Dear Trader,

I introduced a new broker who has been reliable regulation

ExoFXis a leading online trading brokerage specialized to provide individuals and organizations with services in international financial markets. The company is a partner of several leading brokerage software developers. ExoFX applies the STP model with the Bridge Technology to work with its Prime Broker and executes clients’ orders in Non-Dealing Desk mode.

ExoFX acts as support center, providing customer support, back office and compliance services. It also offers extensive education and training services to International traders to help them understand the Currency market better. ExoFX offers round-the-clock trading with various currency pairs, as well as in Gold (Spot), Silver (Spot) and CFD as well as indices.

ExoFX offers its professional and private clients the ability to trade in currency markets through the MetaTrader 4 trading system online and in real time mode. The advanced and convenient MetaTrader 4 platform is equipped with the latest functions and parameters, providing each client with a personalized service tool.

ExoFX offers a safe and reliable environment for online trading and aims at providing the most competitive trading conditions through the provision of low spreads, mobile trading, and other trade advantages.

Our Experience

Over the years of meticulous work the company has gained an extensive client base in dozens of countries worldwide. The company gives clients an option to select the terms of trading operations: instant execution or market execution.

Pushing the Boundaries

ExoFX is a permanently developing company. By extending the list of trading instruments, creating new products and implementing cutting-edge technologies, the company is in continuous contact with its customers and partners. Maintaining the loyalty of clients and long-term cooperation with them is a priority for us.

Diversion

Our company only employs multilingual teams of highly experienced professionals with expertise in trade, finance and IT. ExoFX has set its objective of becoming a leading trade company offering 24-hour access to currency markets worldwide.

Partnership

ExoFX will focus on cooperation with a large number of Referral Partners in many countries of the World. The IB (Introducing Brokers) programmer will have to offers our partners the most competitive commission rates in the Industry.

Focusing on professional participants, ExoFX creates and maintains conditions for the effective use of free cash assets. By offering liquidity with low spreads, reducing margin requirements and removing restrictions on trading, the company strives towards its main goal - to create conditions for private and corporate investors to freely access global financial markets. We keep and multiply the main asset of our company - the reputation and respect of our customers.

Please visit our sponsors

Results 1 to 10 of 22

Thread: ExoFx - Exotic Trading Broker

-

12-02-2015, 05:02 PM #1

ExoFx - Exotic Trading Broker

ExoFx - Exotic Trading Broker

-

Sponsored Links

-

15-02-2015, 05:35 PM #2

ExoFX is the trading name of Alpha Capital Markets Plc incorporated in England and Wales and is registered with Companies House in the UK, under company number 5196460. Founded in 2004, Alpha Capital Markets Plc. is authorised and regulated by the Financial Conduct Authority (“FCA”) to conduct investment business in the United Kingdom (“UK”) under Firm Reference Number 441689. (FCA regulated, where mentioned below, shall refer to FCA authorised and regulated) For any inquiries please contact us or email our compliance department directly.

The main specialization of the company is to provide individuals and organizations with services in international financial markets. The company is a partner of several leading brokerage software developers. The company applies the STP model with the Bridge Technology to work with its Prime Broker and executes customers’ orders in Non-Dealing Desk mode. ExoFX acts in full compliance with European and international legislation and regulation standards. We strongly believe that honesty is the best policy. You can review the Customer Agreement as well as AML policy and other important legal documents in the Legal Documentation section.

Why Trade With ExoFX ?

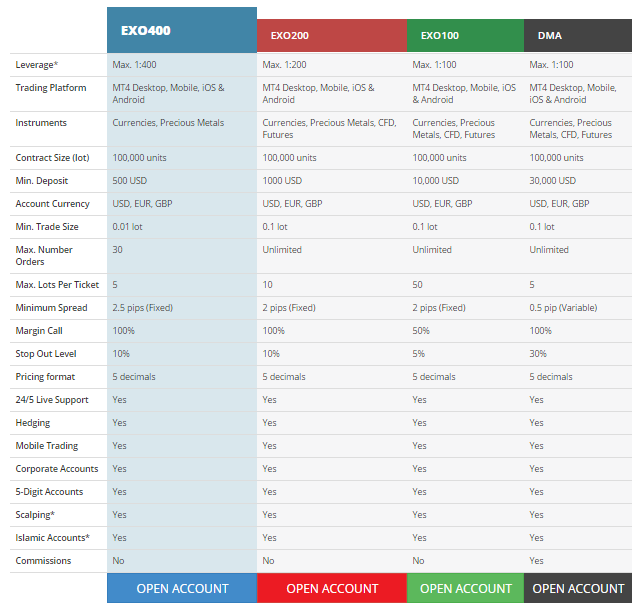

Fixed spread from 2 Pips , Leverage up to 1:400 , Accounts from $500 , UK FCA Regulated Broker , Automated Execution , No Dealing Desk NDD/STP , Fast Deposits & Withdrawals , EAs strategy Capabilities , 24/5 Customer Support , Swap-Free or Islamic Accounts , Segregated & Secure Accounts

-

16-02-2015, 09:08 AM #3

ExoFX is the trading name of Alpha Capital Markets Plc incorporated in England and Wales and is registered with Companies House in the UK, under company number 5196460. Founded in 2004, Alpha Capital Markets Plc. is authorised and regulated by the Financial Conduct Authority (“FCA”) to conduct investment business in the United Kingdom (“UK”) under Firm Reference Number 441689. (FCA regulated, where mentioned below, shall refer to FCA authorised and regulated) For any inquiries please contact us or email our compliance department directly.

The main specialization of the company is to provide individuals and organizations with services in international financial markets. The company is a partner of several leading brokerage software developers. The company applies the STP model with the Bridge Technology to work with its Prime Broker and executes customers’ orders in Non-Dealing Desk mode. ExoFX acts in full compliance with European and international legislation and regulation standards. We strongly believe that honesty is the best policy. You can review the Customer Agreement as well as AML policy and other important legal documents in the Legal Documentation section.

Why Trade With ExoFX ?

Fixed spread from 2 Pips , Leverage up to 1:400 , Accounts from $500 , UK FCA Regulated Broker , Automated Execution , No Dealing Desk NDD/STP , Fast Deposits & Withdrawals , EAs strategy Capabilities , 24/5 Customer Support , Swap-Free or Islamic Accounts , Segregated & Secure Accounts

-

17-02-2015, 03:33 AM #4

The Financial Conduct Authority (FCA)

The FCA is an independent non-governmental body, given statutory powers by the Financial Services and Markets Act 2000 (“FSMA”) as amended by the Financial Services Act 2012 (“FSA12”). The FCA is a company limited by guarantee and financed by the financial services industry. The Board of the FCA sets its overall policy, but day-to-day decisions and management of the staff are the responsibility of the Executive Committee.

The FCA is accountable to Treasury Ministers and through them, Parliament. They are operationally independent of government and are funded entirely by the firms they regulate. The FCA is an open and transparent organisation and provides full information for firms, consumers and others about their objectives, plans, policies and rules. This information can be accessed on their website ( fca.org.uk )

The FCA is the independent body that regulates the financial services industry in the UK and they have been given a wide range of rule-making, investigatory and enforcement powers in order to meet their three operational objectives, which are:

- To secure an appropriate degree of protection for consumers.

- To protect and enhance the integrity of the UK financial system.

- To promote effective competition in the interests of consumers.

FCA Initial Requirements on Firms:

It is compulsory for all companies that are authorised and regulated by the FCA to meet stringent financial standards including that of capital adequacy. The non-submission of required financial reports on a regular basis may instigate regulations governing non-compliance and may lead to severe penalties for the regulated firms including the removal of their authorisation with the FCA.

Margin call is the first warning to notify traders that the margin of the account is reaching the minimum level. A stop out occurs when the account has too little equity to continue the trade and is used as a tool to protect accounts from going into negative equity.

The Financial Ombudsman Service (“FOS”)

It is the role of FOS to resolve individual complaints that consumers and financial businesses have not been able to resolve between themselves. The FOS was set up by parliament to do this on the basis of independent experts and their service is free to consumers. Consequently, the FOS is completely independent and impartial. This means that when they decide on a complaint, they will look carefully at all facts presented by both sides. It should be noted that a complaint against Alpha Capital Markets is not guaranteed to succeed simply because an eligible complainant has referred it to the FOS.

The FOS can look at complaints about a wide range of financial matters including investment business, answers over a million enquiries a year and deals with more than 250,000 disputes.

If the FOS decides that Alpha Capital Markets has treated a client fairly, they will provide an explanation as to why, but if they decide that Alpha Capital Markets is in the wrong and the client has lost out as a result, they may order Alpha Capital Markets to take remedial action.

Clients are not obliged to accept any decision made by the FOS, and going to court instead will remain an option. However, if a client does accept FOS’ decision, it is binding both on the client and on Alpha Capital Markets.

The Financial Services Compensation Scheme (“FSCS”)

The Financial Services Compensation Scheme is the compensation fund of last resort for customers of authorised financial services companies firms in the United Kingdom. The FSCS is the official body that may pay you compensation if Alpha Capital Markets goes into default.

Limits apply to how much compensation the FSCS is able to pay and those limits vary between different types of financial products. The FSCS is an independent body set up by government under FSMA and financial services providers fund the FSCS and the compensation they pay out.

The FSCS can pay compensation to clients who lose money because of false or misleading advice, negligent management of investments, misrepresentation or fraud, or if the firm concerned has gone out of business and can’t return the client`s investments or money owed to the client. Neither the FSCS nor Alpha Capital Markets as a regulated forex broker, pay compensation for losses arising solely from investment performance.

Compensation limit (Investment Firms such as Alpha Capital Markets only)

£50,000 per person per firm for claims against firms declared in default from 1 January 2010. For firms declared in default before that date the maximum level of compensation for claims is 100% of the first £30,000 and 90% of the next £20,000, up to £48,000 per person per firm.

-

18-02-2015, 05:58 AM #5

Security of Funds

Our client's funds security is our top priority. With ExoFX you can be absolutely sure your deposits are secured in every possible way. Here are some of the measures we take to ensure funds protection:

Bank Accounts

The Company maintains operational and client bank accounts with reputable international banking institutions.

Segregated Accounts

In accordance with international regulation standards, ExoFX uses separate accounts to keep protected customers' funds segregated from the company's balance sheets. This keeps your funds secure and untouched.

Supervision

Investment firms are obliged to meet strict financial standards, including capital adequacy requirements. ExoFX Limited maintains sufficient liquid capital to cover all client deposits, potential fluctuations in the company’s currency positions and outstanding expenses. A detailed annual audit performed by an independent auditor points out any deficiencies.

Risk Management

The Company continually identifies, assesses, monitors and controls each type of risk associated with its operations. More specifically, when managing risks, the responsibilities of Senior Management are as follows:

- Assess on a continuous basis the effectiveness of the policies, arrangements and procedures in place;

- Decide on the Company’s risk bearing capability and strategy;

- Review the Risk Assessment Report carried out by the Risk Management Department and take appropriate action where necessary; and

- Ensure that the Company has the ability to cover its financial needs and capital requirement at any time.

SSL-protected Personal Area

We use highly secure technology to protect your personal data and financial transactions. SSL-secured Personal Area is protected with 128-bit encryption, which makes your browsing safe and your data inaccessible to any third parties.

Account verification

ExoFX recommends you to verify your account by submitting your personal ID scan and an address proof. This simple measure will make sure your transactions are authorized and secured.

Secure withdrawal Regulations

Since a withdrawal from a live account requires an email confirmation, no one can ever access your account but yourself. It is also required that you use the same payment details for deposits and withdrawals. Thus, under no circumstances can ExoFX transfer your withdrawal to an unauthorized third party.

3D secure Visa/MasterCard authorization

We apply 3D secure technology when processing credit and debit cards. This technology makes all Visa/MasterCard transactions transparent and safe.

Advanced protection

The ExoFX technical environment is monitored 24/7 by a dedicated team of highly professional security engineers and technical specialists. They have developed and maintain top level protection, so any data loss, damage or other technical issues are highly unlikely.

-

19-02-2015, 04:18 PM #6

Account Types in ExoFX

Forex traders speculate on the value of one currency compared to another in order to generate profits. FX trading is typically executed on margin accounts and the industry practice is to trade on relatively small margin amounts.

Currencies that are traded against the US Dollar (“USD”) are called Majors, and these constitute the highest volumes of Forex trades.

With ExoFX you will enjoy some of the best forex trading conditions as you:

- Get access to various major and exotic currency pairs

- Trade all the major highly liquid currency pairs

- Benefit from access to a pool of liquidity providers

- See fixed spreads and fast, reliable execution

-

20-02-2015, 04:01 PM #7

Islamic Account In ExoFX

Islamic online trading accounts permit clients of Islamic religion to trade on interest free accounts (Swap-free or Roll Over free) with no extra charge or penalty for the ability to trade in accordance with Islamic religious principles. Clients can open and close positions at any time within the ExoFX MetaTrader 4 platform without being limited to holding them for a defined period.

The Swap-free trading account services is for those traders who cannot use Swap fees owing to their religious beliefs. Also called the “Islamic forex accounts”, in case of trading under the Swap-free account, all the remaining trading terms and conditions of accounts remain intact.

When trading using the Swap-free account, any currency pair can be kept open over-night and the swap free account ensures that the client is not charged any swap (interest) on the position for the period of 14 nights. If the client wishes to keep a trade open over-night after the mentioned grace period of 14 nights, the client is charged a fixed storage fee of 10 USD per standard round lot, as in compliance with the Islamic Shariah Law.

Storage is a mechanism used for Sharia Compliant accounts where interest cannot be received nor paid out by our clients.

Storage fees are applied to any contract or product which is not a future (and therefore does not have a set expiry date). Storage will be paid after 14 days of holding open a position, and is a charge reflecting the counterparty costs to ExoFX.

Swaps are small interest payments that are made each night once all foreign exchange balances are settled. Each currency has an interest rate associated with it, and because spot forex is traded in pairs, every trade involves not only two different currencies, but also their corresponding interest rates.

We offer swap free accounts for sharia compliance when requested by our clients, which are subject to approval. In order to apply for a swap free account, please contact our team. Please note that we do not offer swap-free trading on the following currency pairs; USDSEK, USDINR, USDPLN, USDMXN, USDZAR, USDTRY, EURTRY, EURNZD, EURAUD, GBPAU

-

24-02-2015, 01:13 AM #8

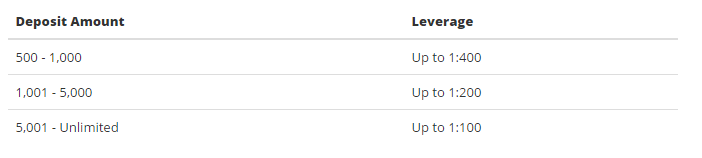

ExoFX offers a flexible leverage philosophy where clients can choose to trade using 1:100 through to 1:400 leverage. The use of leverage should be carefully considered as it can be both beneficial and also risky for clients. The correct use of leverage can help clients maximize the profitability of successful trading positions but if misused, higher leverage can result in stop-outs on unsuccessful positions or if a trade goes against you.

-

25-02-2015, 12:45 AM #9

ExoFX also offers the possibility of trading on variable spreads, as opposed to fixed spreads, with a commission charge per trade.

Variable spreads will change throughout the day in tandem with underlying market spreads, allowing clients to take advantage of extremely tight spreads when underlying market liquidity is high. Conversely, clients may see a wider spread than our fixed spread offering, again dependent on underlying market conditions, but this is likely around important economic data releases.

In order to trade on variable spreads, clients must pay a commission per trade, which is negotiated on a case-by-case basis with Alpha Capital Markets. If you are interested in setting up a variable spreads trading account, or for more information, please contact the dealing desk via email at [email protected].

-

26-02-2015, 03:51 AM #10

ExoFX Clients can Trade the following CFDs:

Commodities:

Described as any tangible product for which a market exists, commodities are widely traded through CFDs. Commodity CFDs cover a vast range of products such as metals, minerals, food grains, oil, energy and coffee. Often used as a strategy by investors against inflation, Commodity CFD trading has seen a surge in the number of transactions per annum in recent years.

Currencies:

The most attractive feature in currency trading is the volatility of the foreign exchange market. This coupled with the fact that they respond in a reasonably predictable way to external factors, makes currencies one of the most intensely traded products in the world. Currency CFDs offer an excellent opportunity to benefit from potential market moves because of the high leverage that may be offered to traders. Currency CFDs also help to negate the risk of currency conversion at the closing of the trade, helping to manage price variation risk as well as conversion charges.

Indices:

Representing a virtual basket of shares, an index provides an indication of the performance of an overall market rather than just an individual share. Indices react to macroeconomic indicators, aiding the anticipation of future market movement. Trading in index CFDs may enable traders to capitalise on wider market movements and take advantage of potential lucrative returns on their investments.

Our experienced and helpful staff are always on hand should you need assistance with CFD trading although it is to be remembered that our staff are not authorised under our regulatory permissions to provide investment advice to you.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote