Forex today: no significant movements

Continue at: https://fbs.com/analytics/news/forex...alyticsrolclub

05.06.2018

On Monday, the US dollar index tested lows near $93.60. Tuesday’s trading isn’t extensive, but the index is at $94. ISM non-manufacturing PMI (17:00 MT time) should support the greenback. The forecast is positive, if the actual data is greater, the greenback will rise.

The euro’s trading isn’t extensive. Traders are looking at European economic data. The data are mixed, as a result, EUR/USD doesn’t show an accurate direction. The pair is trading near 1.17. More economic data will be released during the day. The further movement will depend on them. The euro is anticipated to trade within 1.1650-1.1750.

Please visit our sponsors

Results 1 to 10 of 110

Thread: Forex daily Analysis by FBS

-

05-06-2018, 12:53 PM #1Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Forex daily Analysis by FBS

Forex daily Analysis by FBS

-

Sponsored Links

-

06-06-2018, 10:50 AM #2Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Forex today: the USD continues to plunge

More info: https://fbs.com/analytics/news/forex...alyticsrolclub

06.06.2018

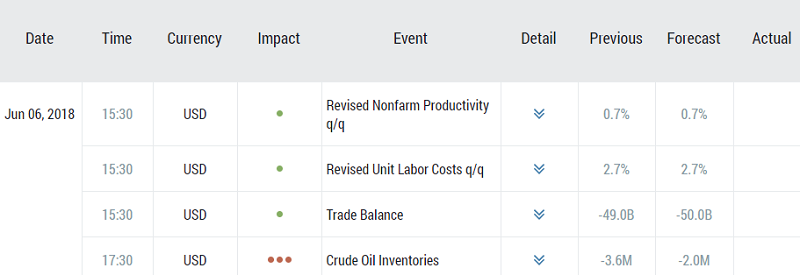

The US dollar index is lower and lower. It is trading near $93.65. Forecasts for today’s economic data aren’t encouraging. If the actual data are greater than the forecast, the US dollar will have chances to find a foothold. Otherwise, the index will fall to the support at $93.50.

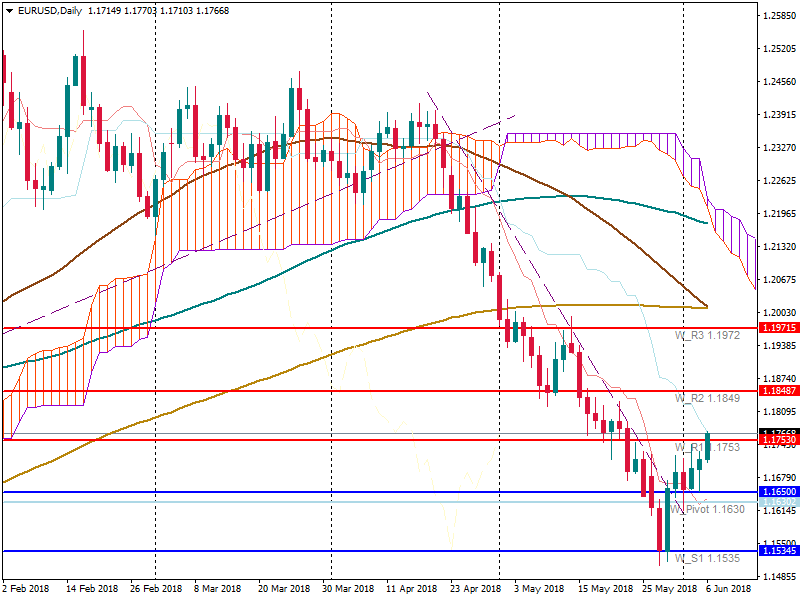

Finally, the euro strongly rebounded from the support at 1.1650. Up to now, EUR/USD is trading above the resistance at 1.1750. No important economic data will be released today, so the euro can rely only on the weak greenback. 50-day MA is near to cross the 200-day MA upside down. It’s a warning signal for the trading. There is a risk of the fall, however, until MAs will be crossed, the trading will be bullish.

The euro is highly volatile as the European Central Bank keeps the quantitative easing program. However, positive news for the euro may come on June 14 when the ECB will hold a press conference. European Central Bank policy makers anticipate holding a pivotal discussion at their meeting next week that could conclude with a public announcement on when they intend to cease asset purchases. Moreover, the ECB is anticipated to debate whether to gradually unwind bond purchases. The head of Germany’s central bank, Jens Weidmann, said market expectations for an end to bond-buying by end-2018 were plausible.

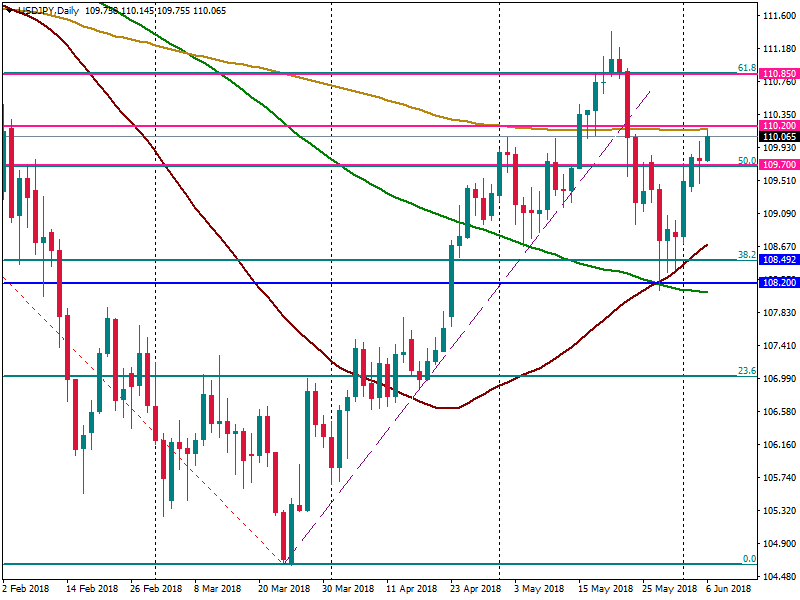

The Japanese yen continues to depreciate against the US dollar. USD/JPY rebounded from the support at 109.70. Up to now, the pair is trading near the 200-day MA (110.20) that is a strong resistance for the pair. If the US dollar index continues to fall, the pair won’t be able to break the resistance, otherwise, the pair will move further to 110.85.

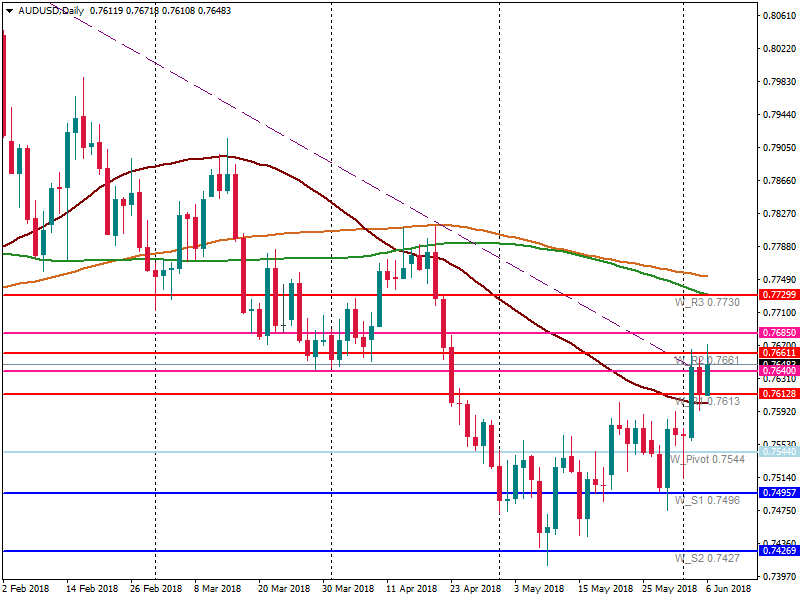

The Australian dollar is rising again because of encouraging economic data. GDP growth was greater than expected (1.0% vs 0.9%). As a result, AUD/USD rebounded from the support at 0.7610 and tested resistances at 0.7640 and 0.7660. On the weekly chart, 100-week MA at 0.7640 doesn’t let the pair stick above it. No more significant data will be released today. However, tomorrow traders will take into consideration trade balance data (4:30 MT time). The forecast is weaker than the previous data, so the AUD/USD pair has risks to return to 0.76 (50-day MA is a strong support). If the data is greater than the forecast, the aussie will have chances to gain a foothold above 0.7660.

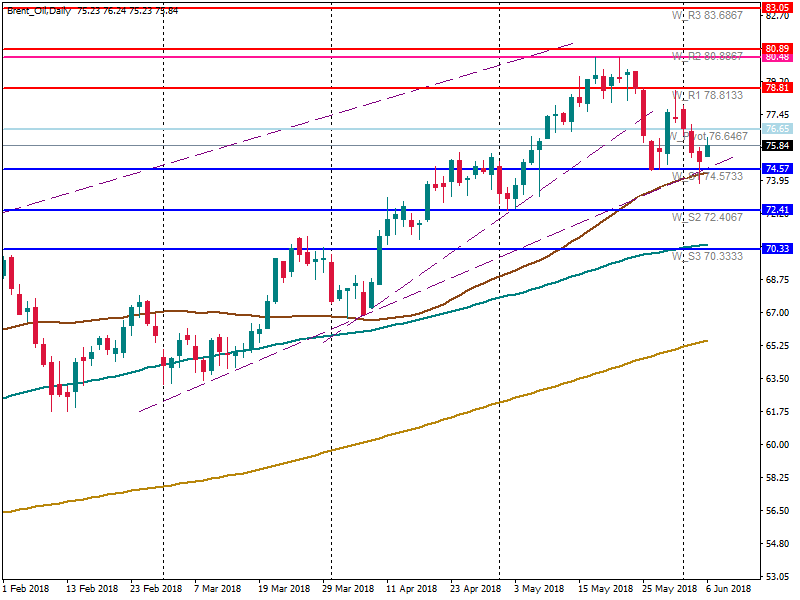

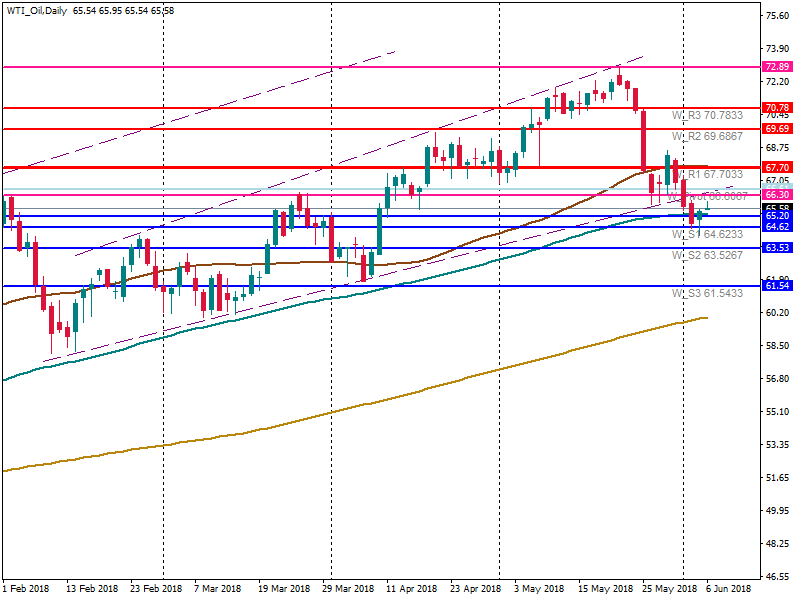

Oil is going up. Brent is trading near $75.90, WTI is at $65.60. Today investors will look at crude oil inventories data at 17:30 MT time. The forecast shows a decline of inventories, however, the decline is less than the previous data. If the actual one shows a surplus or less deficit than the forecast, both oil benchmarks will decline.

Brent: support lies at $74.60 (50-day MA and the trendline), resistance is at $76.65.

WTI: support is at $65.20 (100-day MA), the resistance is at $66.30 (the trendline).

That is all for today. Follow markets news with us!

-

11-06-2018, 05:47 PM #3Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

TRY THE ECN ACCOUNT IN FBS!

An ECN account means that market operations flow to every micro second through an Electronic Communications Network.

This account is highly recommended for very active traders, usually scalpers or professionals, because they get the least possible difference in quotes. FBS offers a special ECN account with the most beneficial trading conditions:

Initial Deposit of 1000$

Floating spread from -1 pip

6$ commission

up to 1:500 leverage

No limits of Maximum open positions and pending orders

Order Volume from 0,1 to 500 lots

With 25 currency pairs Metal and CFDs

Open your FBS ECN account from here

https://fbs.com/trading/ecn?utm_sour...tianECNrolclub

---------------------------------------------------------------------------------------------------

#FBS #Directtrading #ECN #ECNAccounts #ecntrade #tradingdirect

-

12-06-2018, 08:36 AM #4Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Curious trading case: FBS trader survived where global banks failed ��

This case is so amazing it definitely deserves to be on top of our blog. Behold the story of a trading order that was opened during the worst time possible. It happened in the middle of the event that shook the Central Banks and banned many Forex brokers into oblivion.

The the complete article here https://fbs.com/blog/curious-trading...ousCaserolclub

-----------------------------------------

#FBS #ForexTrading

-

13-06-2018, 10:29 AM #5Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

The most important events to trade on. ��

Every trader knows that economic data have a great impact on the Forex market. To become a successful trader, you need to follow economic indicators and Forex news. This way you will be able to keep up with the recent events and get clues about currencies’ movements.

We chose the most significant events that you should definitely follow to predict the behavior of currency pairs you trade. Read about this events here

�� https://fbs.com/analytics/tips/the-m...tsGuiderolclub

--------------------------------

#FBS #EconomicEvents #EconomicCalendar #ForexTrading

-

14-06-2018, 07:36 AM #6Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

China demonstrates signs of slowing economic surge

Follow this: https://fbs.com/analytics/news/china...alyticsrolclub

14.06.2018

China's major financial institution has been heavily distracted by the immediate soar in borrowing costs after the American Federal Reserve System, while Chinese economic data for May disclosed that the economy of the leading Asian country is losing momentum.

In May, in this Asian country industrial output tacked on by up to 6.8% in contrast with 2017, as the National Bureau of Statistics revealed. It turned out to be lower than the previous reading of 7% as well as experts’ estimate of 6.9%.

Additionally, the bureau informed that in May retail sales went up by only 8.5%, although market experts had hoped for a 9.6% leap after a soar of 9.4% in April.

Investments in fixed assets rallied by 6.1% in May in contrast with the same period of 2017, which is also lower than the estimate of market experts as well as the previous reading of 7%. Evidently, it appeared to be the slowest surge since 1999.

In May, the unemployment rate in urban areas went down to about 4.8% versus April’s reading of 4.9%.

With a steep slowdown in lending surge as well as the threat of an escalating trade dispute with America, China’s enterprises are coming across increasingly quite prospects. The country’s major bank made an attempt to back surge by ramping up liquidity and although it can still lift the Fed's rate for market experts, the very fact that it didn’t do so right now is interpreted as an indication of concern about the Chinese economy.

The data is 100% confirmed by a slowdown in industry as well as retail trade in May that points to a slowdown in GDP for the second quarter.

China’s attempting to provide liquidity for the purpose of mitigating any economic downturn and assisting lenders in meeting their repayment obligations.

-

15-06-2018, 09:33 AM #7Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

#motivation

Do you hear voice of financial freedom Maybe not! But you can feel with work from home and make profit! Be own your business.

FBS #AlwaysByYourSide

www.fbs.com?utm_source=forum&utm_medium=affiliate& utm_campaign=EN_English&utm_content=Sebastianmotiv ationrolclub

- - - -

#FBS #Forex #BestBroker

-

18-06-2018, 06:08 AM #8Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

�� Did you check profitable events in this week?

Monday, Jun 18

��ECB President Draghi Speaks- #EUR

Tuesday, Jun 19

�� Monetary Policy Meeting Minutes- #AUD

�� ECB President Draghi Speaks - #EUR

�� Building Permits - #USD

Wednesday, Jun 20

�� RBA Gov Lowe Speaks - #AUD

�� BOJ Gov Kuroda Speaks - #JPY

�� Fed Chair Powell Speaks - #USD

�� ECB President Draghi Speaks - #EUR

�� Crude Oil Inventories - #USD

�� GDP q/q - #NZD

Thursday, Jun 21

�� Libor Rate - #CHF

�� SNB Press Conference - #CHF

�� MPC Official Bank Rate Votes - #GBP

�� Monetary Policy Summary - #GBP

�� Official Bank Rate - #GBP

�� BOE Gov Carney Speaks - #GBP

Friday, Jun 22

�� OPEC Meetings - #ALL

�� Core Retail Sales m/m - #CAD

�� CPI m/m - #CAD

You can find more events in FBS Calendar! Just Click it⬇

https://fbs.com/analytics/calendar?c...alendarrolclub

---------------

#FX #Calendar #FBS #Important

-

19-06-2018, 08:54 PM #9Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

A beautiful day for #FBS8millionthtrader! Mr. Zamani Baldwin Kenny Cemane is from South Africa. We welcome you to our International Family of the best traders in the world! We wish you much success and profitable trading. We hope together with #FBS you accomplish all your dreams! CONGRATULATIONS!

FBS is Always By Your Side

https://fbs.com/news/8-mln-trader-15...Millionrolclub

--------------------------------------------------

#FBS #8thmillion #8million #Family #Forex

-

20-06-2018, 08:44 PM #10Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Brent and WTI: where differences lie

When you read or listen to the news about the oil market, you meet two mysterious words: Brent and WTI (West Texas Intermediate). Maybe you already know that they are the two major oil benchmarks. But do you know what differences between them are and why they have a different cost?

Learn all you need to know about this here https://fbs.com/analytics/tips/brent...chmarksrolclub

------------------------------

#FBS #Oil #CFDs #Trading #Commodities

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Tags for this Thread

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote