British Triangle: Tory, Whigs and Theresa May

Tonight (at about 15:30 London time) Theresa May will again try to convince the British Parliament to support her deal with Brussels. In anticipation of this event, the pound is behaving extremely cautious after a significant decline on Friday. At the end of last week, the pound slumped in a matter of hours by more than a hundred points, as the initial optimism was replaced by habitual pessimism. Today, the mood of traders has not improved: judging by the rhetoric of May's entourage, she does not intend to postpone Brexit's term, not excluding the "hard" scenario.

A new vote on the updated version of the agreement with the European Union will be held in the House of Commons on January 29. But here it is worth noting that the British can demonstrate increased volatility today, that is, until the key moment of the vote. The fact is that many market participants are worried that the government will only make superficial changes to the original version of the agreement, keeping the key points unchanged. Such fears are logically justified - for several days it is simply impossible to prepare an alternative deal, eliminating the positions agreed with the EU. This means that the transaction will retain its design, and all changes will be only of a formal nature.

According to most experts, Theresa May will present a new version of the resolution of the Irish border problem today. This issue is the main stumbling block that impedes the approval of the transaction. Having enlisted the support of the deputies, she will actually go to Brussels with an ultimatum: either the European Union will make concessions, or Brexit will follow the "hard" scenario, without concluding a deal. That is why May categorically rejects the option of postponing Brexit date - in this case, the whole point of the ultimatum of negotiations is lost.

According to available information, the British prime minister will propose to conclude a separate agreement between Britain and Ireland. In this document, the parties will fix the details and terms of the special border regime with Northern Ireland. By and large, we are talking about those legal guarantees from the EU, which have been talked about for so long in the British parliament. It is quite probable that the deputies of the House of Commons will support this scenario - however, it is absolutely impossible to count on the same support from Brussels. First, the Europeans initially stated that they would not revise the agreement reached. Secondly, the idea of London to conclude a bilateral agreement on the border has already been rejected by Ireland.

Therefore, even if the British deputies today support the above proposal of May, the pound can ignore this fact or even react with a decline - after all, this scenario is not viable, given the position of Brussels and Dublin.

But if the House of Commons supports the idea of extending the 50th article of the Lisbon Treaty, then the British currency can demonstrate a strong enough northern impulse. And although the Theresa May government is categorically against this option, this does not mean that it cannot be realized. The previous polls suggest that the prime minister's opponents can, in a fit of unity, take the necessary decisions, regardless of party affiliation.

For example, not only Labour, but some Conservatives also voted for amendments to tax legislation. More than 100 Conservatives voted against the original deal, in unison with the Labour Party. And this is not a complete list of situations when representatives of the Tories find agreement with representatives of Whigs And in this case, they can also vote in harmony, trying, on the one hand, to avoid the chaotic Brexit, and on the other hand, to force May to return to the negotiating table with Brussels.

There is one more scenario, in which the Parliament will gain control over the negotiation process. However, in the context of today, this scenario is unlikely - they can return to it in case of a failed vote on January 29.

Thus, today's statement by the prime minister in the British Parliament will not be formal. Moreover, the presented "Plan B" will make it possible to understand in what direction the subsequent events will develop - either the prime minister will rely on Brussels, or will nevertheless try to convince her party members.

In any case, Brexit continues to be the number one topic for the GBP/USD pair, so you should not focus on the release of tomorrow's data on the growth of the labor market in Britain. Published figures may provide temporary support for the pound (forecasts are mostly optimistic), but the initial reaction may be a trap. Representatives of the Bank of England have repeatedly stated that the prospects of monetary policy directly depend on the prospects of the "divorce process", so macroeconomic data in this context play a secondary role.

Analysis are provided byInstaForex.

Please visit our sponsors

Results 2,701 to 2,710 of 4086

Thread: InstaForex Wave Analysis

-

22-01-2019, 06:06 AM #2701

-

23-01-2019, 05:11 AM #2702

A preview of the January meeting of the Bank of Japan

Tomorrow, the Bank of Japan will hold its first meeting this year. Traditionally, investors do not expect the Japanese regulator to take any action on the parameters of monetary policy: the central bank will continue to purchase bonds for 80 trillion yen a year, the interest rate on deposits will remain at the level of -0.1%, and the target yield of 10-year government bonds-at about 0%. There are no prerequisites for any radical actions on the part of the central bank now, so the main attention of traders will be focused on the press conference of Haruhiko Kuroda.

Here it is worth recalling that since the summer of last year, a form of "sword of Damocles" hangs over the yen. The fact is that then the Japanese central bank expanded the range of the estimated rate, thus admitting the likelihood of monetary policy easing. And although since then Kuroda has not voiced such intentions on a practical plane ("scaring" only traders with a hypothetical probability), this fact has a background pressure on the yen. It is obvious that the regulator has reserved this scenario for the future, if inflation trends become negative. And given the weak growth rates of wages and inflation, now there is every reason for concern: at the January meeting, traders may well hear hints of a possible reduction in the interest rate to -0.2%.

The fact is that consumer prices excluding the cost of fresh food (this is the main indicator of inflation monitored by the Japanese regulator) in December fell to 7-month lows, continuing a consistent decline. Thus, the Core Inflation Rate in September-October was kept at the level of 1%, while in November it decreased to 0.9%, and in December - to 0.7%. At each meeting, Haruhiko Kuroda recalls that inflation remains below the two-percent target, and achieving it "requires a larger time range than previously thought". However, in this case, it can respond to the current negative trend with sharper wording of the "dovish" character.

Weak growth rates of consumer spending against the background of the decline in the oil market have created fertile ground for reducing inflation. Although oil prices showed positive dynamics during the last month, this is clearly not enough to reverse the situation as a whole. Therefore, tomorrow Kuroda can voice soft rhetoric, thereby exerting pressure on the national currency.

Another intrigue of the January meeting of the Bank of Japan is the possible expansion of the range of fluctuations in yield on 10-year government bonds. According to some experts, the regulator will allow a decrease in profitability in the negative area. Let me remind you that last summer the Japanese central bank decided to limit the fluctuations in yield in the range of -0.2% to + 0.2%. The minutes of the last meeting showed that one of the members of the regulator proposed to expand this range, arguing that the stagnation in this issue will neutralize the positive effect of soft monetary policy in the context of inflation expectations. However, there is no unambiguous position on this issue among the members of the regulator: the members of the Board of Governors of the Bank of Japan disagreed, de facto keeping the parameters of monetary policy at the same values.

What to expect from Haruhiko Kuroda following the results of tomorrow's meeting? First, a "dovish" rhetoric. And although the market has long been accustomed to the soft position of the head of the Japanese central bank, tomorrow it may still surprise the market if it allows an interest rate reduction in the foreseeable future. Second, the regulator may lower its forecast for inflation and GDP growth this year. The probability of such a step is quite high, given the recent inflation trends. Thirdly, Kuroda can comment on the issue of a possible expansion of the yield fluctuation range on 10-year government bonds.

The rhetoric of the head of the Bank of Japan can put significant pressure on the yen, especially if it goes beyond the usual theses (and there are prerequisites for this). In this case, the USD/JPY pair can demonstrate a pulse growth to the first resistance level of 111.05 – this is the upper line of the Bollinger Bands indicator on the daily chart.

In general, from a technical point of view, the Ichimoku Kinko Hyo indicator currently demonstrates one of its strongest signals, the Golden Cross, in which the price fixed above the crossed lines of Tenkan-sen and Kijun-sen, while the Kumo cloud is still above the price chart . This signal indicates the upward direction of the pair. Also, the upward movement is confirmed by the location of the price between the middle and upper lines of the Bollinger Bands indicator, which began to narrow its channel. The support level is the Tenkan-sen line, which corresponds to 108.80. And the resistance level is the upper line of the Bollinger Bands indicator - the price is 111.05.

Analysis are provided byInstaForex.

-

24-01-2019, 05:06 AM #2703

The January meeting of the ECB: too dovish expectations may bring down the bears of EUR/USD

The euro/dollar pair this week shows almost no signs of life: any attempts to grow or decline are stopped at the root. The 14 figure is not available to the EUR/USD bulls, and the bears cannot hold the pair below the 1.1350 mark. Everyone is waiting for the main event of this week – the January meeting of the ECB, which will take place tomorrow. Mario Draghi will either knock out the single currency or give it a chance for a corrective recovery. Despite the general negative attitude, both options have a chance to live - to one degree or another.

The vast majority of experts are confident that the ECB head will take a very soft position tomorrow, given his previous rhetoric and the decline in key macroeconomic indicators. Indeed, last week, Draghi said that the incoming data is weaker than the ECB forecasts, and this fact confirms the feasibility of the accommodation policy. These words came amid the release of German data, which showed a slowdown in Germany's largest economy.

Thus, the German GDP index last year grew by only 1.5% - this is the weakest result in the last five years. For comparison - in 2017, this indicator was released at the level of 2.2%. Here again, we can talk about the echoes of the US-China trade war, since China is one of the main trading partners of Germany. Therefore, following the economy of China, the German economy is also declining. According to experts, the slowdown in Europe's largest economy will inevitably affect the growth dynamics in the rest of the EU countries and the eurozone as a whole.

Mario Draghi during his press conference may focus on this fact, especially against the background of slowing inflation and GDP in the eurozone. But in my opinion, the situation is not as critical as many try to present it. Indeed, despite the difficult conditions and the ongoing trade conflict between China and the United States, the German economy was able to avoid a technical recession and showed weak, but still growth. Of course, Draghi, in the course of his communication with journalists, may recall Germany in a negative context, but the text of the accompanying statement will surely contain a statement about balanced risks (and this is much more important for traders).

In general, too "dovish" expectations may bring down the bears of EUR/USD/. At the moment, the market does not expect any "hawkish" hints from Draghi - the general opinion is that the interest rate will not be increased until 2020, and this year the program of long-term financing will be resumed. The previous TLTRO program ends in the middle of next year, however, the banking sector will already need liquidity this year. As the minutes of the last meeting of the ECB showed, regulators raised this topic in December, so tomorrow Draghi can make clearer comments on this issue.

As for the prospects of interest rates, here Mario Draghi is unlikely to take a clear position. At the moment, there are too many uncertain factors that do not make it possible to talk about long-term prospects - neither in the context of "for", nor in the context of "against". Brexit, trade negotiations between Beijing and Washington, prospects for the Chinese/world economy, elections to the European Parliament, the dynamics of the oil market and ultimately the level of domestic consumer demand — these circumstances will not allow Draghi to think too far, assessing the possibility of tightening monetary policy. Most likely, he will disguise his answer with vague phrases that monetary policy will depend on incoming data, and it is not advisable to talk about this earlier this fall, given the trend of incoming data. By the way, such a position can play into the hands of EUR/USD bulls, as it does not exclude an increase in the interest rate in the framework of the current year, while the market has already "put up with" the reference point for 2020.

Thus, the totality of macroeconomic factors suggests that the regulator tomorrow will take a soft, but very "obscure" position. The ECB probably will not talk about shifting risk balances, keeping a waiting position until the next meeting, which will be held in March. In my opinion, the market is now too "twisted" by the fact that Draghi will voice too pessimistic estimates - if these expectations are not met, the European currency can get quite strong support.

In technical standpoint, the situation is as follows. The EUR/USD bulls need to break the mark of 1.1440 to confirm their dominance. In this case, the Ichimoku Kinko Hyo indicator will generate a bullish Parade of Lines signal, which will open the way to the top line of the Bollinger Bands indicator - the mark of 1.1525. The support level is at 1.1310 - this is the bottom line of the Bollinger Bands on the daily chart.

Analysis are provided byInstaForex.

-

25-01-2019, 05:38 AM #2704

ECB meeting: the bearish triumph did not work, but buying EURUSD is risky

Trading "on the news" is extremely risky - today traders could once again see this. The January meeting of the ECB turned out to be very intense, but the expected "bear triumph" turned out to be an illusion or, more simply, a trap.

The initial decline in EUR/USD to the bottom of the 13th figure was very reasonable. Mario Draghi began his press conference with a series of negative comments that did not bode well for the pair's bulls. First, he reiterated that the latest macroeconomic data turned out to be much weaker than the ECB's preliminary forecasts and in the short term this trend will continue. In his opinion, the root cause of such a dynamic is a decrease in external demand in the EU countries. First of all, of course, we are talking about Germany, which showed in last year's lowest growth of the economy over the last 5 years.

Secondly, Draghi recalled that the European Central Bank "has all the necessary tools" for regulating monetary policy and, if necessary, the central bank uses them. What kind of levers of influence are we talking about, the head of the ECB did not elaborate, however, even without this nuance, it became clear that if the downward dynamic of inflation continues, the regulator will apply retaliatory measures to soften its policies.

Third, Mario Draghi was rather pessimistic about Brexit's prospects. In his opinion, the uncertainty in this issue is growing, and the negative factors associated with the "divorce process" only exacerbate the difficult situation in the eurozone economy. "If the factors continue their impact, the economy will show a weakening over a longer period of time," said the ECB head. This is a fairly transparent allusion to the upcoming events to be held in the British Parliament next week. If the parties do not find mutual understanding and do not approve the deal, the uncertainty will have a negative impact on both the European economy and the British one.

Such a portion of the "dovish" comments pulled the EUR/USD to the mark of 1.1307, thereby attracting bears. However, literally in a few minutes the situation changed radically. During the question and answer period, Draghi not only offset the "dovish" mood, but also provoked a demand for a single currency throughout the market. First of all, the head of the ECB said that at the moment there are no grounds for implementing the next TLTRO program. According to him, this issue was discussed at the meeting, but no decision was made on it, and in general this topic requires a "good justification".

It should be noted that TLTRO is perceived by the market as one of the tools to mitigate monetary policy, so this position of Draghi played into the hands of the European currency. Although many experts warned that members of the regulator were still discussing the possibility of a new round of long-term lending programs in December. The previous TLTRO program ends in mid-2020, however, according to some economists, the banking sector may already need liquidity this year. Nevertheless, the central bank is not in a hurry with this issue, and this fact has supported the bulls of EUR/USD.

Afterwards, Mario Draghi made quite optimistic assessments in contrast to his initial statements. In his opinion, the growth rate of core inflation will accelerate in the medium term, given the positive dynamics of wages in the eurozone and the ECB accommodative policy. By the way, Draghi emphasized that in some EU countries full employment has been achieved, and the labor market continues to strengthen steadily. In addition, members of the regulator at the January meeting came to the unanimous opinion that the probability of a recession in the eurozone countries is close to zero. This thesis is consistent with the assessment of the prospects for the Chinese economy - according to "some members of the ECB" (Draghi did not specify exactly who we are talking about), the decline in the PRC economy will not last long, as "Beijing responds to all risks in a timely manner."

The final chord of the January meeting was the question of the prospects of the interest rate. Here Mario Draghi said that traders are laying in the current price of the first increase in early 2020: "...and this suggests that the markets understood us correctly," he added. However, the ECB at the end of the meeting said that it is not going to raise the rate "until the end of summer". And although the market did not receive a clear answer to the question – whether the rates will be changed within the current year – EUR/USD bears could not take advantage of this fact. Too "dovish" expectations of traders did not materialize, so they began to buy back the pair when approaching the bottom of the 13th figure.

In summary, it should be noted that now we should be especially careful with long positions on the EUR/USD pair. First, the dollar received support from the manufacturing PMI. Secondly, the demand for the US currency may increase due to ambiguous news about the US-China trade negotiations. Representatives of Beijing and Washington voice opposite theses – but if the risk of another failure increases, the dollar will rise in price throughout the market, and the EUR/USD pair will not be an exception.

Analysis are provided byInstaForex.

-

28-01-2019, 06:58 AM #2705

USD/JPY Approaching Support, Prepare For Bounce

The USD/JPY pair is approaching its support at 109.16 (61.8% Fibonacci extension, 38.2% Fibonacci retracement, horizontal overlap support) where it could potentially bounce to its resistance at 109.66 (61.8% Fibonacci retracement).

Stochastic (55, 5, 3) is nearing its support at 7.6% where a corresponding bounce could occur.

USD/JPY is approaching its support where we expect to see a bounce.

Buy above 109.16. Stop loss at 108.84. Take profit at 109.66.

Analysis are provided byInstaForex.

-

29-01-2019, 05:15 AM #2706

EUR/USD. The shutdown completed – but the dollar is no better

Late Friday night, the House of Representatives of the U.S. Congress unanimously supported the adoption of the provisional budget, and within hours, the US president signed a bill to stop the shutdown. However, they didn't put an end to this issue - this is a temporary "truce" that will last until February 15. During this time, congressmen and the White House must find a compromise on the allocation of additional funds for the construction of the wall on the border with Mexico. To date, this issue has remained in limbo.

The US currency actually ignored these events: the dollar index shows minimal growth, remaining within 95 points. Similarly, the euro/dollar pair behaves, which, although it has not conquered the 14th figure, but with enviable persistence, has been besieging this level for more than a week. Dollar bulls are still unable to reverse the situation on the pair due to the remaining problems.

According to American political analysts, it will be extremely difficult for the parties to find a common denominator in the migration issue, as Trump offers an unequal exchange: he promises to soften his position in the legislative field, while in return he requires $5 billion for the construction of the notorious wall. Therefore, with a certain probability we can say that the shutdown may have a relapse, especially in February, Republicans and Democrats will start another political battle – this time about the limit of public debt of the country.

The single currency is also under the burden of its problems – the data published last week from ZEW and IFO eloquently demonstrated the slowdown of key economic indicators in Europe, including Germany. ECB head Mario Draghi also did not present any surprises, keeping the "dovish" position on the prospects of monetary policy. After the January meeting of the regulator, the pair did not collapse just because traders expected softer rhetoric from the Draghi. However, he kept a certain balance, optimistic about the prospects for inflation in the eurozone. Therefore, instead of the expected fall, the EUR/USD pair showed an unexpected growth, however, the 14th figure was again too tough for bulls.

All this suggests that the tone of trading on the pair is set by the dollar, which, in turn, focuses on the political climate in the US, the position of the Federal Reserve and the US-China trade negotiations. All these factors, unfortunately, are now opposed to the US currency. The shutdown is only suspended for three weeks, while Republicans and Democrats are not ready to make concessions to each other. Do not forget that next November presidential elections will be held in the United States, so all the events taking place in Washington should be considered in this aspect as well.

The record for the duration of the shutdown strongly hit on the electoral positions of Trump - and the Democrats simply could not fail to draw the appropriate conclusions. Therefore, with a high degree of probability we can say that political conflicts will continue to shake the United States. By the way, at the end of last week, the former political adviser to the American president Roger Stone was arrested: he is accused, in particular, of putting pressure on witnesses, obstructing justice and giving false testimony (total of 7 counts). Since this is the sixth arrested adviser to Trump (though with the prefix "ex"), the American press started talking about the fact that the results of the investigation of US Special Prosecutor Robert Mueller can "hurt" the positions of the head of state.

As for the prospects of monetary policy, there is also no reason for optimism. First, many representatives of the Fed recently almost in unison stated that the regulator can "be patient" this year. It is expected that at the January Fed meeting Jerome Powell will confirm these "dovish" intentions. In addition, according to the American press, the US central bank plans to accelerate the process of reducing its balance sheet. This factor also has a background pressure of the greenback, considering all other circumstances.

The US-China conflict has also stopped fueling dollar growth, despite conflicting rumors about the failure of the negotiation process. So, representatives of Washington last week said that the parties are" too far " from progress. Earlier in the media, information emerged that the negotiations "stalled": the stumbling block was the issue of protecting the intellectual property of American companies. But against all odds, trade talks will resume again this week – this time in Washington. This news reduced the demand for defensive tools, including the US dollar.

Thus, the US currency is still under some pressure, which may increase following the results of the January Fed meeting. The events of the weekend did not change the general fundamental alignment of the pair, forcing traders to maintain a cautious position. The single currency, in turn, also has no arguments for growth, especially given tomorrow's Brexit vote. Thus, the EUR/USD pair is likely to fluctuate in the flat, waiting for powerful news drivers.

Analysis are provided byInstaForex.

-

30-01-2019, 05:13 AM #2707

January Fed meeting: what to expect and what to fear

Tomorrow is an important day for the dollar: we will learn not only the data on the growth of the US economy, but also listen to the head of the Federal Reserve, who will sum up the January meeting of the central bank. This year, Jerome Powell will hold press conferences after each meeting (rather than 4 times a year, as it was before), so traders will be able to get more coherent information about the sentiments of members of the Federal Reserve.

However, at the moment the situation is quite unambiguous. Now, Fed officials observe a 10-day regime of silence on the eve of the next meeting, but until that moment their rhetoric was exclusively "dovish" in character, to one degree or another. In particular, the head of the Federal Reserve Bank of Boston, Eric Rosengren, who for a long time was a consistent hawk, suddenly announced that at the moment there are "potential threats" to tighten monetary policy, given the incoming signals from the markets. His colleague James Bullard, who also has the right to vote this year, again stated that the stakes are now "at an acceptable level" and there is no need to adjust them. The break in the rate increase was also supported by Esther George (he has the right to vote), who was rightly called the "main hawk of the Fed." According to her, the regulator must be patient in raising the rates, "to avoid overheating and prolong the growth of the economy."

Another Fed official, Charles Evans, is concerned about the slowdown in inflation. According to him, now there are no signs that core inflation will cross the 2% target level, so it is not necessary to rush into tightening monetary policy. But at the beginning of this year, Raphael Bostic implied a probability of easing monetary policy. However, he then somewhat adjusted his position (speaking for a smooth rise in the rate to a neutral level), but his initial statement fits very well into the outline of the general sentiments of the members of the regulator.

Given this soft rhetoric, traders do not expect any "hawkish" surprises from the Fed. According to some experts, the probability of a rate increase until June of this year is only 19%. According to estimates by another group of analysts, the regulator will take a wait-and-see position at least until January next year.

On the one hand, the market has already taken into account in current prices a likely dovish Fed meeting. But on the other hand, a certain intrigue of the January meeting remains. We are talking about reducing the rate of folding the Fed's balance sheet. This issue is discussed at the level of rumors, as representatives of the regulator practically do not comment on the perspectives of this aspect. According to many experts, the reduction of the portfolio will be one of the main causes of volatility for the EUR/USD pair, exerting a strong downward pressure on the dollar.

Let me remind you that the Fed began to reduce the volume of investments by Janet Yellen - at that time this volume was 4.5 trillion dollars. Their reduction began with a "modest" $10 billion, then this figure rose to 50. This fact is a strong source of irritation for Donald Trump, who is in favor of both reducing the rate of monetary tightening and early completion of the balance reduction program. And although the Federal Reserve declares its independence from the White House on a public plane, de facto, the regulator still listens to Trump's "wishes". It should immediately be noted that the Fed is unlikely to announce the suspension of the balance reduction - but it may hint at a decrease in its pace.

So, according to the American press, the regulator is ready to state that in the end it will keep more securities in its portfolio than previously planned. However, insider sources disagreed as to whether it will be announced at the January meeting or at the next one, which will be held in March. The fact is that because of the shutdown, many key macroeconomic indicators will be published after the January meeting, so the Federal Reserve can wait a bit with loud statements, assessing the situation in the country's economy. Therefore, the intrigue in this matter remains, putting pressure on the dollar. If concerns about the Fed's balance sheet are not justified at this time, the greenback can receive significant support, even if the prospects for a rate hike remain questionable.

Now a few words about macroeconomic statistics. Tomorrow, a preliminary estimate of US GDP growth for the 4th quarter of last year will be published. According to the general forecast, the indicator will significantly decrease to 2.6%. In the second and fourth quarters, this indicator came out at 4.2% and 3.4%, respectively. The price index of GDP should also show a negative trend - up to 1.7%.

On the one hand, all the attention of the market tomorrow will be focused on the outcome of the January Fed meeting. But if the worst fears of investors are realized, then the fact that the American economy slows down will play the role of the "last drop", pulling down the dollar throughout the market. The nearest upward target of the euro/dollar pair is at the level of 1.1525 - this is the top line of the Bollinger Bands indicator on the daily chart. The support level is the price of 1.1380 - the lower boundary of the Kumo cloud.

Analysis are provided byInstaForex.

-

31-01-2019, 07:53 AM #2708

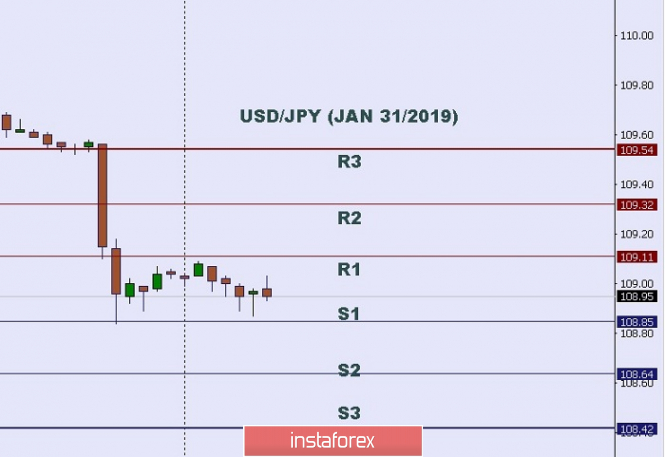

Intraday level for USD/JPY, Jan 31, 2019

In Asia, Japan will release the Housing Starts y/y, and Prelim Industria lProduction m/m and the US will also publish some economic data such as Natural Gas Storage, Chicago PMI, Unemployment Claims, Unemployment Claims, Personal Income m/m, Personal Spending m/m, Employment CostIndex q/q, Core PCE Price Index m/m, and Challenger Job Cuts y/y. So there is a probability the USD/JPY pair will move with a low to a medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Resistance. 3: 109.54.

Resistance. 2: 109.32.

Resistance. 1: 109.11.

Support. 1: 108.85.

Support. 2: 108.64.

Support. 3: 108.42.

(Disclaimer) *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

01-02-2019, 04:47 AM #2709

USD/CAD. The loonie ignored a weak GDP, but is waiting for news from China

Canadian economic growth slowed again: on a monthly basis, GDP fell to a negative area and reached -0.1% in November. In annual terms, the indicator also fell, however, was still in the "green zone": with a growth forecast of 1.6%, the indicator rose to 1.7%, while in October the growth was more significant – 2.2%.

In response to this release, the USD/CAD pair moved away from annual lows (that is, from the level of 1,3119), but the further upward dynamics was questionable. The "loonie" remains in the area of multi-month lows - the last time the pair was at the bottom of the 31st figure in November last year. If we ignore the intraday dynamics, we can say that traders actually ignored today's release, focusing on other fundamental factors.

This reaction is explained quite simply: the market was ready to slow down the Canadian economy – this was said by many experts, this was warned by the head of the Bank of Canada at the end of the last meeting. In monthly terms, the indicator fully coincided with the forecast, and in annual terms – slightly exceeded pessimistic expectations. Therefore, against the background of other events, this release did not act as a catalyst for volatility on the pair – traders showed only a formal reaction, which is unlikely to have any significant continuation.

The limiting factor was the oil, which again went up after the announcement of the results of the January Fed meeting. A barrel of Brent crude oil is now trading around 62 dollars, showing a positive trend. And the weak US dollar cannot afford to seize the initiative in the USD/CAD pair: in my opinion, the market has not fully realized the negative consequences of yesterday's meeting of the Federal Reserve. By and large, the regulator has announced a protracted pause in raising interest rates – and no one knows how long this period will be.

According to most analysts, if the key indicators of US inflation continue to show vague dynamics, the regulator may "be patient" until next year. However, even the most optimistic scenarios assume one rate hike - approximately in October or December of the current year. Therefore, the large-scale growth of the USD/CAD pair can be caused either by a significant weakening of the Canadian dollar, or by the failure of the US-China trade negotiations.

As for "internal" factors, the USD/CAD bulls have nothing to count on. On the one hand, at its January meeting, the Bank of Canada lowered its forecasts for the growth of the country's economy in 2019 (from 2.1% to 1.7%). But, on the other hand, it retained a "hawkish" attitude, to talk about their future plans. The head of the Central Bank, Stephen Poloz, said that the interest rate should eventually grow to a neutral value so that the inflation rate would be in the "necessary range." Given the fact that the latest data on GDP growth came out at a predictable level, the Canadian regulator is unlikely to change its position on this issue. The only question is when exactly the Central Bank will decide on another round of rate increase.

The next meeting of the central bank is scheduled for March 6, while most experts are inclined to believe that the rate will be raised at the April meeting (April 24). By and large, the monthly time gap does not play any role in this context, especially since the market expects another rate increase before the end of this year. In other words, the Canadian regulator is still heading for the normalization of monetary credit policy, in contrast to the Federal Reserve, which yesterday announced a pause in this matter.

Thus, internal fundamental factors will not be able to reverse the downward trend for the USD/CAD pair. But the situation with the external fundamental background looks a bit more complicated. Indeed, oil quotes are rising - the cost of Brent and WTI has increased by almost 20% since the beginning of the year, giving support to commodity currencies. However, the shadow of the trade war puts pressure on traders - if the current negotiation process ends in failure, the oil quotes will go down and the dollar, on the contrary, will gain momentum using the status of a safe-haven asset.

[IMG]https://lh3.googleusercontent.com/Dbl0ffwpfpvHhIkfm7yZiM73RhYG6bP0N0tQqvr34Nj_mo0mOf pBpv1ctaOZugbjvKWK_6ZtMSz5W6T8PV_xRaKELJAKGOt6tSU6 WQ8nGvzHYbbF3-kNBWg0CiKM0L8W0jaKsK_T[IMG]

At the moment there is no unambiguous information about the two-day negotiations. Trump, using his usual way of communication - Twitter - stated that "good intentions and a positive attitude are felt on both sides". He also confirmed that he will meet with the head of the Chinese delegation in the Oval Office today. But then he somewhat tightened his tone, causing a certain alarm in the markets.

First, he stated that a deal could be concluded only after a personal meeting with Xi Jinping, since he needed to discuss "difficult issues" with him. Secondly, Trump delivered a new ultimatum: he said that China should open its markets not only to financial companies, but also to companies in the industrial, agricultural and other sectors. Beijing has not yet responded to these statements - it is likely that the reaction will follow after the return of the Chinese delegation to their homeland. But in general, the situation remains "in the balance": if the parties fail in negotiations, as early as March 1, the trade war will begin with a new force, and the US dollar will receive a reason for its growth.

That is why the expediency of short positions on the USD.CAD pair depends on the outcome of the US-China negotiations. If, in spite of everything, the parties parted on a positive note, the downward impulse of the loonie can be continued with the first target at around 1.3060 (the upper limit of the Kumo cloud on the weekly chart).

Analysis are provided byInstaForex.

-

04-02-2019, 06:52 AM #2710

NZD/USD Approaching Support, Prepare For Bounce

NZD/USD is approaching its support at 0.6860 (61.8% Fibonacci extension, 23.6% Fibonacci retracement, horizontal pullback support) where it could potentially bounce to its resistance at 0.6936 (horizontal swing high resistance).

Stochastic (55, 5, 3) is nearing its support at 1.65% where a corresponding bounce could occur.

NZD/USD is approaching its support where we expect to see a bounce.

Buy above 0.6860. Stop loss at 0.6796. Take profit at 0.6936.

Analysis are provided byInstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote