Market updates on June 11

More at: http://bit.ly/2X9R8gT

11.06.2019

On Tuesday, the improved market sentiment supported risky assets such as stocks, emerging-market currencies, and crude oil.

Oil benchmarks have been trying to recover on the improved market sentiment. Talks that OPEC and its allies would continue its program of oil output cuts supported the oil market. However, the effect was limited. WTI moved up but with small gains. Up to now, the oil benchmark has been trading near 53.60. The resistance is located at 54.48. However, the downward pressure is high. If the benchmark is not able to break above 54.48. We will see a decline to 51.70. Brent rose less than WTI. The benchmark reached a high at 62.86. However, bears were stronger and Brent moved down. The support is located at 60.60.

The Chinese yuan succeeds to appreciate against the USD. On Friday, USD/CNH reached the highest level of the year at 6.9613. However, the improved sentiment encouraged Chinese currency. Up to now, the pair has been trading near 6.9242 moving to the support at 6.9165. A close below this level will lead to the further appreciation of the CNH. The next level to touch is 6.90. In the case of risk aversion, USD/CNH will turn around and will move towards 6.9470 targeting the top near 6.9614.

The Mexican peso keeps gaining strength against the US dollar. USD/MXN has been moving down for the 3 days in a row. If bears manage to pull the pair below 50-day simple MA at 19.08, we will see a further decline to 19.02. If the pair rebounds, we may anticipate a rise towards 19.24. The next resistance is at 19.3120.

Please visit our sponsors

Results 161 to 170 of 370

Thread: Forex daily News FBS

-

12-06-2019, 10:00 PM #161Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

-

12-06-2019, 10:16 PM #162Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Risk management

http://bit.ly/2F4MUg8

Risk management is the key element of Forex trading. It’s better to understand this simple fact rather sooner than later and put a lot of efforts into mastering this science. By definition, risk management is the identification, analysis, assessment, control, and avoidance, minimization, or elimination of unacceptable risks. The risk that exists for Forex traders is simple to understand: it’s the ever-present risk of a bad trade that is closed with a loss.

--------------------------------------------------------------------------

-

13-06-2019, 03:34 PM #163Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

MARKET UPDATES

More at: http://bit.ly/2F7PiTz

13.06.2019

The Australian dollar weakened because of the bigger-than-expected unemployment rate figure. On H4, AUD/USD has been targeting the first support at 0.69. A close below this level will provoke a further decline to 0.6870 with a test of 0.6887. RSI and Stochastic Oscillators are in the oversold area, the rise of the pair will be confirmed as soon as RSI crosses the 30 level bottom up and Stochastic oscillator crosses the signal line. In the case of the rebound, the important resistance is located at 0.6933.

The Swiss franc rose on the Swiss National Bank statement. Although, the central bank kept the interest rate on hold and didn’t provide any hints on a soon increase, comments about the possible weakness of the euro and the USD supported the Swiss currency. As a result, USD/CHF fell. On H4, the pair reached the support at 0.9921 (50-period MA) but rebounded. The first resistance is located at 0.9956, a break above this level will signal a continuation of the upward movement. However, the resistance is strong and we may see a re-test of 0.9921. A break below this level will lift risks of the decline to 0.9888.

Brent has risen significantly after news about oil tankers being attacked in the Gulf of Oman. Up to now, the oil benchmark has been moving to the first resistance at 63.73 with a test of 63.

-

17-06-2019, 01:04 PM #164Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Heads up to the FOMC statement

Read at: http://bit.ly/2KV8WFT

17.06.2019

The Federal Open Market Committee will make its statement and announce the official rate on June 19, at 21:00 MT time.

Despite the demands by US President Donald Trump to cut the interest rate, no changes to it are expected. Now, policymakers keep the interest rate at 2.5%. However, we may find out the hints on the possibility of a rate cut later this year. Wednesday’s statement will show how the US-China trade war and recent weaker economic data affect the Fed decisions.

• If the Fed is hawkish, the USD will go up;

• If the Fed is dovish, the USD will go down.

-

18-06-2019, 03:56 PM #165Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

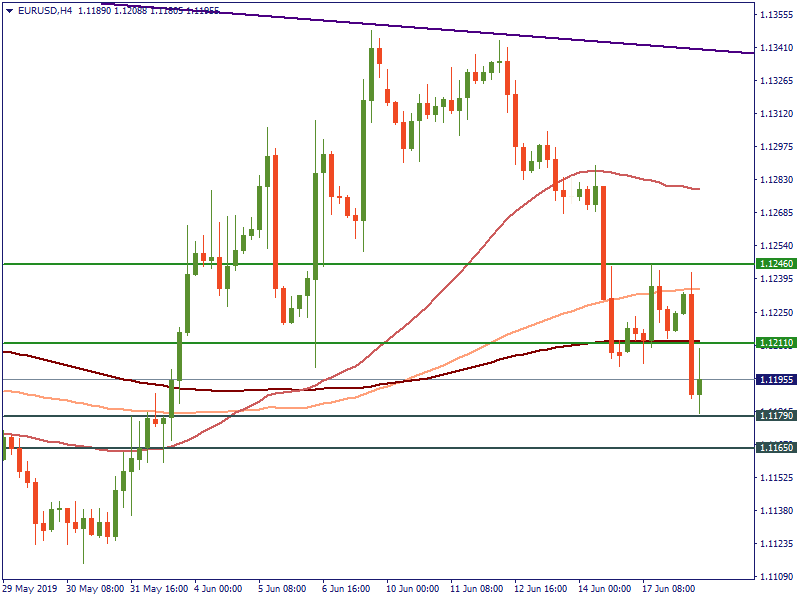

The new stimulus for the euro? Mario Draghi sent EUR/USD lower on the dovish

hints.

Check at: http://bit.ly/2KpcjFK

18.06.2019

During today’s speech, the ECB President Mario Draghi made remarks on using a rate cut as a primary tool for an economic stimulus.

On the H4, EUR/USD fell to the support at 1.1179 during the European trading hours. At the moment, the pair is correcting to the upside. The first resistance is placed at 1.1211. If the positive momentum is short-lived, the pair will break the 1.1179 level and try to test the support at 1.1165.

-

19-06-2019, 12:44 PM #166Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Market updates on June 19

http://bit.ly/2IpSETM

19.06.2019

Key events ahead:

British CPI – 11:30 MT time

Forecast: 2%

Canadian CPI – 15:30 MT time

Forecast: +0.1%

Speech by the ECB president Mario Draghi – 17:00 MT time

FOMC statement – 21:00 MT time

After the plunge of the euro on the dovish comments by the ECB President, EUR/USD has been consolidating near the support at 1.1187 on the H4. If bears manage to break this level, the next support levels will lie at 1.1173 and 1.1165. Bulls need to push the pair higher to the resistance at 1.1209 to confirm their strength. The next resistance will lie at 1.1221. Traders will focus their attention to the fresh comments by the ECB president later today and to the FOMC meeting at 21:00 MT.

US President Donald Trump had a telephone conversation with Chinese President Xi yesterday. The leaders agreed to meet during the G20 Summit in Japan. The news increased the risk appetite in the market. The risk-on sentiment pushed the oil prices and the Canadian dollar up.

The price for WTI retested the $54.28 level on the news. On the daily chart, from the upside, the next resistance levels are placed at $55.71 and $57.60. Bears need to push the pair back to the support at $50.78 to confirm their strength. The next key level lies at $48.47.

Brent, in its turn, retested the upper border of the consolidation range at $62.66. The next resistance is placed at $63.6. In the case of the fall, we need to keep an eye on the lower border of the consolidation at $57.6. The next support is at $57.5.

On the H4, USD/CAD bounced from the 200-period SMA at 1.3427 and plunged below the 100-period SMA. The pair has tested the lows below the 1.3373 level. If bears continue to drive the loonie down, the next support will lie at 1.3357. On the other hand, pay attention to the resistance at 1.3409. The next level for bulls will lie at 1.3419. Next, the CPI release and the FOMC meeting will likely determine the direction for the pair.

-

20-06-2019, 01:27 PM #167Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Market updates on June 20

Read at: http://bit.ly/2x6SjyY

20.06.2019

Key events ahead:

The BOE monetary policy summary – 14:00 MT time

Yesterday, the Fed Chair Jerome Powell hinted the possibility of a rate cut as early as next month. His impatient tone pushed the EUR/USD pair higher. On H4, bulls successfully broke the 50-period SMA. At the moment the EUR is testing the resistance at 1.1294. The next resistance lies at 1.1316. If this level is broken, the next level in focus for bulls will be placed close to the descending trendline at 1.1344. From the downside, we need to pay attention to the support at 1.1257. As soon as it's broken, the next support will lie at 1.1234 (100-period SMA). After that, bears will target the zone between 1.1224 and 1.1213.

USD/JPY fell on the dovish Fed, too. On H4, the pair found the support at 107.64. If the USD continues to weaken, the next support will lie at 107.29. On the flipside, we need to pay attention to the resistance levels at 108.3 and 108.64.

GBP/USD has been supported ahead of the BOE monetary policy summary. At the moment, it is trading near the resistance at 1.2710 on the H4. The next resistance levels lie at 1.2749 and 1.2780. If the GBP is supported today by the comment of Mark Carney, the next key level will lie at 1.2837. Bears need to keep an eye on the support levels at 1.2651 (100-period SMA), 1.2612 and 1.2557.

The Australian dollar has been rising on the hawkish comments by the RBA governor. Right now, the aussie is rising towards the resistance at 0.6931 (100-period SMA). If this level is broken, the next resistance will be placed between 0.6958 and 0.6966. Bears need to pull AUD/USD below 0.6913-0.6905 to confirm their strength. In that case, the next key level for them will lie at 0.6873.

-

20-06-2019, 01:33 PM #168Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Market updates on June 20

Read at: http://bit.ly/2x6SjyY

20.06.2019

Key events ahead:

The BOE monetary policy summary – 14:00 MT time

Yesterday, the Fed Chair Jerome Powell hinted the possibility of a rate cut as early as next month. His impatient tone pushed the EUR/USD pair higher. On H4, bulls successfully broke the 50-period SMA. At the moment the EUR is testing the resistance at 1.1294. The next resistance lies at 1.1316. If this level is broken, the next level in focus for bulls will be placed close to the descending trendline at 1.1344. From the downside, we need to pay attention to the support at 1.1257. As soon as it's broken, the next support will lie at 1.1234 (100-period SMA). After that, bears will target the zone between 1.1224 and 1.1213.

USD/JPY fell on the dovish Fed, too. On H4, the pair found the support at 107.64. If the USD continues to weaken, the next support will lie at 107.29. On the flipside, we need to pay attention to the resistance levels at 108.3 and 108.64.

GBP/USD has been supported ahead of the BOE monetary policy summary. At the moment, it is trading near the resistance at 1.2710 on the H4. The next resistance levels lie at 1.2749 and 1.2780. If the GBP is supported today by the comment of Mark Carney, the next key level will lie at 1.2837. Bears need to keep an eye on the support levels at 1.2651 (100-period SMA), 1.2612 and 1.2557.

The Australian dollar has been rising on the hawkish comments by the RBA governor. Right now, the aussie is rising towards the resistance at 0.6931 (100-period SMA). If this level is broken, the next resistance will be placed between 0.6958 and 0.6966. Bears need to pull AUD/USD below 0.6913-0.6905 to confirm their strength. In that case, the next key level for them will lie at 0.6873.

-

20-06-2019, 01:36 PM #169Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Market updates on June 20

Read at: http://bit.ly/2x6SjyY

20.06.2019

Key events ahead:

The BOE monetary policy summary – 14:00 MT time

Yesterday, the Fed Chair Jerome Powell hinted the possibility of a rate cut as early as next month. His impatient tone pushed the EUR/USD pair higher. On H4, bulls successfully broke the 50-period SMA. At the moment the EUR is testing the resistance at 1.1294. The next resistance lies at 1.1316. If this level is broken, the next level in focus for bulls will be placed close to the descending trendline at 1.1344. From the downside, we need to pay attention to the support at 1.1257. As soon as it's broken, the next support will lie at 1.1234 (100-period SMA). After that, bears will target the zone between 1.1224 and 1.1213.

USD/JPY fell on the dovish Fed, too. On H4, the pair found the support at 107.64. If the USD continues to weaken, the next support will lie at 107.29. On the flipside, we need to pay attention to the resistance levels at 108.3 and 108.64.

GBP/USD has been supported ahead of the BOE monetary policy summary. At the moment, it is trading near the resistance at 1.2710 on the H4. The next resistance levels lie at 1.2749 and 1.2780. If the GBP is supported today by the comment of Mark Carney, the next key level will lie at 1.2837. Bears need to keep an eye on the support levels at 1.2651 (100-period SMA), 1.2612 and 1.2557.

The Australian dollar has been rising on the hawkish comments by the RBA governor. Right now, the aussie is rising towards the resistance at 0.6931 (100-period SMA). If this level is broken, the next resistance will be placed between 0.6958 and 0.6966. Bears need to pull AUD/USD below 0.6913-0.6905 to confirm their strength. In that case, the next key level for them will lie at 0.6873.

-

24-06-2019, 12:33 AM #170Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

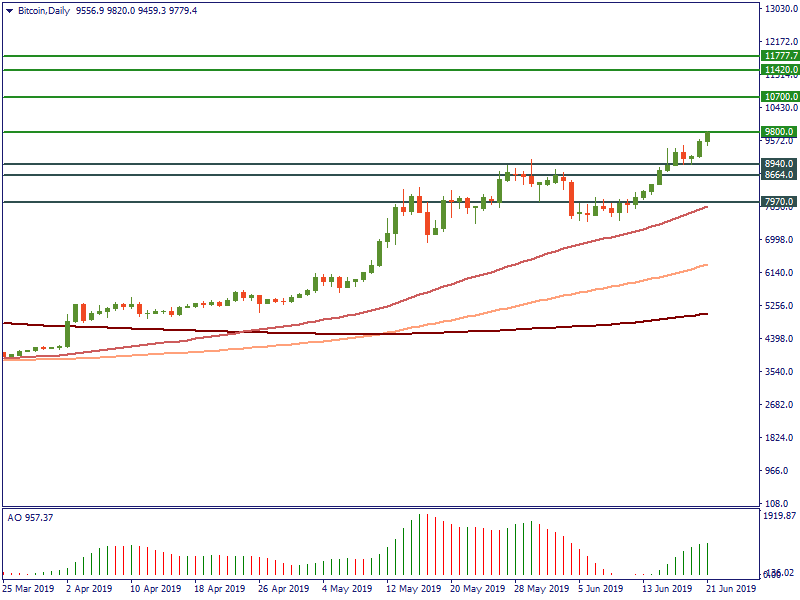

Weekly Cryptonews

More at: http://bit.ly/2RtcYXw

21.06.2019

Brian Kelly, chief executive of investment management firm BKCM:

Bitcoin is ... digital gold. And, in my opinion, it’s probably a lot better than gold, but there is no trusted third party involved, and that’s the huge difference.

This week was super optimistic for Bitcoin bulls. Many positive events in the crypto market, including the announcement of Facebook’s crypto project Libra, pushed the digital asset higher. At the moment, it is looking forward to the breakout of the $9,800 level on the daily chart. If it happens, the next resistance will lie at $10,700. As far as it is broken, the further rise may be limited by the $11,420-$11,777 levels. From the downside, we need to pay attention to the $8,940, $8,664 and $7,970 levels. Awesome oscillator is moving upwards, which is a good signal of the possible further rise.

Regulations:

·The South Korean crypto regulator promised to pay damages to users in case of hackers’ attacks or system lags.

·The Brazilian authorities obligated local and international crypto exchange platforms to share almost all of the users’ transactions.

Crypto announces:

·The Ethereum developer Justin Drake announced that the switch to Ethereum 2.0 was planned to start on January 3, 2020.

·On Tuesday, Facebook's crypto project Libra was presented. Mark Zuckerberg introduced a new website, where you can find the white paper of a project. After the critics by different governments, the developers noted that the project would share with authorities the users' data. Also, Libra Investment token was introduced. The launch of Facebook's cryptocurrency is expected next year.

·Litecoin Foundation together with Bibox exchange platform and Ternio startup will release a debit crypto card.

·CEO of TRON announced the update of the network to the new version called Odyssey 3.6, to increase the protection and the possibility of dApps creation.

New developments:

·100 of leading Japanese producers, including Mitsubishi Electric and Yaskawa Electric, agreed to launch a collaborative blockchain system for the data exchange.

·The IT department of Samsung launches products for using blockchain in different types of business.

·Firefox developers detected and eliminated the vulnerability which could be used for stealing crypto. It’s recommended to update the browser to the latest version.

·The leading international consulting company PwC launched the Halo instrument for providing guarantee services in crypto payments.

·Japanese messenger LINE can get a resolution to create its own crypto exchange platform soon.

Current prices (last update 15:16 MT time):

Bitcoin $9,835

DASH $165.78

Ethereum $233.05

Litecoin: $138.94

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Tags for this Thread

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

6Likes

6Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote