian Quarterly Unemployment Rate. The US will also publish the economic data such as Crude Oil Inventories, Construction Spending m/m, Durable Goods Orders m/m, Core PPI m/m, PPI m/m, and Core Durable Goods Orders m/m, so amid the reports, the EUR/USD pair will move with a low to a medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1344.

Strong Resistance: 1.1338.

Original Resistance: 1.1327.

Inner Sell Area: 1.1316.

Target Inner Area: 1.1290.

Inner Buy Area: 1.1264.

Original Support: 1.1253.

Strong Support: 1.1242.

Breakout SELL Level: 1.1236.

Analysis are provided byInstaForex.

-

14-03-2019, 07:00 AM #2738

Technical analysis: Intraday Level For EUR/USD, Mar 14, 2019

When the European market opens, some economic data will be released such as French Final CPI m/m and German Final CPI m/m. The US will also publish the economic data such as Natural Gas Storage, New Home Sales, Unemployment Claims, and Import Prices m/m, so amid the reports, the EUR/USD pair will move with a low to a medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1383.

Strong Resistance: 1.1376.

Original Resistance: 1.1365.

Inner Sell Area: 1.1354.

Target Inner Area: 1.1330.

Inner Buy Area: 1.1300.

Original Support: 1.1289.

Strong Support: 1.1278.

Breakout SELL Level: 1.1271.

Analysis are provided byInstaForex.

-

15-03-2019, 07:46 AM #2739

USD/CAD approaching support, potential bounce!

USD/CAD is approaching our first support at 1.3241 (horizontal pullback support, 61.8% Fibonacci retracement, 100%, 61.8% Fibonacci extension) where a strong bounce to our major resistance level at 1.3347 (50% Fibonacci retracement) might occur. Stochastic (89,5,3) is also nearing support where we might see a bounce in price. Trading CFDs on margin carries high risk. Losses can exceed the initial investment, so please ensure you fully understand the risks.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

18-03-2019, 06:37 AM #2740

USD/CHF approaching support, potential bounce!

USD/CHF is approaching our first support at 1.0018 (horizontal pullback support, 61.8% Fibonacci extension) where a strong bounce might occur to our major resistance at 1.0054 (38.2% Fibonacci retracement). Stochastic (34,5,3) is also nearing support where we might see a corresponding rise in price. Trading CFDs on margin carries high risk. Losses can exceed the initial investment, so please ensure you fully understand the risks.

Analysis are provided byInstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote