5 important events this week will bring us!

Read at: http://bit.ly/2I3XdSG

27.05.2019

Rate statement by the Bank of Canada (Wed, 17:00 MT (14:00 GMT)) – The changes to the current interest rate are not expected, but the central bank may throw some hints on the possible changes of its monetary policy in the future.

Australian building approvals and private capital expenditure (Thu, 4:30 MT (1:30 GMT)) – According to the forecasts, the number of building approvals will increase by 0.1%. As for the level of private capital expenditure, it is expected to advance by 0.5%. Higher figures will support the Australian dollar.

US Preliminary GDP (Thu, 15:30 MT (12:30 GMT)) – The GDP growth of the US is forecast to rise by 3.1%. If the actual level is higher, the USD will get stronger.

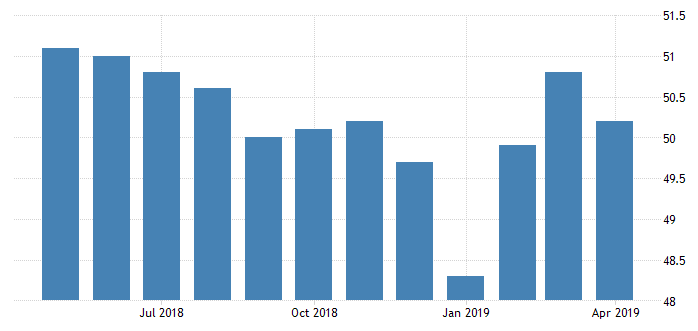

Chinese Manufacturing PMI (Fri, 4:00 MT (1:00 GMT)) – The indicator will affect not only the Chinese yuan but also the risk sentiment in the market, due to the escalation of the US-China trade tensions. According to the forecasts, it will decline to 49.9 points. Higher figures will push the CNH and the risk-weighted currencies higher.

Canadian GDP (Fri, 15:30 MT (12:30 MT)) – If the actual level of indicator is higher than the forecast, the CAD will rise.

Hot news:

During the weekend, the US president Donald Trump met with Japanese Prime Minister Shinzo Abe for trade talks. Today they are going to discuss the key issues. According to Trump’s comments on twitter, the sides have made significant progress in trade negotiations, but the final deal is expected to be reached after July's elections in Japan.

The trade tension between the US and China have intensified. Up to now, we anticipate extra 25% tariffs on $200 billion of Chinese exports to the US and on $60 billion of US exports to China at the end of this week. At the same time, Donald Trump said that the US was not ready to make a trade deal with China.

After the European elections last week, the EU leaders will decide who will be the next president of the European Central Bank after Mario Draghi. During the EU summit dinner on May 28, they are going to discuss the top political appointments.

Theresa May resigned from her post as a Prime Minister on Friday. The leaders who may replace Theresa May, including Boris Jonson and Dominic Raab, say they want the EU to reopen the negotiations on the UK withdrawal agreement.

Please visit our sponsors

Results 151 to 160 of 370

Thread: Forex daily News FBS

-

27-05-2019, 02:47 PM #151Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

-

28-05-2019, 12:58 PM #152Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Will the Bank of Canada support the CAD?

http://bit.ly/2MaIpXu

27.05.2019

The Bank of Canada will publish its monetary policy statement and make the rate announcement on May 29, at 17:00 MT.

The central bank won’t make changes to the current interest rate, which is set at 1.75%. However, the BOC governor Stephen Poloz may throw some hints on the possible changes to the current monetary policy. Last time, Mr. Poloz was more positive about the economic outlook of the country, than during the previous meetings. His tone supported the loonie. If he provides any hawkish hints this time, the CAD will rise.

• If the BOC is hawkish, the CAD will go up;

• If the CAD is dovish, the CAD will go down.

-

29-05-2019, 08:22 PM #153Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

The important release for China may shake the markets

Look at: http://bit.ly/2WtUvPA

29.05.2019

China will release the level of its manufacturing PMI on May 31, at 4:00 MT time. This is a leading indicator of economic health. As China is one of the biggest economies in the world, its data tends to affect the global markets. As a result, higher figures of the indicator affect positively not only the Chinese yuan but also the risk sentiment in the market. Riskier environment increases the demand on the risk-weighted currencies, such as the AUD, the NZD, and the emerging market currencies. On the flipside, the lower actual level of manufacturing PMI for China pulls the Chinese currency down and hurts the risk sentiment in the market. The risk-off sentiment makes the risky assets go down as well.

• If the actual level of manufacturing PMI is higher than the forecasts, the risk sentiment will be on;

• If the actual level of manufacturing PMI is lower than the forecasts, the risk sentiment will be off.

-

30-05-2019, 10:37 PM #154Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Trading strategies for the short-term timeframes!

Some traders prefer to trade on the longer-term timeframes. It helps them to check the positions no more than once a day and have more time for making a final decision. However, if you prefer to be a more aggressive trader and earn money within a day, you will probably try trading on the H1 and H4 charts. In this article, we will explain the most popular strategies for this kind of trading.

http://bit.ly/2W1OO71

------------------------------------------------------------------------

-

31-05-2019, 03:14 PM #155Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

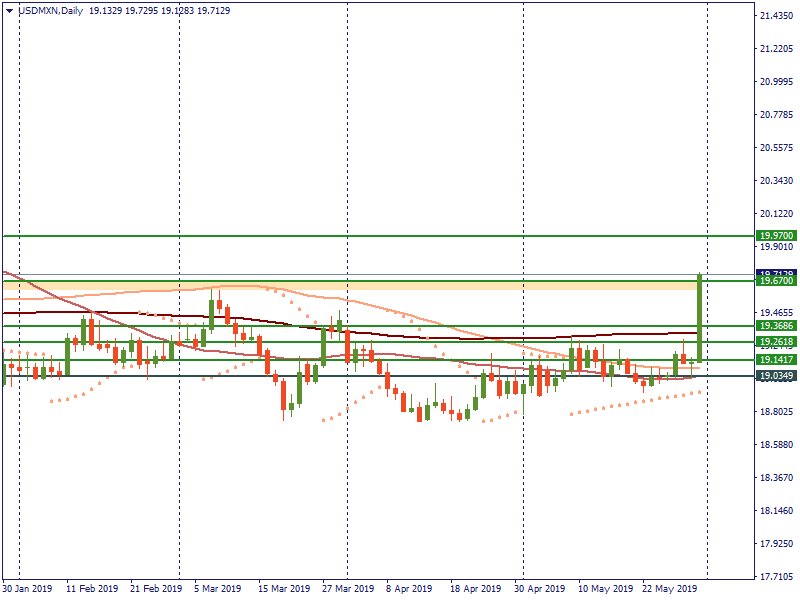

The USD/MXN has risen by more than 5,900 pips on tariff threats

More at: http://bit.ly/2MiCcZF

31.05.2019

President Donald Trump announced the 5% tariffs on Mexican goods until the country stops immigrants from entering the US. The tariffs will be applied on June 10. The tariffs could rise to 25% on October 1.

The USD/MXN has risen above the resistance at 19.67. The next resistance lies at 19.97. On the flipside, bears need to pull the pair below the 19.3686, 19.2618 and 19.1417 pivot levels to take back their strength. The support lies at 19.0349.

-

03-06-2019, 02:34 PM #156Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Will the Reserve bank of Australia weaken the AUD?

More at: http://bit.ly/2HTYHjy

03.06.2019

The Reserve bank of Australia will make its statement and announce the official rate on June 4, at 7:30 MT time.

Analysts anticipate the RBA to cut its interest rate from 1.5% to 1.25%. The chances of a rate cut are high as the Australian economy keeps weakening. The slowdown of the GDP growth, falling house prices and the rise of unemployment are among the key reasons behind the anticipated decision by the RBA. Despite the high chances of the rate cut, the central bank may keep its interest rate unchanged. If it happens, the Australian dollar may get positive momentum.

• If the RBA keeps its interest rate unchanged, the Australian dollar will rise;

• If the RBA cut its interest rate, the Australian dollar will fall.

-

04-06-2019, 12:58 PM #157Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

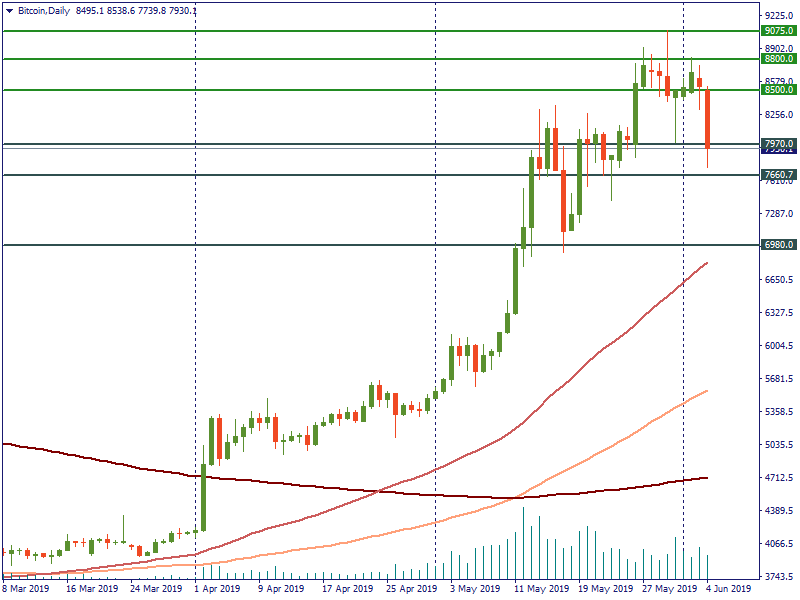

Grandfather of crypto falls below the $8,000 level after consolidation

More at: http://bit.ly/2XtqfBu

04.06.2019

Bears finally took over the cryptomarket and pulled the price for BTC down. At the moment, it is testing the support at $7,970. If this level is broken, bears will face with the next key level at $7,660. If bulls take over, they will need to push the price for Bitcoin above the $8,500 level to the next resistance at $8,800.

-

05-06-2019, 12:58 PM #158Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

The volatility for the USD is expected

Read at: http://bit.ly/2KvhgfA

05.06.2019

The level of non-farm payrolls, also known as non-farm employment change or NFP will be out on June 7, at 15:30 MT time.

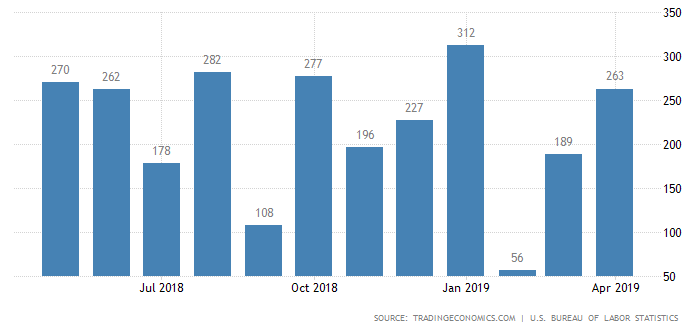

The indicator represents the change in the number of employed people during the previous month without farmers. Traders pay huge attention to it, as it makes the US dollar highly volatile after the release. Also, we recommend you not to underestimate the unemployment rate and the level of average hourly earnings. These indicators are released at the same time as the non-farm payrolls and they tend to affect the USD as well. Last time, the NFP outperformed the forecasts. It advanced by 263 thousand jobs (vs. 181 thousand expected). However, bulls could not hold their positions due to the lower-than-expected average hourly earnings (0.2% vs. 0.3%). This time the employment data may lead to a different outcome.

• If NFP is higher than the expectations, the USD will rise;

• If NFP is lower than the expectations, the USD will fall.

-

06-06-2019, 04:19 PM #159Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

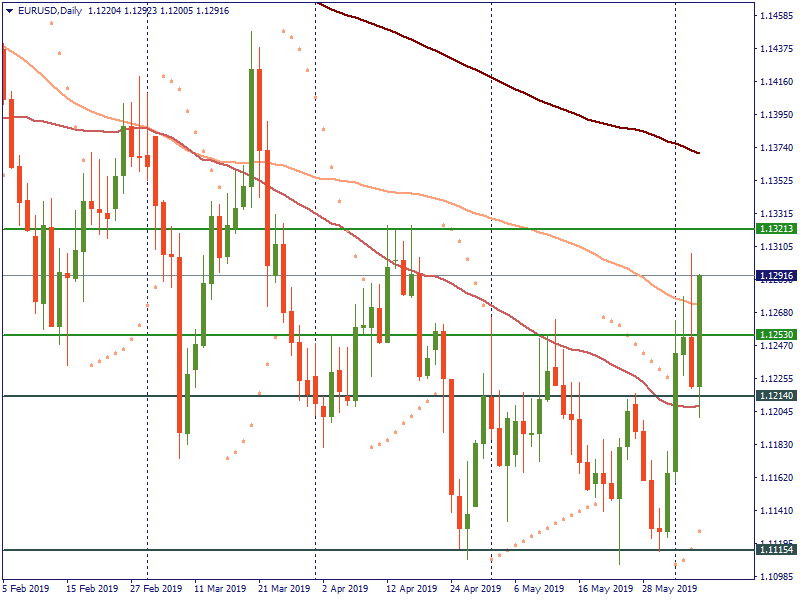

The euro has risen above the 100-day MA on the comments by Mario Draghi

More at: http://bit.ly/2HWZArk

06.06.2019

During today's press conference, the ECB president said that the data was "somewhat" better than the expectations in the first quarter. The euro jumped higher on his comments, targeting the next resistance at 1.1321. If his further comments are more dovish, EUR/USD will fall back below the 1.1253 level to the support at 1.1214.

-

10-06-2019, 02:08 PM #160Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Another chance for the USD

More at: http://bit.ly/2R1jgx5

10.06.2019

The level of retail sales and core retail sales will be out on June 14, at 15:30 MT time.

The indicator of retail sales represents the change in the total value of sales at the retail level. Its core level excludes the sales of autos due to their high volatility. Last time both of the indicators came out lower than the forecasts. The level of retail sales declined to 0.2% (vs. the anticipated increase to 0.2%), while its core level advanced only by 0.1% (vs. the forecast of 0.7%). If this time the situation changes, the USD will rise.

• If the actual levels of indicators are higher than the expectations, the USD will rise;

• If the actual levels of indicators are lower than the expectations, the USD will fall.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Tags for this Thread

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

6Likes

6Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote