EUR and GBP: Indices for the services sector in many countries are declining, putting pressure on the economy

The euro has once again dropped against the background of data in which stagnation is noted in the economies of Italy and France. Only the prospect of growth in the German economy keeps the EURUSD from a larger downward movement.

According to today's report, the Purchasing Managers Index (PMI) for the eurozone services sector remained unchanged in January of this year and amounted to 51.2 points against 51.2 points in December last year. Economists had expected the PMI for the eurozone services sector to drop to 50.8 points. The eurozone composite PMI fell to 51.0 points in January against 51.1 points in December.

Let me remind you that the index value above 50 points indicates an increase in activity.

The above figures for the euro area were mainly saved due to data on the PMI purchasing managers index for the services sector in Germany, which in January of this year rose to 53.0 points, whereas in December the PMI was 51.8 points.

This is where the good news ends. In France and Italy, similar figures continue to be below 50 points, dropping lower and lower, indicating a decline in activity, which will negatively affect the prospects for economic growth in the first quarter of this year.

According to the report, the Purchasing Managers Index (PMI) for France fell to 47.8 points in January against 49.0 points in December. In Italy, the same indicator for the service sector also turned out to be below 50 points and amounted to 49.7 points.

As a result of such weak data, the euro continued its decline against the US dollar, gradually approaching the support level at 1.1400.

The British pound broke through the next weekly lows and continued to decline after the release of weak data on the services sector. All this, of course, may affect the statements of the Bank of England after the decision on interest rates, which will be known this Thursday.

According to the report, PMI for the services sector fell to 50.3 points in January of this year, which is a low of two and a half years. These data once again confirm the concerns associated with Brexit and uncertainty, which negatively affects the economy.

As for the composite index PMI, in January it dropped to 50.1 points from 51.2 points in December. Economists had expected the index to be 51.5 points in December.

The Australian dollar rose today in the morning after the Reserve Bank of Australia left the key interest rate unchanged at 1.50%, but said it had good prospects for the future.

The RBA believes that downside risks for the global economy have increased, but the current monetary policy is consistent with sustainable economic growth.

Annual inflation is expected to return to the target range from 2% to 3%, while Australia's GDP growth is projected at 3% this year. As for unemployment, it can be reduced to 4.75%.

Analysis are provided byInstaForex.

Please visit our sponsors

Results 2,711 to 2,720 of 4086

Thread: InstaForex Wave Analysis

-

06-02-2019, 05:55 AM #2711

-

07-02-2019, 05:33 AM #2712

GBP/USD. Results of the day. New grounds for the fall of the pound will be received?

The amplitude of the last 5 days (high-low): 90p - 62p - 72p - 74p - 128p.

Average amplitude for the last 5 days: 85p (88p).

The British pound sterling, having completed the second support level of 1.2942, rebounded from it and began a weak upward correction. Yesterday's decline was very noticeable, so a correction is logical. Tomorrow, more precisely, Fed Chairman Jerome Powell will hold a speech by tonight, which could potentially have an impact on all currency pairs, including the US dollar. Given the "dovish" rhetoric of representatives of the Federal Reserve in recent months, now we can hardly expect its change into the direction of a "hawk". At the same time, it should be recognized that even Powell's "dovish" rhetoric did not have a lasting positive effect on the British pound. There are so many problems and uncertainties in the UK, and all are connected with Brexit, that the pound will be prone to fall, even if the Fed starts lowering the key rate. The likelihood that a "soft" scenario for Brexit will be implemented has again decreased in recent days. In addition, the results of the meeting of the Bank of England will be announced tomorrow. No change in monetary policy is expected. But a new portion of the fears and warnings from the head of the Bank of England Mark Carney is expected. And the stronger his fears are, the more chances that we will see another decrease in the British pound. From a technical point of view, the current correction is negligible and can be completed at any time. Thus, we recommend to be ready for a sharp resumption of the downtrend. So far, the full potential of the pound's fall is limited to the level of 1.2500.

Trading recommendations:

The GBP/USD currency pair has started a low correction. Thus, it is not recommended to open shorts until the MACD indicator turns back down. After the reversal, the targets will be 1.2883 and 1.2841.

Long positions will become relevant not earlier than the consolidation of the price above the critical Kijun-sen line. In this case, the target will be the level of 1.3175, but this will require serious fundamental grounds.

In addition to the technical picture, fundamental data and the timing of their release should also be taken into account.

Explanation of illustration:

Ichimoku Indicator:

Tenkan-sen-red line.

Kijun-sen – blue line.

Senkou span a – light brown dotted line.

Senkou span B – light purple dotted line.

Chikou span – green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD:

Red line and histogram with white bars in the indicator window.

Analysis are provided byInstaForex.

-

08-02-2019, 07:05 AM #2713

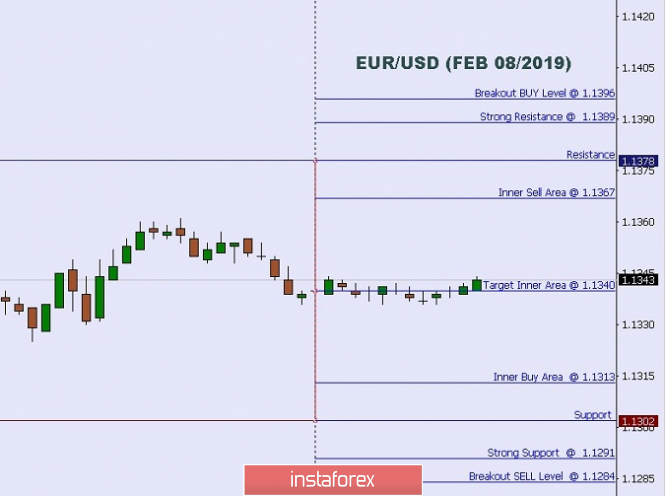

Intraday Level For EUR/USD, Feb 08, 2019

When the European market opens, some economic data will be released such as Italian Industrial Production m/m, French Prelim Private Payrolls q/q, French Prelim Private Payrolls q/q, and French Industrial Production m/m. The US will not publish any economic data today, so amid such conditions, the EUR/USD pair will move with a low to a medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1396.

Strong Resistance: 1.1389.

Original Resistance: 1.1378.

Inner Sell Area: 1.1367.

Target Inner Area: 1.1340.

Inner Buy Area: 1.1313.

Original Support: 1.1302.

Strong Support: 1.1291.

Breakout SELL Level: 1.1284.

(Disclaimer) *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

11-02-2019, 08:22 AM #2714

Forecast for USD/JPY on February 11, 2019

The yen continues to build up strength before breaking out on the resistance of the Krusenstern line daily scale. The price is held by the balance line on the chart of the smaller period-H4. The Marlin line seeks to go out into the growth zone. On the daily chart, the line of this oscillator unfolds in the continuation of growth. The price exit over 110.04 - resistance of the Krusenstern line, will make it possible for the price to attack the Krusenstern line of the higher chart and rise to 110.36 - the resistance of the trend line of the price channel on the daily. Exit above this line opens the way to the resistance of the next line at 111.24.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

12-02-2019, 07:01 AM #2715

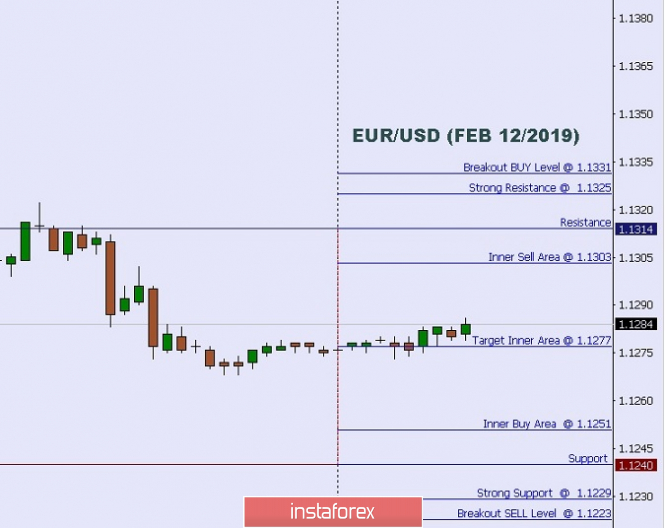

Technical analysis: Intraday Level For EUR/USD, Feb 12, 2019

When the European market opens, no economic data will be released. The US will publish the economic data such as JOLTS Job Openings and NFIB Small Business Index, so amid the reports, the EUR/USD pair will move with a low to a medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1331.

Strong Resistance: 1.1325.

Original Resistance: 1.1314.

Inner Sell Area: 1.1303.

Target Inner Area: 1.1277.

Inner Buy Area: 1.1251.

Original Support: 1.1240.

Strong Support: 1.1229.

Breakout SELL Level: 1.1223.

Analysis are provided byInstaForex.

-

13-02-2019, 07:11 AM #2716

EUR/AUD Approaching Support, Prepare For Bounce

EUR/AUD is approaching its support at 1.5888 (100% Fibonacci extension, 50% Fibonacci retracement, horizontal pullback support) where it could potentially bounce to its resistance at 1.5972 (50% Fibonacci retracement, horizontal swing high resistance).

Stochastic (89, 5, 3) is nearing its support at 2.4% where a corresponding bounce could occur.

EUR/AUD is approaching its support where we expect to see a bounce.

Buy above 1.5888. Stop loss at 1.5845. Take profit at 1.5972.

Analysis are provided byInstaForex.

-

14-02-2019, 05:31 AM #2717

EURUSD: US inflation unchanged. Eurozone continues to slide into recession

The euro fell slightly after data showed that industrial production in the euro zone declined more than expected in December. However, buyers immediately activated in the area of important support levels and did not allow a larger downward movement to be formed.

According to the report, industrial production in the eurozone in December 2018 declined immediately by 0.9% compared with November, while the interviewed economists expected a reduction of 0.3% only. Such weak indicators once again confirm the fact of more than a serious slowdown in the economy at the past and at the beginning of this year.

In the afternoon, there was data on inflation in the United States. Despite the weak report, the US dollar regained some of the positions that was lost yesterday which was paired with the euro.

According to a report by the US Department of Commerce, consumer prices in the United States in January 2019 remained unchanged in comparison with the previous month, while economists had expected an increase of 0.1%. The base consumer price index, which does not take into account volatile categories, including energy, rose by 0.2% compared with December. Economists had expected the base index to rise by 0.2% in January as well. As compared with the same period of the previous year, prices rose by 1.6% in January, yet it is not enough for the Federal Reserve's target level. Base prices, on the other hand, rose by 2.2% compared with January 2018.

The British pound fell immediately after data released indicating that the rate of consumer price inflation in the UK slowed down and was beneath the target level set by the Bank of England.

The main reason for such a sharp decrease was the fall in energy prices at the end of last year.

According to the data, the consumer price index CPI UK in January 2019 increased by 1.8% compared with January 2017 and an increase of 2.1% back in December. The basic level of the Bank of England is around 2%.

The base index, which excludes volatile categories, but includes food, tobacco products, and energy, rose 1.9% in January, as well as in December.

Bear in mind that quite recently, the Bank of England announced that they were not refusing further increases in interest rates. However, given these indicators, it is unlikely that anyone will hurry to tighten monetary policy unnecessarily in the future, which may weaken the position of the British pound, and which will be eliminated under pressure due to the uncertain Brexit scenario and slowdown in the British economy.

As for the technical picture of the GBP / USD pair, yesterday's upward correction, which was observed in the second half of the day, may continue today. However, this requires breaking through the important resistance levels of 1.2920 and 1.2980.

Analysis are provided byInstaForex.

-

15-02-2019, 06:52 AM #2718

Technical analysis: Intraday Level For EUR/USD, Feb 15, 2019

When the European market opens, some Economic Data will

When the European market opens, some economic data will be released such as Trade Balance and Italian Trade Balance. The US will also publish the economic data such as TIC Long-Term Purchases, Prelim UoM Inflation Expectations, Prelim UoM Consumer Sentiment, Industrial Production m/m, Capacity Utilization Rate, Import Prices m/m, and Empire State Manufacturing Index, so amid the reports, the EUR/USD pair will move with a low to a medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1346.

Strong Resistance: 1.1340.

Original Resistance: 1.1329.

Inner Sell Area: 1.1318.

Target Inner Area: 1.1292.

Inner Buy Area: 1.1266.

Original Support: 1.1255.

Strong Support: 1.1244.

Breakout SELL Level: 1.1238.

Analysis are provided byInstaForex.

-

18-02-2019, 06:36 AM #2719

Technical analysis: Intraday Level For EUR/USD, Feb 18, 2019

Today, when the European and the US markets open, no economic data will be released. So amid this condition, the EUR/USD pair will probably move with a low volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1346.

Strong Resistance: 1.1340.

Original Resistance: 1.1329.

Inner Sell Area: 1.1318.

Target Inner Area: 1.1292.

Inner Buy Area: 1.1266.

Original Support: 1.1255.

Strong Support: 1.1244.

Breakout SELL Level: 1.1238.

Analysis are provided byInstaForex.

-

19-02-2019, 06:20 AM #2720

EUR/USD: the next resistance level is 1.1370

The dollar index goes down, while the euro rises in price for almost all currency pairs: the first trading day of the week continued the trend from Friday, when the EUR/USD pair rebounded from the annual low and restored all lost positions. Today, the downward price dynamics have continued.

The main driving force behind the EUR/USD's price growth is the news background on the prospects for trade relations between the US and China. Let me remind you that this week the parties will resume the negotiation process, which may culminate in the conclusion of a "truce" between the two countries. To be more precise, the parties can only come to a framework agreement, where only the main positions of the future document will be indicated. This "letter of intent" will form the basis of a future deal, the details of which will be discussed between the leaders of the People's Republic of China and the United States during a personal meeting.

Over the weekend, Donald Trump said that "great progress" had already been made on the issue of concluding a trade deal, and he is optimistic about the prospects for the upcoming talks. A similar position was voiced by the leader of China Xi Jinping. According to him, the parties managed to achieve significant success in resolving trade disputes. In unison with their leaders, the negotiations and high-ranking officials, in particular, the US Treasury Secretary, the US Trade Representative, and the Vice-Premier of the State Council of the People's Republic of China, Liu He, appreciated the negotiations.

Such optimism was reflected in market sentiment. The US dollar, which is usually in demand against the backdrop of increasing global problems, began to actively slow down. The dollar index moved away from local highs in the area of 96.9, not finding the strength to test the 97th figure. And although the decline in this indicator is fairly smooth, the causal link is obvious: the closer Beijing and Washington are to the deal, the weaker the position of dollar bulls.

However, the EUR/USD did not increase only because of this factor. The Brexit theme also concerns traders of the pair, given the approaching deadline. It is worth noting that the news flow regarding the prospects of the "divorce process" does not always affect the pair (unlike the pound, where this topic is in indisputable priority). The single currency reacts to Brexit news mainly when the parties closely approach the red lines of the negotiation process. This week Theresa May will hold talks with the EU leadership (in particular, with Juncker) and with the leaders of the EU countries.

The central issue is the regime of the Irish border, namely, the mechanism of the backstop, which is the main irritating factor for the majority of British deputies. During the weekend there were rumors that the representatives of France offered Brussels to make some certain concessions on this issue, so that the negotiations would move from a dead point. Although journalists later denied this information, traders are still optimistic about the future, in the hope of a long-awaited compromise on the backstop issue. The European currency follows the pound, although at the moment there are no significant reasons for the price increase: there are a lot of rumors around the upcoming talks, which sometimes contradict each other.

In such circumstances, it is impossible to make any clear predictions, so this fundamental factor can not be called reliable. By the way, a UK government spokesman said today that following a European voyage by the prime minister, the Cabinet could change the terms of the deal or even delay Brexit. This suggests that London doubts that Theresa May will be able to convince her colleagues that the terms of the deal need to be revised. But traders are still inclined to believe optimistic rumors, so both the pound and the euro show a positive trend.

The Bundesbank report published today also provided indirect support to the EUR/USD pair. Recently, news from Germany does not please investors: economists of the German government revised the forecast of GDP growth downwards, and macroeconomic indicators for December and January were released in the "red zone".

The report of the German central bank also acknowledged the slowdown of the main parameters of the national economy. But at the same time, members of the regulators stressed that they did not observe any signs that a slowdown in GDP growth would turn into a decline in the economy. Such an unexpected conclusion was supported by the European currency, especially against the background of Monday's nearly empty economic calendar. During the European session, the Bundesbank report became the only more or less significant source of news, while the American sites are closed today on the occasion of the celebration of Presidents Day.

Thus, the euro-dollar pair has the potential for further correctional growth: today, the price tested the first resistance level of 1.1340 (the Tenkan-sen line on the daily chart). If the pair bulls overcome this barrier, they will approach a stronger level - 1.1370 (the middle line of the Bollinger Bands on the same timeframe).

Analysis are provided byInstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote