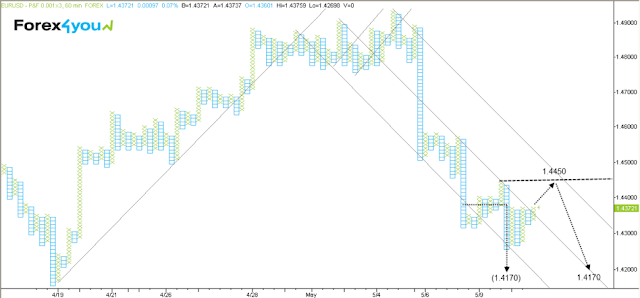

EUR/USD: Technical Analysis

The EUR/USD fell to 1.4260 lows yesterday but has since begun consolidating in a range. The emphasis is still bearish and the larger 0.005x3 chart has met its upside targets indicating possible exhaustion. Shorter term, however, there are no clear vertical downside targets on the 0.001x3 chart, although a horizontal count yields a bearish target of 1.4170. The smallest box size chart, the 0.0005x3 conversely has an upside target of 1.4450. It may be that some upside will be followed by another down move to the 1.41s although the conflicting signals make it difficult to forecast.

EUR/JPY: Technical Analysis

The EUR/JPY pair has fallen and rebounded quite strongly. There are now bullish counts from off the lows established on the 0.1x3 and 0.05x3 charts, although they have yet to be activated. A break above current highs at 116.20 would be required for activation with 119.00 and 118.25 targeted thereafter. The downside targets have already been met, with 114.70 reached exactly on the 0.05x3. There is a bullish emphasis longer term with the 0.5x3 chart showing an unmet target at 126.50. Resistance at 117.50 may also come into play and should be used as an initial target for any advance. Overall bullish rebound potential awaiting confirmation.

Analysis by: Joaquin Monfort

Forex4you analyst

Disclaimer:

Trading Futures and Options on Futures and Cash Forex transactions involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Please visit our sponsors

Results 1 to 1 of 1

-

10-05-2011, 12:44 PM #1Senior Member

- Join Date

- Oct 2010

- Posts

- 114

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Forex4you Technical Analysis 10 May 2011

Forex4you Technical Analysis 10 May 2011

-

Sponsored Links

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote