Market updates on December 3

Check it out: http://bit.ly/2P8Es40

03.12.2019

You will never get bored in the anticipation of the US-China trade deal, as the sides have something to surprise the market all the time. While the major currency pairs have taken advantage of the weak USD, Trump has got something to make us worry. According to his comments, the US-China trade deal may come after the next year’s election. Together with the fresh tariffs against Brazil and France, these announcements will likely determine the market situation now. Pay attention to the risk-weighted currency pairs.

The Australian dollar has strengthened after the RBA kept its interest rate on hold at 0.75%. On H4, AUD/USD broke the 200-period SMA and rose higher to the November resistance levels. The bullish momentum is supported by the weaker USD, too. Upside targets for the pair lie at 0.6863 and 0.6872. However, judging by Stochastic and RSI oscillators, a reversal is likely to happen soon. Stochastic oscillator formed a crossover in the overbought zone, while RSI is moving within this zone. As soon as it crosses the 70th level upside down, it may provide us a selling opportunity. From the downside, the support levels lie at 0.6836 and 0.6825.

The kiwi is demonstrating a strong performance, too. NZD/USD is trading at the early August levels and targeting the resistance at 0.6543 on the 4-hour chart. Bulls may try to break this level and target the next resistance at 0.6561. At the same time, the Stochastic and RSI oscillators are overbought here. While RSI is looking down, a stochastic oscillator formed a crossover above 80. That is why we may expect a correction to the 0.6519 level. If this level is broken, the next support will lie at 0.6504.

USD/JPY has fallen on the comments by the US President Donald Trump. On H4, the pair has been testing the support at 108.82 (200-period SMA). If the downward momentum continues, the next support will be placed at 108.65. From the upside, keep an eye on the 109.04 and 109.2 levels.

Please visit our sponsors

Results 261 to 270 of 370

Thread: Forex daily News FBS

-

04-12-2019, 03:15 AM #261Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

-

04-12-2019, 01:31 PM #262Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Currency market updates on December 4

Trade now: http://bit.ly/2P5LUfW

04.12.2019

Wednesday marks the middle of the trading week. Below you will find the useful information for successful trading.

Key events ahead

American ADP Non-Farm Employment change – 15:15 MT time (13:15 GMT)

Bank of Canada Rate Statement – 17:00 MT time (15:00 GMT)

American ISM Non-manufacturing PMI – 17:00 MT time (15:00 GMT)

EUR/USD is preparing for a decisive move

EUR/USD rose above 1.1070 on Monday and has been consolidating under the resistance level of 1.1090 since then. On the H1, Bollinger bands compressed. This confirms that the market is gathering power to make a more decisive move in the nearest future. The resistance level of 1.1090 has been capping the upward movement of the price since the beginning of November and may require extra effort from the bulls to break. However, the Stochastic Indicator’s fast line already crossed the slow one bottom-up within the oversold zone. This may signal a good moment to open longs. Otherwise, if the support level of 1.1070 is broken later, the price may go down to the support levels of 1.1005 and 1.0990, where it has been trading during the last week of November.

GBP/USD under pressure down

Yesterday, the British pound rose to the resistance level of 1.3008 against the US dollar. On the H4 chart of GBP/USD, since May 2019 this level was reached only on November 21. Today, the price is more likely to decline as the RSI and Stochastic are in the overbought zone and will likely leave it soon. Once the support level of 1.2990 is crossed, the next target for the bears may be located at 1.2926. Otherwise, an additional resistance level to check the bullish move may be placed at 1.3000, being a strong psychological barrier to break.

More concerns about the trade war affecting USD/JPY

US President Donald Trump announced a trade deal with China might not come until after the 2020 US presidential election. This got traders worried. The demand for the safe-haven Japanese yen rose pulling USD/JPY down.

On the H4 chart, the RSI, MACD, and Stochastic Indicators are all reporting the oversold state of the market. Indeed, the price has dropped to 108.50 yesterday and has been in a sideways movement since then. Very likely, it is preparing for a correction. An intermediary resistance level to check that may be located at 108.78 with the next one at 109.20. Otherwise, the support may be placed at 108.30.

Bank of Canada announces the interest rate

Today, the Bank of Canada will announce the interest rate. During the previous session, it was decided to keep it at 1.75%, the highest level since 2008. The policymakers did not express any inclination to change it. However, the governor Mr. Poloz commented that they would observe how well the dynamics of the Canadian economy perform within the context of the global slowdown. Hence, the steady rate signalling the resilience of the Canadian economy may boost the Canadian dollar.

-

06-12-2019, 01:52 AM #263Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Currency market on December 5

More at: http://bit.ly/2s4ySrd

05.12.2019

Thursday's start has been quite eventful. The great pound's surge has been highlighting the day, while oil traders are cautiously awaiting the OPEC meeting. Read more about the main market movers below.

Disappointing economic data pulled the AUD down

While the level of retail sales showed a slowdown versus the expected advance by 0.3%, the Australian exports declined from 6.49 to 4.5 billion AUD. On H4, the Australian dollar has kicked off the resistance at 0.6848 and fell below the 200-period MA to the 0.6831 level. The price is trying to form the “Double top” pattern with the neckline at 0.6821. As soon as this level is broken, bears will be ready to move the aussie towards the lower target at 0.6810. The upside momentum is limited by the 0.6848 and 0.6855 levels.

The British pound has continued its bullish momentum

Today we’ve already explained what is going on with the British pound. You can read more about it here. On H4, GBP/USD continues to move up to May’s peak at 1.3170. If bulls manage to successfully break this level, the next resistance will be placed at 1.3220. In case of the reversal, watch at the supports at 1.3082 and 1.3050.

USD/MXN: More downside is possible

USD/MXN took advantage of the weak USD. On the 4-hour chart, the pair slid below the 50-period MA yesterday. Today, it has already tested the 100-period MA, which serves as strong support at 19.4270. In case of a breakout, we may expect further fall towards the 19.36 level. However, a stochastic oscillator formed a crossover in the oversold zone and RSI is looking up. That is why we may expect a short-term correction to 19.48 and 19.53.

-

09-12-2019, 01:47 AM #264Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Currency market on December 6: the NFP Friday

More at: http://bit.ly/36dS3xG

06.12.2019

Important events today: all around the USD

We can say that today is a Black Friday for currency markets – the American Non-Farm Payrolls are out. Although that is going to be the major market mover today, it is not the only one. Some more details are below.

American Non-Farm Payrolls, unemployment rate, and average hourly earnings are out at 15:30 MT time (13:30 GMT) – be careful with the volatility of USD and related currencies around the data release time

Canadian jobs data - 15:30 MT time (13:30 GMT)

OPEC will be concluding its round of discussions and meetings today

EUR/USD starts the day on a positive note

The price of EUR/USD has started this day by reconfirming the level of 1.1104 that it reached on Wednesday. It was a breakthrough of the month as the currency pair has never been that high since the first week of November. On the H4, the pair trades above the 200-period, 100-period and 50-period Moving Averages, which is another sign that there is a stronger bullish momentum than before. However, we still have to see how strong it is, and the resistance of 1.1130 may be a good level to check that. Today, a major factor influencing that will be the volatility of the USD in the context of relatively strong market expectations from the US Labor Authorities for the Non-Farm Payrolls and related data they are about to release.

USD/CAD waiting for the news

It is safe to assume that the consolidation of USD/CAD at the resistance level of 1.3185 reached on Thursday is a preparation for a more decisive move. There are some preliminary signs of a coming bullish trend to continue the correction after the serious drop at the beginning of the week. The Awesome Oscillator reached the low yesterday and reverted upwards signaling the general upward direction of the price. However, the next step will be defined by the release of the Non-Farm Payrolls due today from the US side and the jobs data due at the same time from the Canadian side. Therefore, watch the news and be careful with the coming price volatility.

USD against JPY and CHF

Against the Japanese yen and the Swiss franc, the American dollar shows similar patterns during the last two weeks. Both currency pairs dropped significantly on December 2-3, below the 200-period, 100-period, and 50-period MAs, and both are showing a mild correction since then, having bounced down on Thursday from the local resistance levels corresponding to each one. Although the internal and external contexts for the Swiss and the Japanese currencies are different, the common factors such as the Non-Farm Payrolls moving the USD will affect both in a similar way once again. That effect may be reinforced by the fact that both currencies are safe-haven and gain strength when the market feels uncertainty about the American dollar.

-

10-12-2019, 05:45 PM #265Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

5 important events this week will bring us

More at: http://bit.ly/2t70BbD

09.12.2019

The second half of this week is going to be well loaded with big events. All major currencies will be affected, for this reason, brace yourselves and prepare for some price action.

Main events

British monthly GDP growth rate (Tue, 11:30 MT time (09:30 GMT))The last two indicators of the monthly GDP growth rate have been at -0.1%. If the monthly GDP growth for October is better than the expected 0.1%, it will make the British pound rise.

Federal Funds Rate (Wed, 21:00 MT time (19:00 GMT)) The American financial authorities will announce the interest rate and release the monetary policy statement. They will also give the economic projections for the nearest future and explain the main issues behind the chosen monetary stance. Steady rate (currently at 1.75%) and positive perspectives will support the US dollar.

The British Parliament elections (Thu, all day)Finally, we will see the resolution of the months-long parliamentary debates and clarification of the coming course of development in Great Britain. Definitely, it is going to be a hard day for the British pound, but the victory of Boris Johnson would boost it.

ECB Main Refinancing Rate and Press Conference (Thu, 15:30 MT time (13:30 GMT))The European Central Bank will announce the interest rate, to which no change is expected (currently at 0%); more importantly, the ECB head Christine Lagarde will give a press conference, which will reveal the economic outlook of the euro area and the intentions of the monetary policy makers. A positive tone of the speech will strengthen the euro.

American monthly retails sales (Fri, 15:30 MT time (13:30 GMT))Although not a major indicator, still the retail sales give a very representative outlook on consumer sentiment. If the picture is more positive than the market expectation, the US dollar will rise.

Background tension

Strong jobs data provided by the Non-Farm Payrolls on December 6 boosted the US dollar. However, the upward movement of the US dollar does not gain full power as there still are serious concerns among the investors on the next stage of the US-China trade war. The deadline of December 15 for imposing new tariffs on the Chinese goods by the US is still in place, while the last comment from the US President Donald Trump was that he liked where the negotiations were going. This means that tensions will keep the market’s optimism in check until next Monday at the very least.

-

10-12-2019, 08:55 PM #266Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Currency market on December 10

Check the charts: http://bit.ly/2P6AM3R

10.12.2019

Clouds are gathering

Today is expected to be a relatively quiet day in terms of economic announcements. The big events start on Wednesday, while at the background the December 15 deadline for imposing new tariffs by the US on the Chinese goods will keep the market dynamics warmed up through the rest of the week. Such a layout represents a future sentiment among many within the financial circles: nothing really disastrous, but a general outlook of uncertainty, misbalance, and slowdown. Essentially, these are the reasons why Goldman Sachs analysts predict the price of gold to rise in 2020.

More specifically, they say it may soar up to $1600, which actually is quite a worrying prediction. The last time gold was in that area were the years 2011-2013, which means crisis and post-crisis period. And the level itself is substantially far away from the current area of $1470 per troy ounce. However, the upward trend is visible since 2016, and it seems that even without any major disappointments in the global economic environment the market would gradually get to the heights of $1600.

Nevertheless, below are some of the noteworthy events of regional impact, which may become the market movers to a certain extent today.

British Balance of Trade (11:30 MT time (09:30 GMT))

German ZEW Economic Sentiment Index (12:00 MT time (10:00 GMT))

You can have a closer look at these events in the economic calendar.

Clear picture for the euro

Since August this year, the euro has been dropping against the British pound and has not made an exception recently. In fact, it may find more reasons to continue the same direction. The pre-election polls show that the Conservative party of Boris Johnson is gaining strength, which in turn supports the GBP. While the questions about the bond purchasing program within the quantitative easing by the ECB keep rising, not leaving much space for positive expectations on the coming press-conference by Christine Lagarde. Altogether, this weakens the EUR/GBP pair. Technically, it is expected to keep falling in any case in the long-term. In the mid-term, however, we may see a surge up to the levels of the 50-period and 100-period Moving Average, to which it came every time before dropping further during the last three weeks. Today, although a recoil up to the resistance of 0.8455 is still a possible scenario, more probably the price will crawl a little further up and then drop. On the H4, we already see that the level of 0.8400 was touched during the trading process previously, and the price is consolidating along the current level in a sideways movement. So watch out for a minor local upswing followed by the continuation of the downtrend.

US news come first

Against the US dollar, the euro has been rising since the end of November, even despite the strong NFP data released by US labor authorities on December 6. On the H1, this marked trend is visible and currently coincides with the 200-period moving average, supporting the price movement. It would be tempting to assume that the price would continue the same direction. However, we have to take into account the news coming. On Wednesday, the Fed will announce the interest rate and give a press conference. That is, after a positive NFP data, showing the resilience of the US economy. On Thursday, the European Central Bank will do the same for the Eurozone, but the expectations are hardly positive. Therefore, it will be safer to price-in the downward reversal later on. But for now, the resistance of 1.1078 is a feasible target for the price to reach.

-

11-12-2019, 04:44 PM #267Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Currency market on December 10

More at: http://bit.ly/2P6AM3R

10.12.2019

Clouds are gathering

Today is expected to be a relatively quiet day in terms of economic announcements. The big events start on Wednesday, while at the background the December 15 deadline for imposing new tariffs by the US on the Chinese goods will keep the market dynamics warmed up through the rest of the week. Such a layout represents a future sentiment among many within the financial circles: nothing really disastrous, but a general outlook of uncertainty, misbalance, and slowdown. Essentially, these are the reasons why Goldman Sachs analysts predict the price of gold to rise in 2020.

More specifically, they say it may soar up to $1600, which actually is quite a worrying prediction. The last time gold was in that area were the years 2011-2013, which means crisis and post-crisis period. And the level itself is substantially far away from the current area of $1470 per troy ounce. However, the upward trend is visible since 2016, and it seems that even without any major disappointments in the global economic environment the market would gradually get to the heights of $1600.

Nevertheless, below are some of the noteworthy events of regional impact, which may become the market movers to a certain extent today.

British Balance of Trade (11:30 MT time (09:30 GMT))

German ZEW Economic Sentiment Index (12:00 MT time (10:00 GMT))

You can have a closer look at these events in the economic calendar.

Clear picture for the euro

Since August this year, the euro has been dropping against the British pound and has not made an exception recently. In fact, it may find more reasons to continue the same direction. The pre-election polls show that the Conservative party of Boris Johnson is gaining strength, which in turn supports the GBP. While the questions about the bond purchasing program within the quantitative easing by the ECB keep rising, not leaving much space for positive expectations on the coming press-conference by Christine Lagarde. Altogether, this weakens the EUR/GBP pair. Technically, it is expected to keep falling in any case in the long-term. In the mid-term, however, we may see a surge up to the levels of the 50-period and 100-period Moving Average, to which it came every time before dropping further during the last three weeks. Today, although a recoil up to the resistance of 0.8455 is still a possible scenario, more probably the price will crawl a little further up and then drop. On the H4, we already see that the level of 0.8400 was touched during the trading process previously, and the price is consolidating along the current level in a sideways movement. So watch out for a minor local upswing followed by the continuation of the downtrend.

US news come first

Against the US dollar, the euro has been rising since the end of November, even despite the strong NFP data released by US labor authorities on December 6. On the H1, this marked trend is visible and currently coincides with the 200-period moving average, supporting the price movement. It would be tempting to assume that the price would continue the same direction. However, we have to take into account the news coming. On Wednesday, the Fed will announce the interest rate and give a press conference. That is, after a positive NFP data, showing the resilience of the US economy. On Thursday, the European Central Bank will do the same for the Eurozone, but the expectations are hardly positive. Therefore, it will be safer to price-in the downward reversal later on. But for now, the resistance of 1.1078 is a feasible target for the price to reach.

-

11-12-2019, 04:47 PM #268Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Opinion polls cast a shadow on the GBP

More at: http://bit.ly/38wAryX

11.12.2019

YouGov, the key organization tracking the UK public opinion has released its final report ahead of the vote that will take place on Thursday, December 12. The news made the pound weaken versus most major currencies. Learn more!

Why is it important?

There are three scenarios of the election outcome, which are expected to affect the Brexit process and the GBP as well.

The first one is the victory of the Conservative party. As you may know, this is the party led by Boris Johnson. Analysts expect this scenario to provide certainty in Brexit, and, therefore, to push the GBP up.

The second scenario is a hung Parliament. In that case, the party with most of the votes will form the minority government. At the same time, as the seats will also be taken by the opposition Labour party, the UK will face the risks of having another Brexit deadlock. As a result, the GBP will go down.

Finally, the third scenario is the leadership of Jeremy Corbyn's Labour party. The opposition leader criticizes the inability of the Conservatives to suggest any clear solution over Brexit and plans a second referendum. No surprise for this outcome to be Brexit-negative.

What do the polls say?

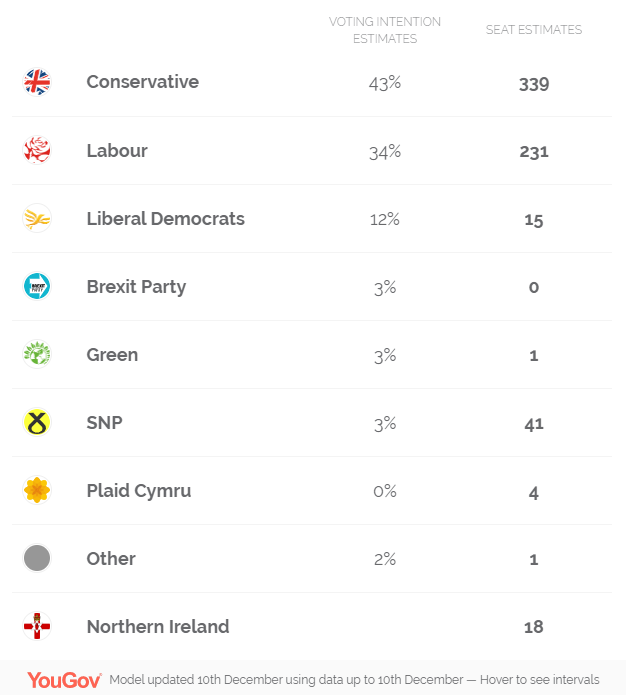

According to YouGov, the Tories (the Conservative party) majority has been shrinking. The final poll shows 43% for the Conservatives and 34% for the Labour. These figures increase the possibility of a hung parliament.

How did the GBP react?

The British pound dropped on the news with the wave of panic selling. The 1.32 cliff appeared to be too tough for GBP/USD and the pair has slid to the 1.31 support level.

-

12-12-2019, 06:22 PM #269Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Top 4 trading opportunities of December 12

More at: http://bit.ly/34gUbTS

12.12.2019

GBP: the room for surprises

It’s an election day in the UK. Traders will watch exit polls. The results will start arriving after 00:30 MT rime on Friday. The results of the vote will become clear by 4:00-5:00 MT time.

The latest opinion polls showed that the Conservative Party has a small majority. This means that the risk of a hung parliament is substantial and the fate of the GBP is hanging in the balance.

In the meantime, Boris Johnson, Prime Minister and the leader of the Conservatives, was in no mood to talk: he hid in an industrial fridge to avoid journalists’ questions.

EUR: mildly negative risks ahead of the ECB

The first meeting of Christine Lagarde as the President of the European Central Bank. Analysts at UBS expect that she will deal with the divided Government Council and won’t initiate any new policy action. Still, the Lagarde may try to make the news. She may comment on the policy tools available to the central bank. In addition, the ECB may lower growth and inflation forecasts for the euro area.

USD: it’s not so bad

Yesterday, the Federal Reserve kept its interest rate unchanged at a 1.5%-2% range during its meeting. What is more important is that the Fed’s dot plot indicated the federal funds rate at 1.6% in 2020, without any changes. You can read more about the outcome of the meeting here.

Trump’s meeting is ahead

Today, US President Donald Trump plans to meet the top trade advisers to discuss tariffs on China. The meeting will be crucial ahead of the tariffs deadline on December 15. According to an anonymous source, the US administration will raise tariffs on Sunday, but the final word will still belong to Trump. The fresh tariffs will increase uncertainties in the process of the US-China trade deal and be hurtful for the risk-weighted assets, such as the AUD, the NZD, and stocks.

What else happens in the market?

Follow the news and our social networks: Telegram and Facebook to stay up to date with the changes!

-

13-12-2019, 11:20 PM #270Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Victorious Boris Johnson

Check the charts: http://bit.ly/34k3Rgy

13.12.2019

Conservatives win

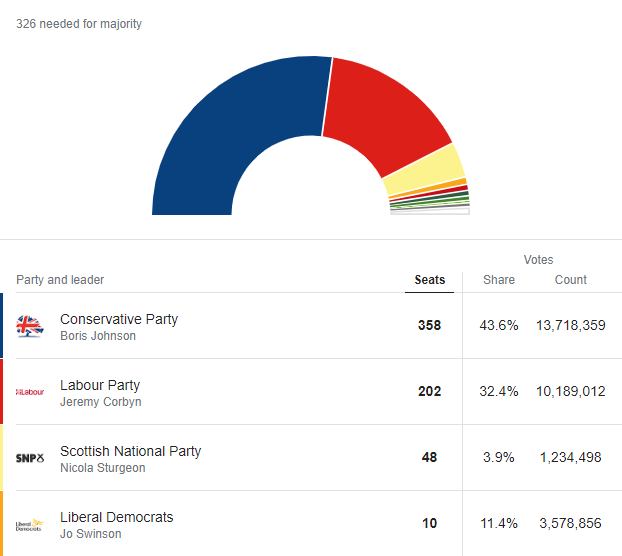

Finally, the victory of the Сonservative party under the leadership of Boris Johnson is confirmed. They have a 43.6% majority, while the Labour party follows with 32.4% and the Liberal Democrats got 11.4%.

The consequences?

Boris Johnson had previously commented he had a strong agenda for the United Kingdom should he win the election. One of the pillars of his plan was to “get Brexit done” at the soonest and in the best interest of the UK.

For the UK, it means higher stability and a better economic outlook with all the consequences.

For the world, it means stronger GBP against the related currencies.

All of that, of course, takes place if Mr. Johnson does not fail on his intentions.

GBP celebrating the victory

In the meantime, the British pound reacted immediately to the victory of Boris Johnson.

On the weekly chart, it is visible that the price of GBP/USD rose to the area of 1.35 – a height it has never been to since May 2018. And it is testing the August-2018-December-2019 resistance currently. Crossing this barrier would confirm the market’s intention to go even higher.

In the short term, however, we are expecting a certain correction downwards, as confirmed by the Awesome Oscillator. In any case, whether it is going further upwards now or later, the price would need to make a stop at the resistance it is testing now. On the hourly chart, the level of 1.3500 is going to be capping the bullish direction for a while, while 1.3450 will be the support. Crossing the support would mean a deeper correction downwards. Otherwise, we will observe a more sideways movement of the price.

Watch the news and stay informed!

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Tags for this Thread

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

6Likes

6Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote